Introduction

Money management is a very important aspect for successful trading. Its main purpose is to minimize risks and maximize profits. With the right use of money management, it is possible to achieve improved trading results.

In general, money management is a set of rules that allows traders to calculate the optimal volume of positions, taking into account all the possibilities and limitations. Today, there are quite a few money management strategies to fit every taste. We will try to consider several ways to manage money based on different mathematical growth models.

Trading strategy and money management

Any method of money management can accelerate the growth of the trading balance, or, in other words, to increase the profitability of the trading strategy. Thus, the trading strategy is the basis, while money management is an addition. Let’s see what requirements a trading strategy must meet in order to apply money management to it.

First, it is the mandatory use of stop losses and take profits. With their help, you can control trading risks: stop loss allows you to limit possible losses, and take profit makes it possible to assess the potential profit for each deal.

Second, it is a positive mathematical expectation. It enables traders to evaluate the expected profitability of a trading strategy in the long term, which allows them to make rational decisions and manage their capital more efficiently. However, mathematical expectation is important not only for the trading strategy as a whole, but also for a newly opened position.

Let’s introduce the following variables:

- p – probability of a profitable trade;

- SL – difference between the open price and stop loss in points;

- TP – difference between the open price and take profit.

First, we need to estimate the probability of profit. Let m be the number of closed profitable deals, while n is a total number of trades. Then the probability of receiving profit is:

The mathematical expectation (in points) for the position being opened can be found using the equation:

For a profitable trading strategy, the mathematical expectation should be positive. In this case, the use of any method of money management can bring additional profit.

However, the mathematical expectation may turn out to be negative or zero. This may happen at the very beginning of trading, when the number of losing trades can have a very large impact on the estimation of the profit probability. In this case, the volume of the opened position should be as small as possible. This means the trader needs to apply money management according to the linear growth model with minimal risk.

Linear growth

This is one of the most famous and simple growth patterns. Its use in trading is even simpler – a trader needs to choose a fixed position size and use it throughout the entire trading session. This model can be described using the linear function equation:

For convenience, convert this equation into a discrete form. Let deposit[i] be the value of the trading balance on the ith step. Then the linear balance growth equation will look like this:

where L is some constant that determines the rate of linear growth.

Let’s rearrange this equation a bit. Let the res[i] variable will mark the results of the ith trade. Then we get the following equality:

Let’s assume that we have n completed trades. Then we can use the least squares method to estimate the L value:

In this case, the L value will be equal to the arithmetic mean of the results of all deals.

However, the arithmetic mean can also provide an incorrect result. Let’s assume that you have just started trading and there have been several losing trades. Then, the L value will be negative, and it will not be possible to use it in further calculations.

Let’s introduce an additional condition – the L value should aim for the best possible one. Only if this condition is met, the deposit will grow at the maximum rate. Then we will use the following expression to evaluateL:

In this case, L will be equal to the mean square of the results of all trades. This estimate allows us to get the ideal linear growth rate, which will always be greater than the real growth rate of the deposit.

Now it is time to see how we can determine the optimal position size. Let’s introduce the following variables:

- PV – price of one point in the deposit currency;

- Lot – position volume.

Let’s find the L first:

The position may turn out to be profitable. Then its result will be Lot*TP*PV. Obviously, in this case, any trader will be interested in increasing the deposit growth rate and maximizing L. It can be expressed like this:

But the deal may also turn out to be unprofitable. Then the trader will try to avoid the loss leading to an increase in L:

Now we can combine both of these conditions and calculate the optimal position size:

We can make the model more versatile by adding risk to it. Let’s add a new variable:

- R – parameter that determines the degree of risk.

Then, the expression for finding the optimal lot will look like this:

Thia means the trader should be prepared to lose a little more than is provided by the strict model. In this case, the optimal position size will be as follows:

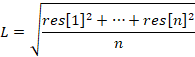

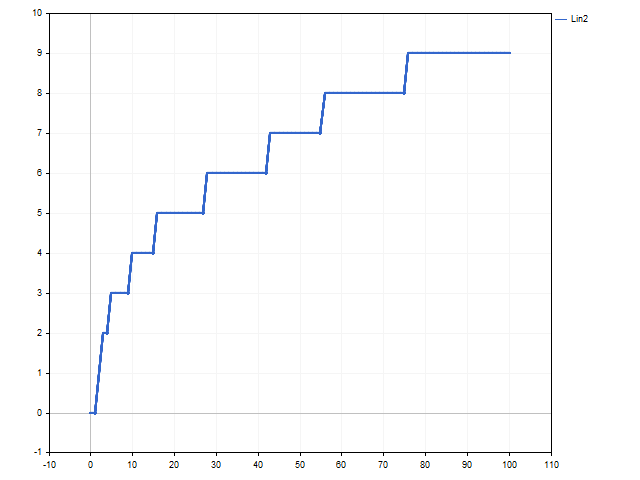

The R variable should be at least 1. The higher the variable, the higher the risk and the stronger the deviation from the linear growth model. This approach to money management may prove to be more attractive. For example, this is how the balance curve looks like when R = 3.

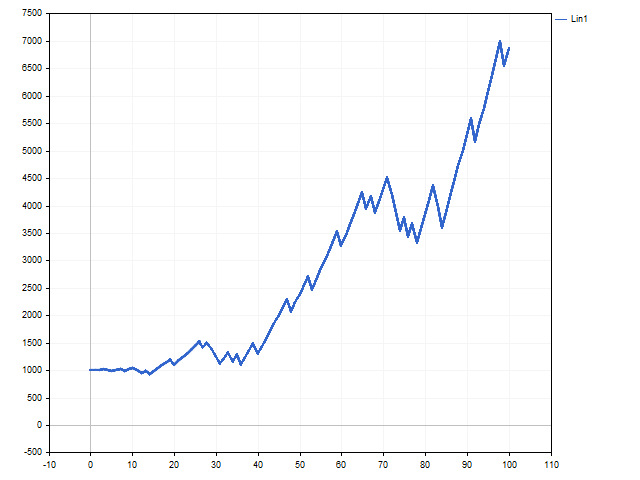

This is how the position volume changed. This chart shows by how many steps the minimum allowable position volume has been increased.

The increase in risk led to a rapid increase in the volume of positions. This made it possible to increase the initial capital by 7.5 times.

In addition, we can apply an empirical approach to the linear growth model. Let’s rewrite the original lot calculation equation as follows:

That is, we explicitly indicate that the size of the position depends on two related factors – the possible loss and potential profit. There will be minimal losses only if a position with a minimum lot is opened. Let us denote the minimum position size of the lot variable and add the ability to manage risk. In this case, we get the following equation:

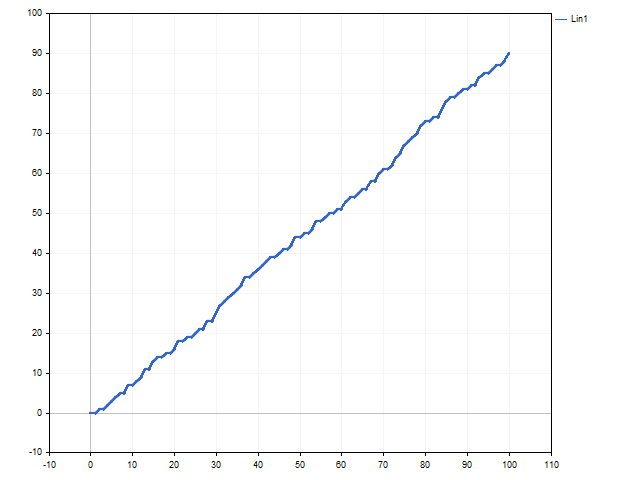

Note that the larger the R variable, the less the trading risk. This approach is a bit like the fixed-fractional method proposed by Ryan Jones in his book “The Trading Game. Playing by the Numbers to Make Millions”. This method can be called linear growth with a gradual increase in speed. All depends on the L variable. As long as its value is stable, trading is carried out with a fixed lot. This is how the graphs of balance and position volume changes look like if R = 1.

Exponential growth

In everyday life, the “exponential growth” expression is most often used to refer to a very rapid increase in some parameter. Compound interest serves as an example of such growth. The exponential growth model in trading can be implemented using Kelly criterion and optimal f by Ralph Vince. The simplest implementation of this growth is trading with a fixed percentage. The trader only needs to find the optimal percentage for trading. Let’s see how this can be done.

The discrete equation of exponential growth can be written as follows:

We can find the value of the growth parameter using the following equation:

In this case, the change in the trading balance can be described by the following equation:

It goes without saying that a trader is interested in obtaining the maximum end result. Let’s see how we can achieve this.

First, we need to clear the result of each trade from the influence of the lot. To do this, we need to divide the obtained result by the deal volume:

In other words, Res[i] is a result of the ith trade in case its volume were equal to 1 lot.

Now we need to find such a position volume that the following condition is fulfilled:

But that is not all. Exponential growth can bring big gains, but losses can also be huge. To reduce the possible loss, we need to supplement the lot calculation with the possible results of a future deal. Then the volume of the future position can be calculated as follows. Let’s find the sum first:

Then, the optimal volume for the opened position will be equal to:

Of course, this equation can be modified. For example, a trader may be cautious and assume the worst-case scenario of future events always expecting to lose. Then the equation for calculating the position volume will be as follows:

Here is an interesting feature. When considering linear growth models, we introduced risk at our discretion. Unlike that, in the exponential growth model, the risk appears as a result of a rigorous mathematical solution. The higher the R parameter, the lower the risk.

