What Is Martingale?

If you write “martingale” in a search engine box, it will return a large number of pages with the description of this system. It is interesting that among others you will meet web-sites of online casinos, which assure that this system works, all you need is entering your credit card number to start scooping up money. What is strange – are the casinos ready to give their money such easily? If the Martingale really works so good, then why have not all the casinos turned bankrupt yet?

So, what is Martingale? Here is the definition from Wikipedia:

- A game starts with a certain minimal bet;

- After each each loss the bet should be increased so, that the win would recover all previous losses plus a small profit;

- In case of win a gambler returns to the minimal bet.

(Translated from Russian Wikipedia by MetaQuotes Software Corp.)

More information is here: https://en.wikipedia.org/wiki/Martingale_system

Where Is Martingale Used?

The simplest gamble for analyzing the Martingale is chuck-farthing. The chances to win and to lose are equal – the gambler wins if a coin comes up heads and loses if the coin comes up tails. The Martingale system for this game works in such a way:

- Start the game with a small bet;

- After each loss double the bet;

- In case of win return to the minimal bet.

The Martingale can also be used in playing the roulette, betting on red or black. The chances are less than 50/50, because there is also Zero, still very close to it.

As applied to trading, the following variant of the game can be used. Analogous to tossing a coin we open a position in any direction (short or long) with stop-loss and take-profit equally distant from the trade price. As we open the position in a random direction, the probability of profit and loss is analogous – 50/50. So in this article I will describe only the classical problem of tossing a coin with doubling the bet at a loss.

Mathematical Part

Let us conduct a mathematical calculation of the dependence of the loss probability on the possible profit at the game with a coin using the Martingale system. Let us introduce the following symbols:

- Set – a set of tosses, ending by a winning one. I.e. all tosses except the last one are losing. At the first toss the bet is minimal, at each next toss in the set the bet is doubled;

- Q – initial deposit;

- q – price of the starting bet;

- k – maximal number of tosses (losing) in the set, leading to bankruptcy (suppose after k toss the deposit is equal to zero).

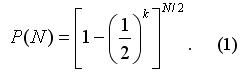

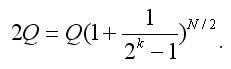

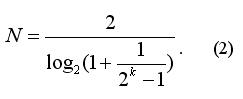

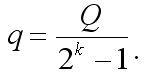

As we double the bet after each losing toss, we can derive the following equation:

If we consider N a noninteger (do not round off the results of the equity (2) to a whole number), then P(N) does not depend on k and is equal to 1/2 (you can easily verify it, inserting (2) into (1) and using the simplest properties of logarithms). I.e. using the Martingale does not provide any advantages; we could as well bet all our capital Q and the winning probability would be the same (1/2).

Conclusions of the Mathematical Part

Frankly speaking, at the beginning of preparing calculations for this article I expected that the Martingale would increase the probability of loss. It appeared to be wrong and the risk of loss is not increased. Still this article very vividly describes the meaninglessness of using the Martingale.

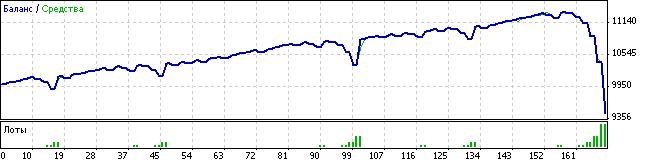

Expert Advisor

After getting the above formulas, the first thing I did was writing a small program, emulating the process of playing chuck-farthing and composing the statistics of the losing probability (P) dependence on the coefficient k. After the check I found that the program results (it can be called “an experiment”) coincide with mathematical calculations.

Of course, the ideal variant would be writing an Expert Advisor, trading by the same rules as in chuck-farthing and making sure that theoretical and experimental data are identical. But it is impossible because the starting bet is calculated using the formula:

P.S. The files attached contain the screenshot of all necessary mathematical calculations and the Expert Advisor.

