Introduction

This trading method is actively used in a wide variety of Expert Advisors. Moreover, it has many varieties and hybrids. In addition, judging by the number of references to such systems, it is obvious that this topic is very popular not only on this site, but also on any other web resources. All method varieties have a common concept involving trading against the market movement. In other words, the EA uses rebuys to be able to buy as low as possible and sell as high as possible.

This is a classic trading scheme that is as old as the world. In one of the previous articles, I partially touched on this topic, while highlighting possible ways to hybridize such methods. In this article, we will have a closer look at the concept delving deeper than forum users do. However, the article will be more general and much broader as the rebuy algorithm is very suitable for highlighting some very interesting and useful features.

Methods for refining trading characteristics based on the averaging algorithm

“Help me get out of the drawdown” (from the authors of “my EA makes good money, but sometimes blows up the entire account”)

This is a common issue of many algorithmic and manual traders. At the time of writing this article, I had a conversation with such a person, but he did not grasp my point of view in its entirety. Sadly, it seems to me that he has practically no chance of ever understanding the whole comedy of such a situation. After all, if I could once ask a similar question to my older and more experienced self, I would also most likely be unable to understand the answer. I even know how true answers to myself would make me feel. I would think that I am being humiliated or dissuaded from further engaging in algorithmic trading.

In reality, everything is much simpler. I just had the patience to walk a certain path and gain some wisdom, if you can call it that. This is not an idealization and self-praise, but rather a necessary minimum. It is a pity that this path took years instead of weeks and months.

Here we have a whole world of dreams and self-deception, and to be honest, I am already starting to get tired of the simplicity of some people. Please stop doing nonsense and thinking that you are the kings of the market. Instead, contact an experienced person and ask them to choose an EA for your budget. Trust me, you will save a lot of time and money that way, not to mention your sanity. One of those persons has written this article. The proofs are provided below.

General thoughts about the averaging algorithm

If we have a look at the rebuy algorithm, or “averaging”, it first may seem that this system has no risk of loss. There was a time when I did not yet know anything about such tricks and was surprised at the huge mathematical expectations that beat any spreads. Now it is clear that this is only an illusion, nevertheless, there is a rational grain in this approach, but more on that later. To begin with, in order to be able to objectively evaluate such systems, we need to know some indirect parameters that can tell us a little more than a simple image of growing profits.

The most relevant parameters in the strategy tester report can even help to understand that the system is obviously losing, despite the fact that the balance curve looks great. As you might have already understood, it is really all about the profitability curve. In fact, all the important indicators of the trading system are secondary to the first and most basic mathematical characteristics, which, of course, are the mathematical expectation and its primary characteristics. But it is worth noting that the mathematical expectation is such a flexible value that you can always fall into the trap of wishful thinking.

In fact, in order to correctly use such a concept as mathematical expectation, one must first of all understand that this is the terminology of probability theory, and any calculation of this quantity should be carried out according to the rules of probability theory, namely:

- Calculations are the more accurate, the larger the analyzed sample, ideally the exact value is calculated from an infinite sample.

- If we break infinity into several parts, we get several infinities

Someone might think how to calculate the exact mathematical expectation of a particular strategy, if we have only a limited sample of real quotes at our disposal. And someone will think, why do we need these infinities at all. The thing is that all estimates of certain averaged values, such as mathematical expectation, have weight only in the area where these calculations were made, but have nothing to do with another area. Any mathematical characteristic has weight only where it is calculated. Nevertheless, some techniques can be distinguished to refine the characteristics of the profitability of a particular strategy, which will make it possible to obtain the values that are closest to the true values of the required parameters.

This is directly related to our task. After realizing that we cannot see into the future of an infinity-long strategy, which in itself already sounds like complete nonsense. Nevertheless, this is a mathematical fact and a necessary and sufficient condition for calculating the true mathematical characteristics. We come to the idea of how to make the number calculated on a limited sample closer to the number that could be calculated on an infinite sample. Those who are familiar with mathematics know that there are two mathematical concepts which can be applied to calculate infinite sums:

- Integral

- Sum of infinite series

I think it is clear to everyone that in order to calculate the integral, as well as the sum of the series, it is necessary to obtain either all points of the function, the integral of which needs to be calculated, within the considered area of integration, or all elements of the sequence of numbers within the series under consideration. There is still the most perfect option – getting the appropriate mathematical expressions for the function that we are going to integrate, and the expression for generating the elements of the series. In many cases, if we have the appropriate mathematical expressions, we can get the exact equations for the finished integral or the sum of the series, but in the case of real trading, we will not be able to apply differential calculus, and in general this will not help us much, but it is important to understand.