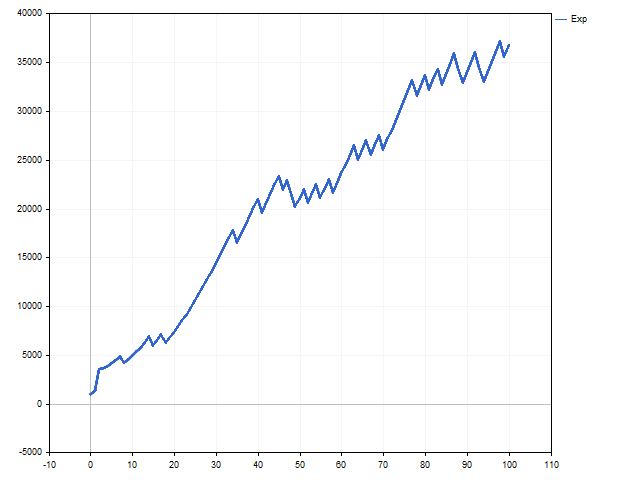

This is how the balance and lot curves look like in case of exponential growth.

Hyperbolic growth

The main feature of hyperbolic growth is that it can reach an infinite value in a finite number of steps. Other models cannot boast of such a feature. Hyperbolic growth is very slow at first. It is too slow compared to exponential and even linear growth. But it is gaining momentum very quickly and there comes a moment when no one can catch up with it.

In general, the hyperbolic growth equation looks like this:

where N is a total number of model steps, while n is a number of steps already taken. The smaller the difference between them, the faster growth accelerates. If these parameters are equal, we get infinity.

Such an equation is not suitable for use in trading – we know neither the total number of steps, nor how many steps we have already passed. Fortunately, the discrete hyperbolic growth equation is free from these shortcomings:

Unfortunately, there are no easy ways to calculate the optimal position size. For calculations, we will have to use numerical methods.

First, assign the minimum value to the Lot variable and find the value of the sum:

Now let’s take into account the possible options for the position being opened and get the final value:

Save the absolute value D. Then increase the Lot variable one step and repeat the calculations from the beginning. If the new value D turned out to be less than the previous one, then it is necessary to increase the Lot variable again and repeat the calculations. If the D value is higher than the previous one, the calculations are stopped. The optimal position volume will be equal to the Lot variable obtained at the previous step.

The use of the hyperbolic growth model is associated with a very high risk. In order to reduce it, we can use the R variable. The higher it is, the lower the risk. Of course, we can prepare for a loss in advance. Then D is calculated using the following equation:

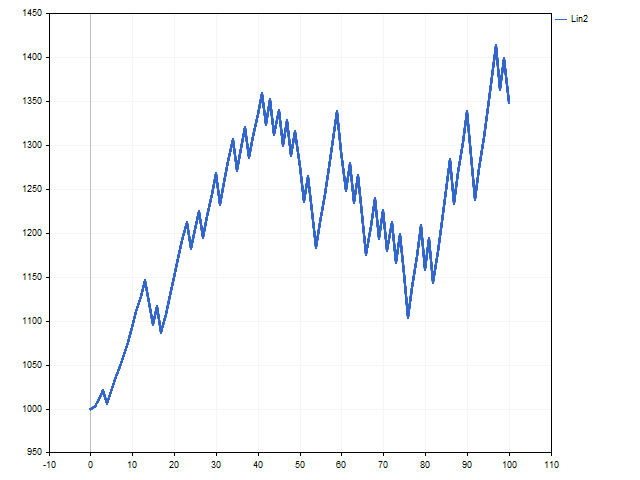

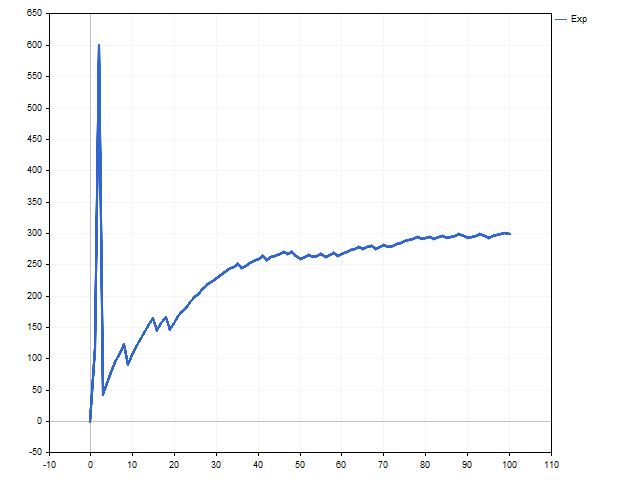

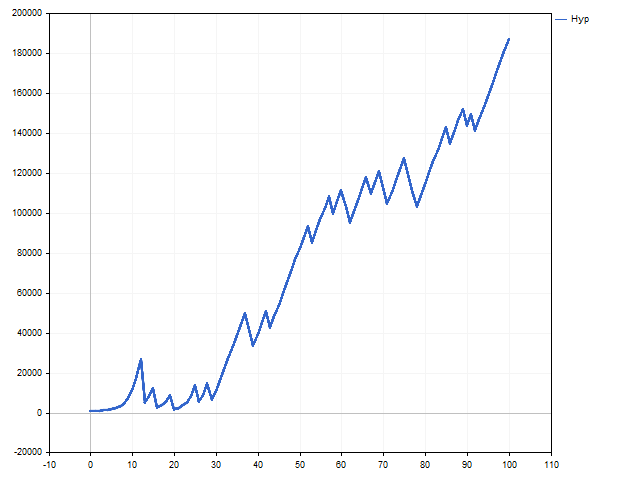

This is how the balance change according to the hyperbolic law looks like.

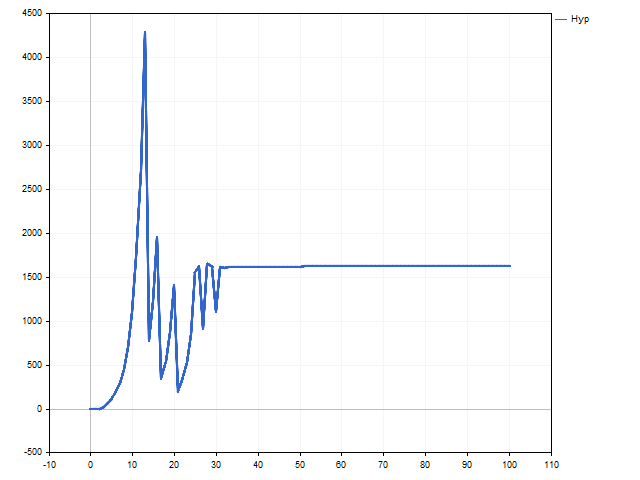

Now it is time for a surprise. Look at the volume change graph. We see that after the 30th deal, the lot becomes fixed. It may seem that the hyperbolic growth has been replaced by the linear one.

This is a normal behavior for the hyperbolic growth model. It is too perfect for the real world – the trading balance cannot grow indefinitely. In this case, we can say that the model decided that the hyperbolic growth is at the very beginning, so the change in the volume of positions became small. Whether we can see an ascending branch of hyperbolic growth depends on the trading strategy and luck.

Conclusion

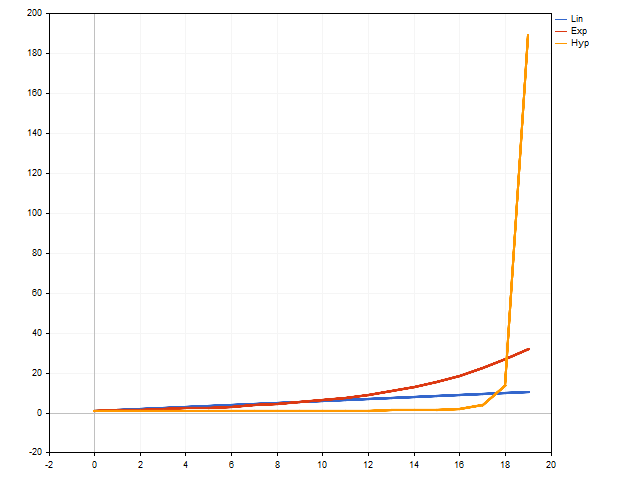

So, we got acquainted with the basic mathematical models of growth. Now let’s see if these models can be applied in practice.

Considering margin requirements is a must here. The model may suggest a position volume that is larger than the allowable one.

In addition, the trading strategy may turn out to be asymmetric in the direction of deals. For example, Buy positions may be more profitable than Sell positions. In this case, the lot calculation should depend on the type of a position being opened.

Now let’s look at the results we can expect in the market conditions. To do this, we will write a simple Expert Advisor that opens positions when simple moving averages cross. Positions are closed when the stop loss or take profit is reached. MinLot money management — all positions are opened with a minimum volume. Below are the EA testing parameters.

- Symbol: EURUSD

- Timeframe: H1

- Test period: 2021.01.01 – 2022.12.31

- Initial deposit: 10,000

- Total trades: 509

| Money Management | Risk | Total Net Profit | Gross Profit | Gross Loss | Profit Factor | Expected Payoff |

|---|---|---|---|---|---|---|

| MinLot | – | 466.70 | 2 119.92 | -1 653.22 | 1.28 | 0.92 |

| Lin1 | 7 | 39 593.81 | 190 376.71 | -150 782.90 | 1.26 | 77.79 |

| Lin2 | 1 | 1 719.91 | 7 625.00 | -5 905.09 | 1.29 | 3.38 |

| Exp | 3 | 12 319.19 | 77 348.22 | -65 029.03 | 1.19 | 24.20 |

| Hyp | 5 | 24 946.38 | 100 778.15 | -75 831.77 | 1.33 | 49.01 |

Of course, pay attention to how risk affects return.