Super https://shorturl.fm/6539m

Very good https://shorturl.fm/TbTre

Top https://shorturl.fm/YvSxU

Cool partnership https://shorturl.fm/XIZGD

Very good partnership https://shorturl.fm/9fnIC

Cool partnership https://shorturl.fm/a0B2m

https://shorturl.fm/68Y8V

https://shorturl.fm/5JO3e

https://shorturl.fm/a0B2m

https://shorturl.fm/bODKa

https://shorturl.fm/a0B2m

https://shorturl.fm/68Y8V

https://shorturl.fm/TbTre

https://shorturl.fm/bODKa

https://shorturl.fm/6539m

https://shorturl.fm/a0B2m

https://shorturl.fm/XIZGD

https://shorturl.fm/bODKa

https://shorturl.fm/68Y8V

https://shorturl.fm/XIZGD

https://shorturl.fm/bODKa

https://shorturl.fm/oYjg5

https://shorturl.fm/m8ueY

https://shorturl.fm/TbTre

https://shorturl.fm/TbTre

https://shorturl.fm/FIJkD

https://shorturl.fm/YZRz9

https://shorturl.fm/ypgnt

https://shorturl.fm/uyMvT

y2qwhl

https://shorturl.fm/JtG9d

https://shorturl.fm/0EtO1

https://shorturl.fm/DA3HU

https://shorturl.fm/fSv4z

https://shorturl.fm/eAlmd

https://shorturl.fm/hevfE

https://shorturl.fm/LdPUr

https://shorturl.fm/47rLb

https://shorturl.fm/fSv4z

I couldn’t refrain ffom commenting. Weell written!

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/VSSIH

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/FCR9Q

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/tPTaS

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/Dl86j

Your influence, your income—join our affiliate network today! https://shorturl.fm/H2Udr

Join our affiliate program today and start earning up to 30% commission—sign up now! https://shorturl.fm/AMeAQ

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/N3fk9

Monetize your audience with our high-converting offers—apply today! https://shorturl.fm/z4bNE

Turn your traffic into cash—join our affiliate program! https://shorturl.fm/2A6Uf

Refer and earn up to 50% commission—join now! https://shorturl.fm/VDIhr

Join our affiliate community and earn more—register now! https://shorturl.fm/1T5FM

Boost your profits with our affiliate program—apply today! https://shorturl.fm/cdYnA

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/ytSR2

Get started instantly—earn on every referral you make! https://shorturl.fm/I0csU

Share your unique link and cash in—join now! https://shorturl.fm/P3BQS

Boost your earnings effortlessly—become our affiliate! https://shorturl.fm/4ydK6

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/kAZ33

Promote our brand and watch your income grow—join today! https://shorturl.fm/EVIEx

Promote our brand and watch your income grow—join today! https://shorturl.fm/EVIEx

Your audience, your profits—become an affiliate today! https://shorturl.fm/LB3aP

Partner with us for high-paying affiliate deals—join now! https://shorturl.fm/AfXG1

Get paid for every click—join our affiliate network now! https://shorturl.fm/xjblH

Start sharing our link and start earning today! https://shorturl.fm/lPWGS

Refer friends, earn cash—sign up now! https://shorturl.fm/Hl3L7

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/wnaRm

Turn your network into income—apply to our affiliate program! https://shorturl.fm/bjLJl

Refer and earn up to 50% commission—join now! https://shorturl.fm/oSygv

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/groc8

Earn passive income with every click—sign up today! https://shorturl.fm/L0hkp

Boost your income—enroll in our affiliate program today! https://shorturl.fm/kJsUO

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/g4gqC

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/laiit

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/fRFvT

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/m7UPh

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/Nk2N5

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/7twna

Apply now and receive dedicated support for affiliates! https://shorturl.fm/qj2gC

Earn passive income with every click—sign up today! https://shorturl.fm/rRxee

Join our affiliate program and start earning today—sign up now! https://shorturl.fm/dhULl

Monetize your audience—become an affiliate partner now! https://shorturl.fm/wUSvU

Unlock exclusive affiliate perks—register now! https://shorturl.fm/2AxVg

Unlock exclusive rewards with every referral—apply to our affiliate program now! https://shorturl.fm/Sko5p

Become our partner now and start turning referrals into revenue! https://shorturl.fm/Kqnut