The conclusion from all this is that for the direct evaluation of any system we have only a limited sample and certain parameters that we get in the strategy tester. In fact, their significance is greatly exaggerated. The question arises as to whether it is possible to judge the profitability of a particular strategy using the the strategy tester parameters, whether these parameters are sufficient for an unambiguous answer and most importantly, how to use these parameters correctly and whether we really use them correctly.

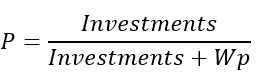

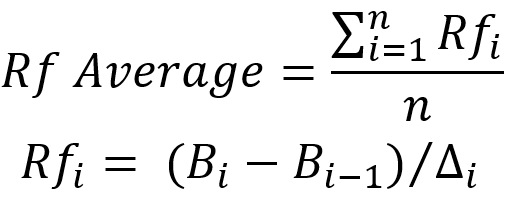

Additionally, we need to understand that for each strategy, any parameter, by which we can correctly assess the real profitability and security of the strategy can be completely different. This is directly related to the evaluation of the profit curve. To understand this, let’s first draw an approximate general view of the trading curve that we get when using the rebuy algorithm:

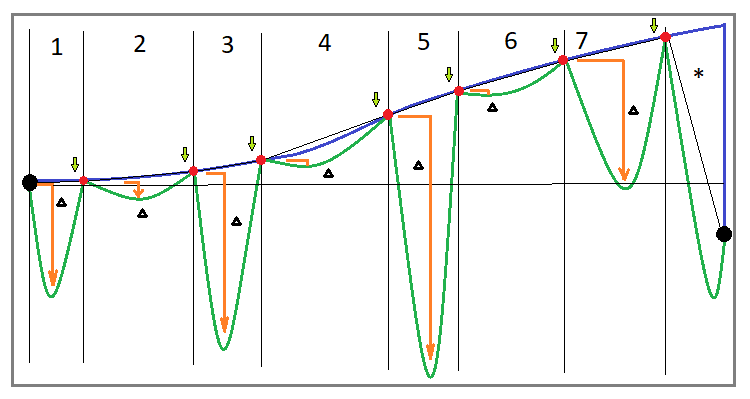

Fig. 1

Let’s start with the implementation of a rebuy for one instrument. If you correctly implement this algorithm, then your trading will in any case consist of cycles. Ideally, all cycles should be positive. If some cycles close in the negative zone, then either you are implementing this algorithm incorrectly, or it is no longer a pure algorithm and there are already modifications in it. But we will consider the classic rebuy. Let’s define some characteristic parameters of the trading curve to denote a classic rebuy:

- The balance curve must be growing and consist of N cycles

- All cycles have a positive profit

- When trading breaks, we are likely to find ourselves in the last incomplete cycle

- Incomplete cycle has negative profitability

- Cycles have characteristic drawdowns in terms of funds.

It seems that the general appearance of the curve should make it clear at first glance that such a system is profitable, but not everything is so simple. If you look at the last unfinished trading cycle, which I specifically closed below the starting point, you will see that in some cases you will be lucky and you will wait for the successful completion of the cycle, while in some cases you may either not wait till the end and face a big loss or blow up your deposit entirely. Why is this happening? The thing is that the image may give a false impression that the amount of drawdown by funds is limited in its absolute value and, as a consequence, the time spent in this drawdown should also be limited.

In reality, the longer the testing area, the longer the average drawdown area. There is absolutely no limit here. The limit exists only in the form of your deposit and the quality of your money management. However, a competent approach to setting up your system based on this principle, can only lead to an increase in the lifespan of your deposit before it is eventually blown up or,at best, makes a very little profit.

When it comes to testing systems based on the rebuy (averaging) algorithm, in order to correctly assess its survivability, reliability and real profitability, one should adhere to a special testing structure. The whole point is thatthe value of a single test in this approach is minimized for one simple reason, that when testing any “normal” strategy, your profit for the entire test in the strategy tester is very close to the “normally” distributed value. This means that when testing any average strategy without holding a position for a long time, you will get an approximately equal number of profitable and unprofitable testing areas, which will very quickly let you know that the strategy is unstable, or that the strategy has a correct understanding of the market and works on the entire history.

When we are dealing with a rebuy strategy, this distribution can be strongly deformed, because for the correct testing of this system you need to set the maximum possible deposit. In addition, the test result is highly dependent on the length of the test section. Indeed, in this approach, all trading is based on trading cycles, and each unique setting of this system can have both a completely different parameter of the average drawdown and the parameter of the average duration of the drawdown associated with it. Depending on these indicators, too short test sections can show either too high or too low test result. As a rule, few such tests are carried out, and this can in most cases be the cause of excessive confidence in the operation of these systems.