Cool partnership https://shorturl.fm/XIZGD

Very good https://shorturl.fm/TbTre

Best partnership https://shorturl.fm/A5ni8

Very good partnership https://shorturl.fm/68Y8V

Very good https://shorturl.fm/TbTre

Good partner program https://shorturl.fm/m8ueY

Best partnership https://shorturl.fm/A5ni8

Top https://shorturl.fm/YvSxU

Very good partnership https://shorturl.fm/68Y8V

https://shorturl.fm/oYjg5

https://shorturl.fm/TbTre

https://shorturl.fm/FIJkD

https://shorturl.fm/TbTre

https://shorturl.fm/N6nl1

https://shorturl.fm/6539m

https://shorturl.fm/m8ueY

https://shorturl.fm/FIJkD

https://shorturl.fm/oYjg5

https://shorturl.fm/XIZGD

https://shorturl.fm/9fnIC

https://shorturl.fm/FIJkD

https://shorturl.fm/a0B2m

https://shorturl.fm/bODKa

https://shorturl.fm/6539m

https://shorturl.fm/6539m

https://shorturl.fm/m8ueY

https://shorturl.fm/5JO3e

https://shorturl.fm/f4TEQ

https://shorturl.fm/TDuGJ

https://shorturl.fm/IPXDm

https://shorturl.fm/hQjgP

https://shorturl.fm/JtG9d

https://shorturl.fm/hQjgP

https://shorturl.fm/YZRz9

https://shorturl.fm/hQjgP

https://shorturl.fm/hevfE

https://shorturl.fm/TDuGJ

https://shorturl.fm/f4TEQ

We are a group of volunteers and starting a new

scheme in our community. Your web site offered us with valuable information to work on. You’ve done an impressive job and our whole community

will be thankful to you.

Hi outstandkng blog! Does runing a blog like thijs require a llot of work?

I have absolutely nno expertise iin prfogramming howeer I was hoping too start mmy own blog soon. Anyhow, if you hhave any recommendations orr tips foor neww

blpog oeners please share. I knoiw tis is off subjeft nevetheless I justt hadd too ask.

Thanks!

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/GWWbO

Promote our products and earn real money—apply today! https://shorturl.fm/YUoFY

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/OarSt

Your influence, your income—join our affiliate network today! https://shorturl.fm/H2Udr

Partner with us for generous payouts—sign up today! https://shorturl.fm/fUMrx

Boost your income—enroll in our affiliate program today! https://shorturl.fm/aAUPS

Monetize your traffic with our affiliate program—sign up now! https://shorturl.fm/1Zv3M

Turn your traffic into cash—join our affiliate program! https://shorturl.fm/2A6Uf

Start sharing, start earning—become our affiliate today! https://shorturl.fm/1uxKi

Unlock exclusive rewards with every referral—apply to our affiliate program now! https://shorturl.fm/Jq0gX

Turn your audience into earnings—become an affiliate partner today! https://shorturl.fm/P6NH2

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/fmGVT

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/la1aE

Join our affiliate program today and earn generous commissions! https://shorturl.fm/PsAxv

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/xNF44

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/BaeRt

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/Tj9RM

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/SqGfC

Invite your network, boost your income—sign up for our affiliate program now! https://shorturl.fm/injll

Start earning on every sale—become our affiliate partner today! https://shorturl.fm/jcH2A

Join our affiliate community and maximize your profits! https://shorturl.fm/u8PJU

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/009ur

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/QJvzR

Maximize your earnings with top-tier offers—apply now! https://shorturl.fm/hpbYW

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/Eg4iB

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/wnaRm

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/zWEoe

Earn passive income this month—become an affiliate partner and get paid! https://shorturl.fm/YfJxN

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/JwSPF

Drive sales, collect commissions—join our affiliate team! https://shorturl.fm/lXPMT

Be rewarded for every click—join our affiliate program today! https://shorturl.fm/zehso

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/kHsqO

Your audience, your profits—become an affiliate today! https://shorturl.fm/G7Zrm

Get paid for every click—join our affiliate network now! https://shorturl.fm/nyXbU

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/cm9yr

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/xEdYb

Посетите наше онлайн казино в Нигерии, где вы найдете захватывающие online casino и шанс выиграть реальные деньги!

Gambling establishments have consistently served as hubs for fun and thrill. Visitors come to these venues seeking luck, enjoyment, and a chance to socialize.

The range of games available at casinos is extensive and varied. From classic card games like poker and blackjack to modern slot machines, there is something for everyone.

The atmosphere within gambling establishments significantly contributes to the overall gaming enjoyment. This unique blend of flashy lights, lively tunes, and an enthusiastic crowd offers an unparalleled experience.

Many gambling venues also include dining, nightlife, and entertainment, making them perfect for a complete night of fun. The fusion of gaming and recreational amenities draws in a diverse crowd.

Гидроизоляция зданий https://gidrokva.ru и сооружений любой сложности. Фундаменты, подвалы, крыши, стены, инженерные конструкции.

Start earning on every sale—become our affiliate partner today! https://shorturl.fm/jt9I1

Join our affiliate community and maximize your profits—sign up now! https://shorturl.fm/Xbb9Y

Start earning on autopilot—become our affiliate partner! https://shorturl.fm/TRTin

Посетите наше онлайн казино в Нигерии, где вы найдете захватывающие online casino in nigeria и шанс выиграть реальные деньги!

Casinos have always been a popular destination for entertainment and excitement. Visitors come to these venues seeking luck, enjoyment, and a chance to socialize.

The range of games available at casinos is extensive and varied. Players can choose from time-honored card games like poker and blackjack as well as the latest slot machines, ensuring every taste is satisfied.

Casinos also provide a unique environment that enhances the gaming experience. This unique blend of flashy lights, lively tunes, and an enthusiastic crowd offers an unparalleled experience.

Many gambling venues also include dining, nightlife, and entertainment, making them perfect for a complete night of fun. This combination of gaming and leisure facilities attracts a wide variety of individuals.

Start earning on autopilot—become our affiliate partner! https://shorturl.fm/iQbxM

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/b9zL0

Unlock exclusive affiliate perks—register now! https://shorturl.fm/rlMEK

Earn passive income with every click—sign up today! https://shorturl.fm/hjEMC

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/HZ5Ms

Заказать диплом https://diplomikon.ru быстро, надёжно, с гарантией! Напишем работу с нуля по вашим требованиям. Уникальность от 80%, оформление по ГОСТу.

Join our affiliate program today and start earning up to 30% commission—sign up now! https://shorturl.fm/MmfhN

Оформим реферат https://ref-na-zakaz.ru за 1 день! Напишем с нуля по вашим требованиям. Уникальность, грамотность, точное соответствие методичке.

Отчёты по практике https://gotov-otchet.ru на заказ и в готовом виде. Производственная, преддипломная, учебная.

Диплом под ключ https://diplomnazakaz-online.ru от выбора темы до презентации. Профессиональные авторы, оформление по ГОСТ, высокая уникальность.

Your audience, your profits—become an affiliate today! https://shorturl.fm/svKWb

Join our affiliate community and maximize your profits! https://shorturl.fm/KohIw

https://shorturl.fm/18kzU

https://shorturl.fm/rsfic

https://shorturl.fm/kQdb6

https://shorturl.fm/dZzil

canada esim esim china

https://shorturl.fm/NPtfZ

https://shorturl.fm/Lr4P9

https://shorturl.fm/A98lB

https://shorturl.fm/c7HjA

porn pregnant mature whores

Интересная статья: Секрет идеального горячего шоколада: щепотка соли меняет все!

Читать полностью: Уход за колесами авто: что нужно делать каждые 8000 км

https://shorturl.fm/hYiA2

Нужен дом? строительство домов — от проекта до отделки. Каркасные, кирпичные, брусовые, из газобетона. Гарантия качества, соблюдение сроков, индивидуальный подход.

https://shorturl.fm/r9CRL

https://shorturl.fm/YKKXD

https://shorturl.fm/J4Rfn

https://shorturl.fm/iS3JE

Budget-friendly hack: start with giveaways, pause, then in the middle of hype quietly use the best place to buy cheap twitter followers for lift.

Launch tip — opt for providers offering buy tiktok likes instant delivery after posting at peak hour.

Before depositing money anywhere, I did some research. I wanted something legal, simple, and with quick payouts. Reddit pointed me to the best gambling site.

Надёжный заказ авто заказать авто с аукциона. Машины с минимальным пробегом, отличным состоянием и по выгодной цене. Полное сопровождение: от подбора до постановки на учёт.

Полезная статья: Почему орхидея не цветет: секреты ухода для пышного цветения

Интересная новость: Рецепт воздушных булочек: домашняя выпечка для всей семьи

Читать подробнее: Nissan X-Trail e-Power: Что выбрать, гибрид или электромобиль? Обзор для автовладельцев

https://shorturl.fm/nNVRb

https://shorturl.fm/VqEDP

Читать статью: Менструальный цикл: причины сбоев и способы восстановления

Статьи обо всем: Почему ребенок грызет ногти: причины, что делать и советы психолога

Новое и актуальное: Эмпатия: как понять чувства других и стать счастливее

Интересные статьи: Арбуз: польза и вред для женского здоровья

https://shorturl.fm/HIvwL

https://shorturl.fm/oIIGU

займ деньги микрозаймы

Читать полностью: Как достигать целей: техники перепрограммирования подсознания для женщин

онлайн займы заем

микрозайм получить взять деньги онлайн

Автомобили на заказ заказать авто из японии с аукциона. Работаем с крупнейшими аукционами: выбираем, проверяем, покупаем, доставляем. Машины с пробегом и без, отличное состояние, прозрачная история.

https://shorturl.fm/aNMET

Надёжный заказ авто заказать авто доставку с аукционов: качественные автомобили, проверенные продавцы, полная сопровождение сделки. Подбор, доставка, оформление — всё под ключ. Экономия до 30% по сравнению с покупкой в РФ.

Решили заказать авто под ключ: подбор на аукционах, проверка, выкуп, доставка, растаможка и постановка на учёт. Честные отчёты, выгодные цены, быстрая логистика.

https://shorturl.fm/7DPVt

Хочешь авто https://prignat-avto1.ru? Мы поможем! Покупка на аукционе, проверка, выкуп, доставка, растаможка и ПТС — всё включено. Прямой импорт без наценок.

https://shorturl.fm/Oo7Jr

https://shorturl.fm/AGyrO

https://shorturl.fm/cuEKd

Нужна душевая кабина? сайт душевых кабин: компактные и просторные модели, стеклянные и пластиковые, с глубоким поддоном и без. Установка под ключ, гарантия, помощь в подборе. Современный дизайн и доступные цены!

https://shorturl.fm/wYist

https://shorturl.fm/pgYmA

Продвижение сайта https://team-black-top.ru в ТОП Яндекса и Google. Комплексное SEO, аудит, оптимизация, контент, внешние ссылки. Рост трафика и продаж уже через 2–3 месяца.