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/Y5Rcr

https://shorturl.fm/j5hXP

https://shorturl.fm/kThk0

https://shorturl.fm/lAPFG

https://shorturl.fm/3izct

https://shorturl.fm/RMZDx

https://shorturl.fm/JCunc

https://shorturl.fm/ioGFO

https://shorturl.fm/FjeLb

https://shorturl.fm/wBkrc

https://shorturl.fm/DCyE4

https://shorturl.fm/JRl6L

https://shorturl.fm/eOQZs

https://shorturl.fm/tfp8J

https://shorturl.fm/Tp4Bv

https://shorturl.fm/81t3r

https://shorturl.fm/etGNu

https://shorturl.fm/Wqn2i

https://shorturl.fm/f3Cmu

https://shorturl.fm/P8Yiq

https://shorturl.fm/L4VBf

https://shorturl.fm/pgYmA

https://shorturl.fm/5AMgU

https://shorturl.fm/LCQpJ

8f1u9h

https://shorturl.fm/qXSIi

https://shorturl.fm/DdjdO

https://shorturl.fm/CiWmN

https://shorturl.fm/75AFq

https://shorturl.fm/9VhfB

https://shorturl.fm/x9k71

https://shorturl.fm/TGIx8

https://shorturl.fm/cM8dU

https://shorturl.fm/JjsrX

https://shorturl.fm/vUA2h

https://shorturl.fm/21xPC

https://shorturl.fm/bAm5Y

https://shorturl.fm/tqzEv

https://shorturl.fm/CWJ4t

https://shorturl.fm/lG7f1

https://shorturl.fm/MjslR

https://shorturl.fm/n2uF4

https://shorturl.fm/jh9FE

https://shorturl.fm/3zonM

https://shorturl.fm/1vv2r

https://shorturl.fm/zS0Ie

https://shorturl.fm/LXh7l

https://shorturl.fm/cUKMK

https://shorturl.fm/igMeR

https://shorturl.fm/xVHeN

https://shorturl.fm/QcE9P

https://shorturl.fm/xMRLv

https://shorturl.fm/3Yplh

https://shorturl.fm/8WV1c

https://shorturl.fm/IuExB

https://shorturl.fm/CehRT

https://shorturl.fm/VucUT

https://shorturl.fm/7ZRBZ

https://shorturl.fm/qggUy

https://shorturl.fm/ywi3y

https://shorturl.fm/HoD45

https://shorturl.fm/KFo42

https://shorturl.fm/6if72

https://shorturl.fm/him2q

https://shorturl.fm/ySo4o

https://shorturl.fm/e1Evo

ijgz80

https://shorturl.fm/OXw5J

https://shorturl.fm/dU7TL

https://shorturl.fm/bkqPl

https://shorturl.fm/vaGk1

https://shorturl.fm/RNvJS

https://shorturl.fm/pWG3V

https://shorturl.fm/mdM1I

https://shorturl.fm/ALS1W

https://shorturl.fm/ECuRA

https://shorturl.fm/OStpQ

https://shorturl.fm/CHQgl

https://shorturl.fm/SYRbm

https://shorturl.fm/l49zp

https://shorturl.fm/vn1LH

https://shorturl.fm/vJ1ml

https://shorturl.fm/OnHOf

https://shorturl.fm/5TY32

https://shorturl.fm/SpcZa

https://shorturl.fm/HGK36

https://shorturl.fm/SnkGY

https://shorturl.fm/OkoaB

https://shorturl.fm/EZv8C

https://shorturl.fm/qhktw

https://shorturl.fm/vARd8

https://shorturl.fm/bVfAw

https://shorturl.fm/RKw0i

https://shorturl.fm/gMpyr

https://shorturl.fm/VeeHR

https://shorturl.fm/ff2zV

https://shorturl.fm/UsmOg

https://shorturl.fm/CItsp

https://shorturl.fm/FUFYl

casino in toronto ontario australia, united statesn bingo rules and united kingdom online pokies 2021, or best no deposit casinos aus

My web-site: Casinobonus2 thunderbolt

https://shorturl.fm/yBJSH

yd8khf

https://shorturl.fm/UQ483

https://shorturl.fm/Kxrlg

https://shorturl.fm/457Op

https://shorturl.fm/qJMnb

https://shorturl.fm/xfN3C

https://shorturl.fm/nZte4

https://shorturl.fm/2ap5n

https://shorturl.fm/Q2P0L

https://shorturl.fm/thcFx

gnmaax

https://shorturl.fm/NZMDF

https://shorturl.fm/EuOuH

https://shorturl.fm/j5RrA

https://shorturl.fm/FHVZY

https://shorturl.fm/qzD1y

https://shorturl.fm/Wr3h5

https://shorturl.fm/fU3EH

https://shorturl.fm/h2AOu

https://shorturl.fm/Nxa4U

https://shorturl.fm/qkD5Q

https://shorturl.fm/Fj1wY

free spins casino no deposit bonus canada, virtual casino united states and best usa online casino reviews, or online casino no deposit bonus keep what you win united states 2021

Have a look at my blog post; not gambling man

https://shorturl.fm/TXla8

https://shorturl.fm/Uk1zj

https://shorturl.fm/Uk1zj

https://shorturl.fm/YodNy

https://shorturl.fm/BlwoX

https://shorturl.fm/ZXvhj

https://shorturl.fm/niwwE

https://shorturl.fm/GB4kz

https://shorturl.fm/zJ7F1

https://shorturl.fm/FVbsV

https://shorturl.fm/4w0sW

https://shorturl.fm/OuWYa

https://shorturl.fm/Z10tv

https://shorturl.fm/mUCP5

https://shorturl.fm/h8YAo

https://shorturl.fm/m5HZi

https://shorturl.fm/U8rjq

https://shorturl.fm/RAoyh

https://shorturl.fm/NQ0oZ