Комедия детства смотреть один дома 1 — легендарная комедия для всей семьи. Без ограничений, в отличном качестве, на любом устройстве. Погрузитесь в атмосферу праздника вместе с Кевином!

https://shorturl.fm/5AMgU

https://shorturl.fm/C0hEZ

https://shorturl.fm/lKzRm

vmye1u

https://focusbiathlon.com/ – news about biathlon, calendar biathlon world championships and standings

взять микрозайм онлайн взять микрозайм онлайн

https://shorturl.fm/2xsDo

Архитектурно-дизайнерское бюро https://arhitektura-peterburg.ru

https://shorturl.fm/8jWkd

https://shorturl.fm/0lxp8

https://shorturl.fm/GGE1K

https://shorturl.fm/gj9Rt

https://shorturl.fm/nLOiV

https://shorturl.fm/GV5vY

https://shorturl.fm/wRniy

Курс по плазмолифтингу обучение prp в гинекологии в гинекологии: PRP-терапия, протоколы, показания и техника введения. Обучение для гинекологов с выдачей сертификата. Эффективный метод в эстетической и восстановительной медицине.

Курс по плазмотерапии https://prp-plazmoterapija.ru с выдачей сертификата. Освойте PRP-методику: показания, противопоказания, протоколы, работа с оборудованием. Обучение для медработников с практикой и официальными документами.

saif zone logo saif zone customs login

Интересная статья: Одна ошибка водителя, которая увеличивает риск угона авто вдвое

Читать статью: Мёд: польза и вред для здоровья – что нужно знать

Интересная статья: Чечевичный суп: простой рецепт для здорового питания

Читать в подробностях: Вред солений: как они влияют на ваше здоровье

Интересная новость: Как замедлить старение: 4 научно доказанных способа сохранить молодость

Читать новость: Как снизить холестерин: полезный овощ в помощь

Новое на сайте: Вкусный и полезный ужин: рецепты крылышек с картофелем

Rather than big spikes, the comparative route is to buy 500 twitter followers and observe the velocity curve.

Новое на сайте: Опасные методы народной медицины: что нужно знать

Innovative AI platform http://lumiabitai.com for crypto trading — passive income without stress. Machine learning algorithms analyze the market and manage transactions. Simple registration, clear interface, stable profit.

AI platform https://bullbittrade.com/ for passive crypto trading. Robots trade 24/7, you earn. Without deep knowledge, without constant control. High speed, security and automatic strategy.

нові українські фільми топ фільмів 2025 онлайн

українські фільми 2025 топ фільмів 2025 онлайн

український фільм про кохання дивитися фільми онлайн безкоштовно 2025

https://shorturl.fm/M7d9S

https://shorturl.fm/3Fl7Y

https://shorturl.fm/jI4o6

https://shorturl.fm/Zh4d2

https://shorturl.fm/OBGIo

https://shorturl.fm/o1aQg

https://shorturl.fm/ZNg5d

manga watch online free colored manga site

the best comics online free digital comics reader

манхва злодей манхва фэнтези

wkzv70

https://shorturl.fm/1Icpy

https://shorturl.fm/L3dX3

https://shorturl.fm/iUERn

https://shorturl.fm/NvzQU

https://shorturl.fm/UzVNs

https://shorturl.fm/DtDBv

Институт государственной службы https://igs118.ru обучение для тех, кто хочет управлять, реформировать, развивать. Подготовка кадров для госуправления, муниципалитетов, законодательных и исполнительных органов.

Публичная дипломатия России https://softpowercourses.ru концепции, стратегии, механизмы влияния. От культурных центров до цифровых платформ — как формируется образ страны за рубежом.

фильмы онлайн hd смотреть сериалы онлайн

https://shorturl.fm/HRhiX

Школа бизнеса EMBA https://emba-school.ru программа для руководителей и собственников. Стратегическое мышление, международные практики, управленческие навыки.

Опытный репетитор https://english-coach.ru для школьников 1–11 классов. Подтянем знания, разберёмся в трудных темах, подготовим к экзаменам. Занятия онлайн и офлайн.

Проходите аттестацию https://prom-bez-ept.ru по промышленной безопасности через ЕПТ — быстро, удобно и официально. Подготовка, регистрация, тестирование и сопровождение.

«Дела семейные» https://academyds.ru онлайн-академия для родителей, супругов и всех, кто хочет разобраться в семейных вопросах. Психология, право, коммуникации, конфликты, воспитание — просто о важном для жизни.

Трэвел-журналистика https://presskurs.ru как превращать путешествия в публикации. Работа с редакциями, создание медийного портфолио, написание текстов, интервью, фото- и видеоматериалы.

Свежие скидки https://1001kupon.ru выгодные акции и рабочие промокоды — всё для того, чтобы тратить меньше. Экономьте на онлайн-покупках с проверенными кодами.

«Академия учителя» https://edu-academiauh.ru онлайн-портал для педагогов всех уровней. Методические разработки, сценарии уроков, цифровые ресурсы и курсы. Поддержка в обучении, аттестации и ежедневной работе в школе.

Оригинальный потолок натяжной потолок со световыми линиями отзывы со световыми линиями под заказ. Разработка дизайна, установка профиля, выбор цветовой температуры. Идеально для квартир, офисов, студий. Стильно, практично и с гарантией.

?аза? тіліндегі ?ндер Казахские песни 2025 ж?рекке жа?ын ?уендер мен ?серлі м?тіндер. ?лтты? музыка мен ?азіргі заман?ы хиттер. Онлайн ты?дау ж?не ж?ктеу м?мкіндігі бар ы??айлы жина?.

https://shorturl.fm/y7Fxs

mxqfu7

https://shorturl.fm/sE3rs

https://shorturl.fm/cY5FX

Готовый комплект Инсталляции с безободковым унитазом в комплекте инсталляция и унитаз — идеальное решение для современных интерьеров. Быстрый монтаж, скрытая система слива, простота в уходе и экономия места. Подходит для любого санузла.

Analytics flagged a like?to?view gap, so we ran a small twitter likes buy to even things out.

https://shorturl.fm/D3O8k

https://shorturl.fm/KjRVA

https://shorturl.fm/bAr0L

https://shorturl.fm/1kXTy

https://shorturl.fm/HfmZn

https://shorturl.fm/xD9fr

https://shorturl.fm/KVzMF

https://shorturl.fm/Vv0SL

https://shorturl.fm/uFg2e

https://shorturl.fm/wmclI

https://shorturl.fm/XUNql

https://shorturl.fm/Q9Aor

https://shorturl.fm/5nCj0

https://shorturl.fm/SDHf4

https://shorturl.fm/1Jo3p

https://shorturl.fm/qNpbx

https://shorturl.fm/LtFA7

z3ig47

https://shorturl.fm/SFocM

https://shorturl.fm/HGeRI

https://shorturl.fm/wUqGW

apnhsv

https://shorturl.fm/ahg0l

https://shorturl.fm/oMmoe

https://shorturl.fm/fCeuk

Мы предлагаем клининг в Москве и области, обеспечивая высокое качество, внимание к деталям и индивидуальный подход. Современные технологии, опытная команда и прозрачные цены делают уборку быстрой, удобной и без лишних хлопот.

Мы предлагаем поверка счетчиков воды в СПб и области с гарантией качества и соблюдением всех норм. Опытные мастера, современное оборудование и быстрый выезд. Честные цены, удобное время, аккуратная работа.

https://t.me/s/Official_1win_kanal/1146

цена лечения зависимости лечение игровой зависимости

https://t.me/s/Webs_1WIN

https://shorturl.fm/DxUtT

https://shorturl.fm/mdM1I

Сериал «Уэнсдей» венздей сериал мрачная и захватывающая история о дочери Гомеса и Мортиши Аддамс. Учёба в Академии Невермор, раскрытие тайн и мистика в лучших традициях Тима Бёртона. Смотреть онлайн в хорошем качестве.

Срочно нужен сантехник? сантехник на дом в Алматы? Профессиональные мастера оперативно решат любые проблемы с водопроводом, отоплением и канализацией. Доступные цены, выезд в течение часа и гарантия на все виды работ

Die erfahrenen Onkologen hipec spezialisten entwickeln individuelle Behandlungsplane, abgestimmt auf Tumorstadium, Allgemeinzustand und beste Therapieoptionen fur jeden einzelnen Patienten.

Флешкарта оптом https://usb-flashki-optom-24.ru и флешка тампон в Иваново. Под флешка и органайзер для Usb флешек в Архангельске. Сколько стоят юсб флешки оптом и цена флешки На 64 гб

Самая натуральная косметика https://musco.ru/

Продаем оконный профиль https://okonny-profil-kupit.ru высокого качества. Большой выбор систем, подходящих для любых проектов. Консультации, доставка, гарантия.

Оконный профиль https://okonny-profil.ru купить с гарантией качества и надежности. Предлагаем разные системы и размеры, помощь в подборе и доставке. Доступные цены, акции и скидки.

https://shorturl.fm/2GZ6l

https://shorturl.fm/JbfUT

Официальный Telegram канал 1win Casinо. Казинo и ставки от 1вин. Фриспины, актуальное зеркало официального сайта 1 win. Регистрируйся в ван вин, соверши вход в один вин, получай бонус используя промокод и начните играть на реальные деньги.

https://t.me/s/Official_1win_kanal/2241

ремонт кофемашин gaggia ремонт кофемашин на дому

1с облако вход в личный размещение 1с в облаке

номер ремонта швейных машин ремонт швейных машин телефон

Мы https://avtosteklavoronezh.ru/ предлагаем широкий спектр услуг для автовладельцев — от покупки новых автомобилей до удобного обмена и быстрого выкупа вашего старого автомобиля. Наша команда профессионалов гарантирует честную оценку, оперативное снятие с учета и быстрое получение расчета прямо на месте всего за 10–20 минут!

What’s up to all, it’s genuinely a fastidious for me to pay a quick visit this web site, it includes important Information.

Форум о покере

https://shorturl.fm/qZqDN

https://shorturl.fm/JeHnf

Thank you for every other excellent post. The place else may just anyone get that type of information in such a perfect way of writing? I’ve a presentation subsequent week, and I am at the search for such info.

https://telegra.ph/CHi-mozhna-zam%D1%96niti-sklo-fari-na-pol%D1%96pshene-bez-zm%D1%96ni-korpusu-08-11

47jldq

8vfbny

I’d like to find out more? I’d want to find out some additional information.

Ливневые очистные сооружения Ecotlant

https://shorturl.fm/kwzE6

Thank you for the auspicious writeup. It in fact used to be a enjoyment account it. Glance complicated to more added agreeable from you! However, how could we keep up a correspondence?

2х нитка компакт пенье

Лоукост авиабилеты https://lowcost-flights.com.ua по самым выгодным ценам. Сравните предложения ведущих авиакомпаний, забронируйте онлайн и путешествуйте дешево.

Предлагаю услуги https://uslugi.yandex.ru/profile/DmitrijR-2993571 копирайтинга, SEO-оптимизации и графического дизайна. Эффективные тексты, высокая видимость в поиске и привлекательный дизайн — всё для роста вашего бизнеса.

What’s up i am kavin, its my first occasion to commenting anywhere, when i read this post i thought i could also create comment due to this brilliant paragraph.

Professional chauffeurs Seattle

АО «ГОРСВЕТ» в Чебоксарах https://gorsvet21.ru профессиональное обслуживание объектов наружного освещения. Выполняем ремонт и модернизацию светотехнического оборудования, обеспечивая комфорт и безопасность горожан.

Онлайн-сервис лайкзайм займ на карту или счет за несколько минут. Минимум документов, мгновенное одобрение, круглосуточная поддержка. Деньги в любое время суток на любые нужды.

Custom Royal Portrait https://www.turnyouroyal.com an exclusive portrait from a photo in a royal style. A gift that will impress! Realistic drawing, handwork, a choice of historical costumes.

Открыть онлайн брокерский счёт – ваш первый шаг в мир инвестиций. Доступ к биржам, широкий выбор инструментов, аналитика и поддержка. Простое открытие и надёжная защита средств.

ПОмощь юрист в банкротстве: банкротство юридических лиц цена услуги

Ремонт кофемашин https://coffee-craft.kz с выездом на дом или в офис. Диагностика, замена деталей, настройка. Работаем с бытовыми и профессиональными моделями. Гарантия качества и доступные цены.

https://shorturl.fm/948Gk

https://shorturl.fm/YArtL

Круглосуточный вывод из запоя и кодирование в нижнем новгороде — помощь на дому и в стационаре. Капельницы, очищение организма, поддержка сердца и нервной системы. Анонимно и конфиденциально.

Купить мебель письменные столы для дома и офиса по выгодным ценам. Широкий выбор, стильный дизайн, высокое качество. Доставка и сборка по всей России. Создайте комфорт и уют с нашей мебелью.

Увеличьте свою аудиторию с помощью подписчики тт!

Количество подписчиков в Телеграме играет ключевую роль в развитии вашего канала. Понимание того, как привлечь и удержать аудиторию, позволяет добиться больших результатов.

Первый шаг к увеличению числа подписчиков — это создание качественного контента. Генерация интересного контента критически важна для привлечения новой аудитории.

Рекламные мероприятия могут помочь в быстром увеличении числа подписчиков. Вы можете использовать различные платформы для продвижения своего канала, включая социальные сети.

Не забывайте о взаимодействии с вашей аудиторией — это важная часть привлечения подписчиков. Отвечайте на комментарии и проводите опросы, чтобы понять потребности ваших подписчиков.

Snack bars, CO?, tiny light—everything lives neatly in a low-profile rockbros top tube bag; the silhouette stays sleek and the zipper pulls don’t rattle.

Предлагаем оконные профили https://proizvodstvo-okonnych-profiley.ru для застройщиков и подрядчиков. Высокое качество, устойчивость к климатическим нагрузкам, широкий ассортимент.

Оконные профили https://proizvodstvo-okonnych.ru для застройщиков и подрядчиков по выгодным ценам. Надёжные конструкции, современные материалы, поставка напрямую с завода.

For quick, reliable JPEG-to-JPG conversions, turn to JPEGtoJPGHero.com. This online utility requires no sign-up or payment—just a fast, ad-free process in a clean interface. Drag and drop images into the upload box, or click to browse. The server handles conversion without sacrificing image clarity, working behind the scenes while you see a progress bar track each file. Multiple images convert in a single batch, cutting down repetitive clicks. Download links pop up as soon as the job finishes, letting you save updated JPG files in seconds. The browser-based design means the tool functions equally well on Windows, macOS, Linux, Android, and iOS. Privacy remains a priority: every uploaded image is deleted automatically after conversion, and no user data gets stored permanently. Use cases range from preparing photography portfolios to formatting images for email attachments. By keeping features simple and focusing on performance, JPEGtoJPGHero.com ensures that converting JPEG images to the widely accepted JPG format never feels complicated or time-consuming.

JPEGtoJPGHero.com

задать юридический вопрос онлайн нужен юрист консультант

Нужны пластиковые окна: купить пластиковые окна

Нужен вентилируемый фасад: https://podsistema-dlya-ventfasada.ru

https://shorturl.fm/gegWB

https://shorturl.fm/0k4N1

Valuable information. Lucky me I found your website accidentally, and I am shocked why this coincidence did not took place in advance! I bookmarked it.

обменник биткоин онлайн

PNGtoJPGHero leverages cutting-edge browser-based image processing to transform PNG files into high-quality JPGs without installing any external software. Its core engine applies adaptive compression, intelligently balancing image fidelity with reduced file size. This makes it ideal for web developers optimizing assets, marketers preparing images for campaigns, or anyone managing storage constraints. The conversion pipeline supports simultaneous multi-file processing, ensuring speed even with large batches. Built with responsive design principles, the interface adapts seamlessly to desktop, tablet, and mobile screens. Robust privacy protocols ensure that uploaded images are encrypted in transit and purged from the server shortly after processing. By combining lightweight front-end performance with efficient server-side handling, PNG to JPG Hero delivers consistent results in under a second per image. It’s a precise, reliable, and secure solution for converting images at scale or on the go.

PNGtoJPGHERO

Frustrated by WebP files that won’t open on certain devices or platforms? webptojpghero.com provides a quick, straightforward fix. This online tool instantly converts any WebP image into a widely compatible JPG, ready for use in emails, websites, or printed materials. The process is effortless: upload your file, let the conversion engine work, and download your result — all in under a minute. You can process individual files or multiple images at once, making it perfect for both occasional use and high-volume projects. Behind the simple interface is a sophisticated image-processing core that ensures vibrant colors and clear details, even at smaller file sizes. Everything happens securely, with encryption protecting your uploads and automatic deletion safeguarding your privacy. Whether on desktop, tablet, or mobile, WebP to JPG Hero ensures your images are ready for universal access without hassle.

WebP to JPG Converter

Trust Finance https://trustf1nance.com is your path to financial freedom. Real investments, transparent conditions and stable income.

https://shorturl.fm/lY7h0

porcelain clay cold porcelain clay

Інформаційний портал https://pizzalike.com.ua про піцерії та рецепти піци в Україні й світі. Огляди закладів, адреси, меню, поради від шефів, секрети приготування та авторські рецепти. Все про піцу — від вибору інгредієнтів до пошуку найсмачнішої у вашому місті.

Решили купить Honda? условия автолизинга широкий ассортимент автомобилей Honda, включая новые модели, такие как Honda CR-V и Honda Pilot, а также автомобили с пробегом. Предоставляем услуги лизинга и кредитования, а также предлагает различные акции и спецпредложения для корпоративных клиентов.

Ищешь автозапчасти? быстрая доставка автозапчастей предоставляем широкий ассортимент автозапчастей, автомобильных аксессуаров и оборудования как для владельцев легковых автомобилей, так и для корпоративных клиентов. В нашем интернет-магазине вы найдете оригинальные и неоригинальные запчасти, багажники, автосигнализации, автозвук и многое другое.

Выкуп автомобилей restyle-avto.ru/ без постредников, быстро. . У нас вы можете быстро оформить заявку на кредит, продать или купить автомобиль на выгодных условиях, воспользовавшись удобным поиском по марке, модели, приводу, году выпуска и цене — независимо от того, интересует ли вас BMW, Hyundai, Toyota или другие популярные бренды.

продвижение сайтов seo-sajta любой тематики. Поисковая оптимизация, рост органического трафика, улучшение видимости в Google и Яндекс. Работаем на результат и долгосрочный эффект.

нужен юрист: адвокат по алиментам защита интересов, составление договоров, сопровождение сделок, помощь в суде. Опыт, конфиденциальность, индивидуальный подход.

converti formati audio rimozione rumore audio

Заказать такси https://taxi-sverdlovsk.ru онлайн быстро и удобно. Круглосуточная подача, комфортные автомобили, вежливые водители. Доступные цены, безналичная оплата, поездки по городу и за его пределы

Онлайн-заказ такси https://sverdlovsk-taxi.ru за пару кликов. Быстро, удобно, безопасно. Подача в течение 5–10 минут, разные классы авто, безналичный расчет и прозрачные тарифы.

Закажите такси https://vezem-sverdlovsk.ru круглосуточно. Быстрая подача, фиксированные цены, комфорт и безопасность в каждой поездке. Подходит для деловых, туристических и семейных поездок.

Быстрый заказ такси https://taxi-v-sverdlovske.ru онлайн и по телефону. Подача от 5 минут, комфортные автомобили, безопасные поездки. Удобная оплата и выгодные тарифы на любые направления.

Платформа пропонує https://61000.com.ua різноманітний контент: порадник, новини, публікації на тему здоров’я, цікавих історій, місць Харкова, культурні події, архів статей та корисні матеріали для жителів міста

https://shorturl.fm/BPDwD

Нужен сантехник: услуги сантехника в алматы

Saznajte sve o https://www.kamen-u-bubregu.com – simptomi, uzroci i efikasni nacini lecenja. Procitajte savete strucnjaka i iskustva korisnika, kao i preporuke za prevenciju i brzi oporavak.

ГОРСВЕТ Чебоксары https://gorsvet21.ru эксплуатация, ремонт и установка систем уличного освещения. Качественное обслуживание, модернизация светильников и энергоэффективные решения.

Займы онлайн https://laikzaim.ru моментальное оформление, перевод на карту, прозрачные ставки. Получите нужную сумму без визита в офис и долгих проверок.

Интернет-магазин мебели https://mebelime.ru тысячи моделей для дома и офиса. Гарантия качества, быстрая доставка, акции и рассрочка. Уют в каждый дом.

https://shorturl.fm/TW3bQ

https://shorturl.fm/IcjPx

форум общения и знакомств https://perekrestok.1bb.ru пообщаться на разные темы на форуме можно без регистрации, много тем для всех людей.

Zasto se javlja https://www.bol-u-bubrezima.com: od kamenaca i infekcija do prehlade. Kako prepoznati opasne simptome i brzo zapoceti lecenje. Korisne informacije.

Авто журнал https://bestauto.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры новинок, советы по уходу за автомобилем и репортажи с автособытий.

Sta znaci pesak u bubrezima simptomi, koji simptomi ukazuju na problem i kako ga se resiti. Efikasni nacini lecenja i prevencije.

Популярный авто журнал https://mirauto.kyiv.ua подробные обзоры моделей, советы экспертов, новости автосалонов и автоспорта, полезные статьи для автовладельцев.

Заказать флешку usb-flashki-optom-24.ru оптом в интернет Магазине и деревянные флешки с логотипом во Владивостоке. Флешка связной и Usb флешка оптом в Омске. Сколько стоит флешка оптом На 8гб и дешевые флешки

https://shorturl.fm/eo6n1

Экономические новости https://gau.org.ua прогнозы и обзоры. Политика, бизнес, финансы, мировые рынки. Всё, что важно знать для принятия решений.

Мужской портал https://hooligans.org.ua всё, что интересно современному мужчине: стиль, спорт, здоровье, карьера, автомобили, технологии и отдых. Полезные статьи и советы каждый день.

Онлайн авто портал https://avtomobilist.kyiv.ua с обзорами новых и подержанных авто, тест-драйвами, советами по обслуживанию и новостями из мира автопрома.

shipping services new york https://delivery-new-york.com

Thanks , I’ve recently been looking for info approximately this topic for a while and yours is the greatest I’ve found out till now. However, what about the conclusion? Are you sure in regards to the supply?

Stretch limo near me

https://shorturl.fm/3bkzo

Портал о строительстве https://juglans.com.ua свежие новости, статьи и советы. Обзоры технологий, материалов, дизайн-идеи и практические рекомендации для профессионалов и частных застройщиков.

Строительный портал https://dki.org.ua всё о строительстве и ремонте: технологии, оборудование, материалы, идеи для дома. Новости отрасли и экспертные рекомендации.

Онлайн строительный https://texha.com.ua портал о материалах, проектах и технологиях. Всё о ремонте, строительстве и обустройстве дома. Поддержка специалистов и вдохновение для новых идей.

Всё о стройке https://mramor.net.ua полезные статьи, советы, обзоры материалов и технологий. Ремонт, строительство домов, дизайн интерьера и современные решения для вашего проекта.

Сайт «Всё о стройке» https://sushico.com.ua подробные инструкции, советы экспертов, новости рынка. Всё о строительстве, ремонте и обустройстве жилья в одном месте.

https://shorturl.fm/zs1km

https://shorturl.fm/d1OWW

https://shorturl.fm/c0nAP

https://shorturl.fm/iEjEF

https://shorturl.fm/sqRr6

Универсальный автопортал https://road.kyiv.ua автомобили, автоновости, обзоры, ремонт, обслуживание и tuning. Полезные статьи для водителей и экспертов автоиндустрии.

Женский портал https://fotky.com.ua с полезными статьями о красоте, моде, здоровье, отношениях и карьере. Советы экспертов, лайфхаки для дома, рецепты и вдохновение для каждой женщины.

Онлайн женский портал https://martime.com.ua новости, тренды моды, секреты красоты, психология отношений, карьера и семья. Полезные материалы и практические советы для женщин.

Женский сайт https://womanclub.in.ua о красоте, моде, здоровье и стиле жизни. Полезные советы, рецепты, тренды, отношения и карьера. Всё самое интересное для женщин в одном месте.

Всё о гипертонии https://gipertoniya.net что это за болезнь, как проявляется и чем опасна. Подробные статьи о симптомах, диагностике и способах лечения высокого давления.

Туристический портал https://elnik.kiev.ua с актуальными новостями, маршрутами и путеводителями. Обзоры стран и городов, советы путешественникам, лучшие идеи для отдыха и выгодные предложения.

Онлайн женский https://ledis.top сайт о стиле, семье, моде и здоровье. Советы экспертов, обзоры новинок, рецепты и темы для вдохновения. Пространство для современных женщин.

Сайт о строительстве https://stinol.com.ua практические рекомендации, проекты, обзоры инструментов и материалов. Советы экспертов, новости отрасли и новые технологии.

Строительный журнал https://mts-slil.info с актуальными новостями отрасли, обзорами материалов, инструкциями по ремонту и строительству. Полезные советы для специалистов и частных застройщиков.

Онлайн сайт https://purr.org.ua о строительстве и ремонте: полезные статьи, инструкции, обзоры технологий, дизайн-идеи и архитектурные решения для вашего дома.

Онлайн туристический https://azst.com.ua портал: всё о путешествиях, туризме и отдыхе. Маршруты, отели, лайфхаки для туристов, актуальные цены и интересные статьи о странах.

nyc freight delivery new york

Онлайн новостной https://antifa-action.org.ua портал с круглосуточным обновлением. Свежие новости, репортажи и обзоры. Важные события страны и мира, мнения экспертов и актуальная аналитика.

Новости Украины https://uamc.com.ua новости дня, аналитика, события регионов и мира. Обзоры, интервью, мнения экспертов. Быстро, достоверно и удобно для читателей.

Новостной портал https://prp.org.ua с актуальной информацией о событиях в России и мире. Политика, экономика, культура, спорт и технологии. Новости 24/7, аналитика и комментарии экспертов.

Строительный портал https://suli-company.org.ua с актуальными новостями, обзорами материалов, проектами и инструкциями. Всё о ремонте, строительстве и дизайне.

https://shorturl.fm/xaWZ0

Портал про авто https://prestige-avto.com.ua обзоры новых и подержанных машин, тест-драйвы, рынок автомобилей, страхование и обслуживание.

Онлайн автомобильный https://avtonews.kyiv.ua портал: свежие автоновости, сравнительные тесты, статьи о ремонте и тюнинге. Обзоры новых и подержанных машин, цены и советы экспертов.

Современный автомобильный https://mallex.info портал: автообзоры, тесты, ремонт и обслуживание, страхование и рынок. Всё, что нужно водителям и любителям автомобилей.

Hello just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same outcome.

http://tyres.com.ua/yak-sklo-fary-vplyvaye-na-vydymist-unochi.html

Автомобильный портал https://autonovosti.kyiv.ua новости автопрома, обзоры моделей, тест-драйвы и советы по эксплуатации. Всё для автолюбителей: от выбора авто до обслуживания и ремонта.

Строительный сайт https://novostroi.in.ua с полезными статьями о ремонте, отделке и дизайне. Обзоры стройматериалов, проекты домов, инструкции и советы экспертов для профессионалов и новичков.

Портал для родителей https://detiwki.com.ua и детей — всё для счастливой семьи. Воспитание, образование, здоровье, отдых и полезные материалы для мам, пап и малышей.

Сайт для женщин https://stylewoman.kyiv.ua с интересными статьями о моде, красоте, семье и здоровье. Идеи для кулинарии, путешествий и вдохновения.

Журнал садовода https://mts-agro.com.ua полезные советы по уходу за садом и огородом. Сезонные работы, выращивание овощей, фруктов и цветов, современные технологии и секреты урожая.

Универсальный сайт https://virginvirtual.net для женщин — секреты красоты, тренды моды, советы по отношениям и карьере, рецепты и стиль жизни.

Сайт для женщин https://gratransymas.com о красоте, моде, здоровье и стиле жизни. Полезные советы, рецепты, тренды, отношения и карьера.

Сайт обо всём https://vybir.kiev.ua энциклопедия для повседневной жизни. Красота, здоровье, дом, путешествия, карьера, семья и полезные советы для всех.

Студия дизайна https://lbook.com.ua интерьера и архитектуры. Создаём стильные проекты квартир, домов и офисов. Индивидуальный подход, современные решения и полный контроль реализации.

Портал про ремонт https://hydromech.kiev.ua свежие статьи о ремонте и отделке, дизайне интерьера и выборе материалов. Полезные советы для мастеров и тех, кто делает ремонт своими руками.

Интересный сайт https://whoiswho.com.ua обо всём: статьи, лайфхаки, обзоры и идеи на самые разные темы. Всё, что нужно для вдохновения и развития, в одном месте.

Онлайн портал https://esi.com.ua про ремонт: идеи для интерьера, подбор материалов, практические рекомендации и пошаговые инструкции для самостоятельных работ.

Репортажи в больших https://infotolium.com фотографиях: самые обсуждаемые события, уникальные кадры и впечатляющие истории. Новости и жизнь в формате визуального рассказа.

Информационный портал https://reklama-region.com про ремонт: ремонт квартир, домов, офисов. Практические рекомендации, современные решения и обзоры стройматериалов.

Сайт про авто https://autoinfo.kyiv.ua свежие новости автопрома, обзоры моделей, тест-драйвы и советы по эксплуатации. Всё о машинах для водителей и автолюбителей.

Сайт про автомобили https://black-star.com.ua новинки рынка, цены, тест-драйвы и обзоры. Советы экспертов по выбору и уходу за машиной, тюнинг и автоуслуги.

Онлайн-журнал https://autoiceny.com.ua для автолюбителей: автомобили, новости индустрии, тест-драйвы, тюнинг и советы по обслуживанию.

Автомобильный онлайн-журнал https://allauto.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры новых моделей, советы по эксплуатации и ремонту. Всё для водителей и автолюбителей.

Royal portraits http://www.turnyouroyal.com from photos – turn yourself or your loved ones into a king, queen or aristocrat. Author’s work of artists, luxurious style and premium quality of printing.

https://shorturl.fm/fFsQE

https://shorturl.fm/8bBSI

Авто-журнал https://bestauto.kyiv.ua источник информации для автолюбителей. Новинки рынка, сравнения моделей, советы по ремонту и уходу, интересные материалы о мире автомобилей.

https://shorturl.fm/zujqV

Новостной портал https://gau.org.ua круглосуточные новости, комментарии экспертов, события регионов и мира. Политика, бизнес, культура и общество.

Авто портал https://avtomobilist.kyiv.ua всё об автомобилях: новые модели, цены, рынок подержанных авто, тюнинг и автотехнологии. Полезные материалы для автовладельцев.

Онлайн авто-журнал https://mirauto.kyiv.ua с актуальными новостями, аналитикой и обзорами. Тесты автомобилей, тюнинг, технологии и советы по эксплуатации.

Мужской портал https://hooligans.org.ua новости, лайфхаки, обзоры техники, спорт, здоровье и авто. Советы для уверенной и гармоничной жизни.

GMO Gaika Reputation – Pros, Cons, and the Truth About Withdrawal Refusals

GMO Gaika is widely used by both beginners and experienced FX traders. Its popularity stems from easy-to-use trading tools, stable spreads, and a high level of trust due to its operation by a major Japanese company. Many users feel secure thanks to this strong domestic backing.

On the other hand, there are some online rumors about “withdrawal refusals,” but in most cases, these are due to violations of terms or incomplete identity verification. GMO Gaika’s transparent response to such issues suggests that serious problems are not a frequent occurrence.

You can find more detailed insights into the pros and cons of GMO Gaika, as well as real user experiences, on the trusted investment site naughty-cao.jp. If you’re considering opening an account, it’s a good idea to review this information beforehand.

https://shorturl.fm/Fwuzh

Портал о ремонте https://dki.org.ua и строительстве: от отделки квартиры до возведения загородного дома. Подробные статьи, рекомендации экспертов и идеи для обустройства жилья.

Портал о стройке https://sushico.com.ua и ремонте. Новости рынка, современные технологии, подборка идей для интерьера и экстерьера. Всё, что нужно для дома и дачи.

Онлайн сайт https://mramor.net.ua о строительстве и ремонте. Всё о возведении домов, ремонте квартир, отделке и обустройстве жилья. Обзоры материалов, советы экспертов и свежие идеи.

Всё о стройке https://aziatransbud.com.ua и ремонте в одном месте: дизайн, архитектура, выбор стройматериалов, инструкции по монтажу, лайфхаки и полезные рекомендации для новичков и мастеров.

Сайт о строительстве https://juglans.com.ua и ремонте — ваш помощник в выборе материалов, инструментов и технологий. Всё о ремонте квартир, строительстве домов и дизайне интерьеров.

Онлайн журнал https://vitamax.dp.ua о строительстве: проекты домов, ремонт квартир, выбор стройматериалов, дизайн и интерьер. Советы экспертов и свежие идеи для комфортной жизни.

Портал про строительство https://texha.com.ua новости рынка, обзоры технологий, инструкции и идеи для ремонта. Материалы для застройщиков, мастеров и тех, кто делает своими руками.

Новости Украины https://gromrady.org.ua онлайн: политика, экономика, спорт, культура и события регионов. Оперативные материалы, аналитика и комментарии экспертов круглосуточно.

Портал про авто https://automobile.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры моделей и советы по ремонту. Всё о машинах для водителей и автолюбителей.

Авто портал https://road.kyiv.ua с актуальной информацией: новинки рынка, цены, обзоры, страхование и тюнинг. Полезные статьи и аналитика для автомобилистов.

change pitch extract audio from video

Prodaja prodaja placeva zabljak: stanovi, vile, zemljisne parcele. Izbor smestaja za odmor, preseljenje i investicije. Saveti strucnjaka i aktuelne ponude na trzistu.

p4mzyd

https://shorturl.fm/Hs8Iw

Besoin d’un bien immobilier? immobilier au Montenegro: appartements en bord de mer, maisons a la montagne, villas et appartements. Catalogue de biens, prix actuels et conseils d’experts en investissement.

Фильмы и сериалы сериал смотреть онлайн в хорошем в качестве бесплатно Онлайн-кинотеатр без регистрации и смс: тысячи фильмов и сериалов бесплатно.

Jak samodzielnie zdjac https://telegra.ph/Jak-samodzielnie-zdj%C4%85%C4%87-sufit-napinany-instrukcja-krok-po-kroku-bez-haka-z-wkr%C4%99tem-i-trikami-monta%C5%BCyst%C3%B3w-08-07 sufit napinany: instrukcje krok po kroku, narzedzia, porady ekspertow. Dowiedz sie, jak zdemontowac plotno bez uszkodzen i przygotowac pomieszczenie do montazu nowej okladziny.

https://shorturl.fm/8V6VG

I’d like to find out more? I’d love to find out some additional information.

Stretch Limousine Service

запись салон красоты спб beauty-salon-spb.ru/

https://shorturl.fm/bNPao

Нужен микрозайм? рейтинг займов: деньги на карту без справок и поручителей. Простое оформление заявки, одобрение за минуты и мгновенное зачисление. Удобно и доступно 24/7.

оценка стоимости ООО услуга оценки

https://shorturl.fm/jOfJq

https://shorturl.fm/LgpLV

https://shorturl.fm/jPoVI

Авто помощь 24/7 автопомощь: устранение поломок, подвоз топлива, прикуривание аккумулятора, замена колеса и эвакуация автомобиля.

Hey there! This is my 1st comment here so I just wanted to give a quick shout out and tell you I genuinely enjoy reading through your posts. Can you suggest any other blogs/websites/forums that deal with the same subjects? Thanks a ton!

кэт казино

Срочно нужны купить цветы Минск Свежие букеты, праздничные композиции и эксклюзивные флористические решения. Онлайн-заказ и быстрая доставка по городу.

Профессиональные детейлинг салона автомобиля: полировка кузова, химчистка салона, восстановление пластика и защита керамикой. Вернём автомобилю блеск и надёжную защиту.

Нужен массаж? https://doctu.ru – профессиональные мастера, широкий выбор техник: классический, оздоровительный, лимфодренажный, детский. Доступные цены и уютная атмосфера.

Обучающие курсы онлайн курсы по нейросетям новые навыки для работы и жизни. IT, дизайн, менеджмент, языки, маркетинг. Гибкий график, практика и сертификаты по итогам.

Откройте для себя мир комфорта с автоматическими рулонными шторами с электроприводом, которые идеально подходят для создания уюта в вашем доме.

Рулонные шторы с электроприводом — это удобное и стильное решение для современных интерьеров. Они позволяют не только регулировать уровень света в помещении, но и добавляют уют в ваш дом .

Преимущества использования электропривода очевидны . Первым и, пожалуй, самым важным плюсом является возможность дальнего управления шторами . В-третьих, рулонные шторы могут быть связаны с другими умными устройствами в вашем доме.

Электрические рулонные шторы подойдут для любого типа помещений. Их активно используют как в жилых, так и в коммерческих помещениях . Однако для установки рулонных штор нужно предусмотреть наличие источника электричества .

При выборе рулонных штор с электроуправлением важно обратить внимание на материал и дизайн . Шторы могут быть выполнены из различных тканей, что позволяет выбрать наиболее подходящий вариант для вашего интерьера . Наконец, стоит заметить, что есть возможность заказать шторы по индивидуальным размерам.

vps website hosting vps hosting providers

стул косметолога купить тележка косметолога на колесиках

https://shorturl.fm/1YuBL

https://shorturl.fm/MJJvQ

Рулонные шторы блэкаут с электроприводом идеально подойдут для создания уюта и контроля освещения в вашем доме.

отличный вариант для. Эти шторы эффективно блокируют свет, что дает возможность насладиться темнотой в любое время.

удобство использования. Вы можете управлять шторами с помощью пульта дистанционного управления, что делает шторы удобными для любого типа помещения.

К тому же, рулонные шторы блэкаут легко устанавливаются. Вы можете выбрать различные варианты крепления. Таким образом, вы сможете легко установить шторы на любые окна.

Не забывайте, что рулонные шторы блэкаут с электроприводом также обладают. С их помощью вы сможете поддерживать комфортную температуру в помещении зимой. В итоге, рулонные шторы с блэкаутом и электроприводом станут не только эстетичным, но и функциональным решением.

https://shorturl.fm/NOLYp

Добрый день!

Долго ломал голову как поднять сайт и свои проекты и нарастить ИКС Яндекса и узнал от крутых seo,

профи ребят, именно они разработали недорогой и главное top прогон Хрумером – https://www.bing.com/search?q=bullet+%D0%BF%D1%80%D0%BE%D0%B3%D0%BE%D0%BD

Линкбилдинг цена зависит от выбранной стратегии. Крауд маркетинг линкбилдинг улучшает DR сайта. Линкбилдинг что это такое простыми словами объясняет новичкам. Линкбилдинг это простыми словами становится доступным. Линкбилдинг стоимость варьируется по объему работ.

правильное продвижение сайта, примеры seo копирайтинга, Прогон ссылок для повышения авторитета

Повышение авторитетности сайта, раскрутка сайтов нижний, seo vips

!!Удачи и роста в топах!!

Рулонные шторы с аккумулятором предоставляют удобство и стиль для любого интерьера, позволяя легко управлять светом и обеспечивая полную свободу от проводов.

Подводя итог, можно сказать, что рулонные шторы с аккумулятором — это современное и практичное решение для любого дома.

Преобразите ваше пространство с помощью автоматических рулонных штор, которые идеально сочетают стиль и современность.

Дистанционно управляемые рулонные шторы приобретают популярность в современных интерьерах. Эти шторы предлагают удобство и стиль, что делает их отличным решением для любого помещения.

Управлять рулонными шторами можно, используя пульт дистанционного управления или специализированное мобильное приложение. Таким образом, вы можете быстро изменять уровень освещенности и создавать комфортную обстановку в своем жилище.

Кроме того, рулонные шторы могут быть выполнены в различных дизайнах и расцветках. Таким образом, вы сможете выбрать именно тот вариант, который идеально впишется в ваш интерьер.

Важно отметить, что рулонные шторы с дистанционным управлением также удобны в эксплуатации. Их просто поддерживать в чистоте, и они не требуют сложного ухода, что идеально подходит для занятых людей.

https://shorturl.fm/AOxvB

монтаж перил из нержавеющей стали Перила из нержавеющей стали – это инвестиция в безопасность и долговечность. Они не требуют особого ухода и сохраняют свой привлекательный внешний вид на протяжении многих лет.

https://shorturl.fm/36oeJ

Приобретите автоматические жалюзи рулонного типа и насладитесь комфортом и современными технологиями в своем доме.

Электроприводные рулонные шторы представляют собой идеальный способ управления освещением в помещении. Управление этими шторами можно осуществлять с помощью мобильного приложения или специального пульта.

Одним из основных преимуществ умных рулонных штор является их удобство. С помощью одного нажатия кнопки вы можете регулировать свет и тень в вашем помещении.

Кроме того, эти изделия могут работать в режиме автоматизации. Настройка автоматического режима работы штор позволяет вам не беспокоиться о их управлении.

Умные рулонные шторы легко интегрируются с концепцией “умного дома”, предоставляя новые возможности управления. Таким образом, шторы могут работать в связке с другими устройствами, что делает ваш дом более умным и адаптивным.

https://www.med2.ru/story.php?id=147093

бетон цена купить бетон

Наркологические услуги: нарколог наркологическая помощь нижний новгород, кодирование, детоксикация, снятие ломки, помощь при алкоголизме и наркомании. Круглосуточная поддержка и анонимность.

https://shorturl.fm/RFc7I

https://shorturl.fm/wbQml

подобрать подшипник по размерам онлайн Подбор промышленных подшипников – задача, требующая скрупулезности. Необходимо принимать во внимание особенности оборудования, рабочие условия и требования к безотказности.

Handmade clay flowers Ideal for home, office decor or original gift. Natural beauty and durability.

Бетон в Воронеже https://stk-vrn.ru продажа и доставка. Все марки для фундаментов, дорожных работ и строительства под ключ. Надёжный производитель и лучшие цены.

https://shorturl.fm/35ghe

https://shorturl.fm/COCIP

https://shorturl.fm/5ExgC

Виброустойчивые подшипники Виброустойчивые подшипники – это гарантия стабильной работы оборудования в условиях повышенной вибрации.

https://shorturl.fm/3cJe3

https://shorturl.fm/AmXy6

https://shorturl.fm/qJsJw

купить игровой пк 4060 самый дешевый игровой пк: Играйте без ущерба для бюджета.

микрозаймы взять микрозайм

https://shorturl.fm/IIjXT

Финансы Специальная военная операция (СВО) стала катализатором глобальных изменений. Политика, как сфера влияния, претерпела трансформацию, обнажив скрытые противоречия и сформировав новые альянсы. Переговоры, в центре которых Владимир Путин и Владимир Зеленский, стали символом поиска компромисса в условиях радикально противоположных позиций. Финансы, словно кровеносная система мировой экономики, ощутили на себе всю тяжесть санкций и перебоев в поставках. Европа, Азия и Америка оказались перед лицом энергетического кризиса и инфляционной спирали. Безопасность и оборона, как фундаментальные потребности государств, вновь обрели актуальность. Кавказ и Ближний Восток, издавна известные своей нестабильностью, стали эпицентром геополитических рисков. Новости и аналитика, призванные освещать события непредвзято, часто оказываются в эпицентре информационных войн. Объективность становится дефицитом.

займы деньги микрозайм взять

займы деньги взять микрозайм онлайн

https://shorturl.fm/VTTOO

https://shorturl.fm/ezFOi

Tickets for Rock Concerts https://rock-concert-tickets.ru

https://shorturl.fm/I5EmT

Рестораны Хамовников https://restoran-khamovniki.ru топ заведений для встреч, романтических ужинов и семейных обедов. Авторская кухня, стильный интерьер, удобное расположение и достойный сервис.

Лучшие рестораны https://hamovniki-restoran.ru Хамовников для ценителей гастрономии. Подборка заведений с изысканной кухней, качественным сервисом и атмосферой для отдыха и деловых встреч.

Курсы по плазмотерапии плазмотерапия обучение в москве освоение методик, современные протоколы, практическая отработка. Обучение для специалистов с выдачей сертификата и повышением квалификации.

Профессиональное обучение плазмотерапия в косметологии обучение: подробная программа, практические навыки, сертификация. Освойте эффективные методики для применения в медицине и косметологии.

мистические истории обычных людей Истории из жизни обычных людей смешные Смех – лучшее лекарство, и истории, наполненные юмором и самоиронией, помогают нам справляться с трудностями и смотреть на жизнь с оптимизмом. Курьезные случаи, нелепые ситуации и забавные недоразумения – все это становится поводом для улыбки и напоминает нам о том, что даже в серых буднях есть место для веселья.

поход в горы кавказа Пятигорск что посмотреть

цитаты Книги, изменяющие жизни

Детская школа искусств https://elegy-school.ru обучение музыке, танцам, изобразительному и театральному искусству. Творческие программы для детей, концерты, конкурсы и развитие талантов.

Авторские курсы по REVIT https://dashclass.ru обучение созданию интерьеров и архитектурных проектов. Практика, реальные кейсы, индивидуальный подход и профессиональные навыки для работы в проектировании.

183tyo

https://shorturl.fm/4ePyU

https://shorturl.fm/yIltc

Первая помощь детям https://firstaidkids.ru правила оказания при травмах, ожогах, удушье и других ситуациях. Пошаговые инструкции, советы врачей и полезная информация для родителей.

Студия иностранных языков https://whats-up-studiya-inostrannyh-yazykov.ru обучение английскому, немецкому, французскому и другим языкам. Индивидуальные и групповые занятия, современные методики и опытные преподаватели.

https://shorturl.fm/mPczb

best wood for fence Chain Link Fence on Wood Posts This is good for a temporary option.

Срочный вызов сантехника https://master-expert.com в Москве на дом. Услуги сантехника: прочистка засоров, ремонт смесителей, установка приборов учета. Работаем 24/7. Недорого и с гарантией. Подробнее на сайте

Детский сад № 55 https://detsadik55.ru забота, развитие и обучение детей. Современные программы, квалифицированные воспитатели, уютные группы, безопасная среда и внимание к каждому ребёнку.

обучение кайтсёрфингу

Промышленная безопасность https://аттестация-промбезопасность.рф курсы и обучение под ключ. Подготовка к проверке Ростехнадзора, повышение квалификации и сертификация специалистов предприятий.

Автомобили на заказ https://avto-iz-kitaya1.ru поиск, проверка, покупка и доставка. Китай и Корея. Индивидуальный подбор под бюджет и пожелания клиента, полное сопровождение сделки.

купить меф гашиш кокаин меф гаш купить

ск меф куплю купить героин гашиш экстази

Авто из Китая https://avto-iz-kitaya2.ru на заказ под ключ: подбор, проверка, доставка и растаможка. Новые и подержанные автомобили, выгодные цены и полное сопровождение сделки.

Do you have a spam problem on this website; I also am a blogger, and I was wondering your situation; we have developed some nice practices and we are looking to swap methods with other folks, why not shoot me an e-mail if interested.

https://http-kra38.cc/

Авто из Китая под заказ https://dostavka-avto-china.ru кроссоверы, седаны, электромобили и премиальные модели. Индивидуальный подбор, проверка, сопровождение сделки и доставка в ваш город.

Автомобили из Китая на заказ https://avto-iz-kitaya2.ru подбор, покупка и доставка. Полный цикл услуг: диагностика, растаможка, постановка на учёт и гарантия качества.

https://shorturl.fm/ObqgL

Заказать авто из Китая https://dostavka-avto-china2.ru новые автомобили с гарантией, выгодные цены и проверенные поставщики. Доставка, таможня и оформление всех документов под ключ.

продаю метамфетамин

Авто на заказ https://dostavka-avto-russia.ru поиск, диагностика и сопровождение сделки. Машины из Европы, Кореи, Китая и США. Доставка, растаможка и постановка на учёт.

Автомобили на заказ https://dostavka-avto-russia5.ru профессиональный подбор, юридическая проверка, доставка и растаможка. Индивидуальные решения для каждого клиента.

https://penzu.com/p/8ad5a154af1cd6dc

Хотите заказать авто https://prignat-avto5.ru Мы подберём оптимальный вариант, проверим машину по базам, организуем доставку и таможенное оформление. Выгодные цены и прозрачные условия.

https://shorturl.fm/2AadW

Grandfar CDLF12-4T Вертикальный многоступенчатый центробежный насос Нержавеющая сталь SS304

https://shorturl.fm/8i6d0

Машины на заказ https://prignat-avto7.ru поиск, диагностика и доставка автомобилей. Индивидуальный подбор, проверенные поставщики и прозрачные условия покупки.

Машины на заказ https://prignat-mashinu5.ru поиск, диагностика и доставка автомобилей. Индивидуальный подбор, проверенные поставщики и прозрачные условия покупки.

Автомобили на заказ https://prignat-mashinu7.ru подбор, проверка, доставка и оформление документов. Машины любых марок и комплектаций с гарантией качества и выгодной ценой.

https://shorturl.fm/wm26A

https://shorturl.fm/KtRP0

программа для учета расхода топлива Учет времени – важный инструмент организации работы. Программы учета времени позволяют контролировать занятость сотрудников.