Subtleties of a more accurate assessment of rebuy systems

Now let’s learn how to correctly evaluate the performance of systems using the rebuy algorithm, while applying the known parameters of trading systems. First of all, with such an assessment, I would advise using one single characteristic – recovery factor. Let’s figure out how to count it:

- Recovery Factor = Total Profit / Max Equity Drawdown

- Total Profit – total profit per trading area

- Max Equity Drawdown – maximum drawdown of equity relative to the previous joint point for balance and equity (balance peak)

As we can see, this is the final profit divided by the maximum drawdown of the funds. The mathematical meaning of this indicator in the classical sense is that, according to the idea, it should show the system’s ability to restore its drawdown by equity. The boundary condition for the profitability of a trading system when using such a characteristic is the following fact:

- Recovery Factor > 1

If translated into understandable human language, it will mean that in order to make a profit, we can risk no more than the same amount of the deposit. This parameter in many cases provides an accurate assessment of trading quality for a particular system. Use it, but be very careful, because this is a rather controversial value regarding its mathematical significance.

Nevertheless, I will have to reveal you all its disadvantages, so that you understand that this parameter is also very arbitrary and the level of its mathematical significance is also very low. Of course, you might say if you criticize something, then offer an alternative. I will certainly do that, but only after we analyze this parameter. This parameter is tied to the maximum drawdown, which, in turn, can be tied to any point on the trading curve, which means that if we recalculate this drawdown relative to the starting balance and substitute it for the maximum drawdown, we almost always get an overestimated recovery factor. Let’s formalize it all properly:

- Recovery Factor Variation 1 = Total Profit / Max Equity Drawdown From Start

- Max Equity Drawdown From Start – maximum drawdown from the starting balance (not from the previous maximum)

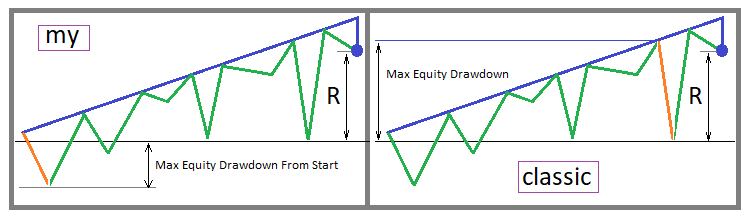

Of course, this is not a classical recovery factor, but in its essence it actually determines profitability much more correctly relative to the generally accepted boundary condition. Let’s first visually depict both options for calculating this indicator – the classic one and mine:

Fig. 2

It can be seen that in the first case, this parameter will take higher values, which, of course, is what we want. But from the point of view of profitability assessment, two approaches can be followed. The classic parameter is more adapted to the approach, in which it is better to take the duration of the testing section as long as possible. In this case, a higher value of Max Equity Drawdown compensates for the fact that this drawdown does not start from the very beginning of the trading curve, and thus this parameter in most cases is close to the true estimate. My parameter is more efficient when evaluating multiple backtests.

In other words, this parameter is more accurate the more tests of your strategy you have done. The tests of your strategy should be in as many different areas as possible. This means that the start and end points should be chosen with maximum variability. For a correct assessment, it is necessary to select “N” of the most different areas and test them, and then calculate the arithmetic average of this indicator for all testing areas. This rule will allow us to refine both versions of the recovery factor, both mine and the classic one, with the only amendment that fewer independent backtests will need to be performed to refine the classic one.

Nevertheless, saying that such clarifying manipulations are few for clarifying these parameters would be an understatement. I have demonstrated my own version of the recovery factor in order to show that anyone can come up with their own similar parameter, and it can even be added as one of the calculated characteristics for backtesting in MetaTrader. But any of these parameters does not have any mathematical proof, and moreover, any of these parameters has its own errors and limits of applicability. All this means that at the moment there is no exact mathematical indicator for an absolutely accurate assessment of one or another algorithm using rebuy. However, my parameter will tend to the absolute accuracy with an increase in the number of various tests. I will provide more details in the next section.

In-depth and universal understanding of profitability

Universal assessment

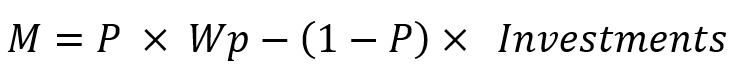

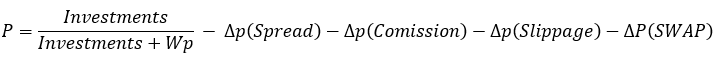

I believe, everyone knows that such parameters as the mathematical expectation of profit and the profit factor exist in any strategy tester report or in the characteristics of a trading signal, but I think no one told you that these characteristics can also be used to calculate profitability of such trading systems where there is not enough analysis of deals. So, you can use these parameters by replacing the “position” unit with “test on the segment”. When calculating this indicator, you will need to make many independent tests with no consideration to any structure inside. This approach will help you assess the real prospects of the trading system using only the two most popular parameters. In addition, it can instill in you an extremely useful habit – multiple tests. In order to use this approach, you only need to know the following equation:

where:

- M – expected payoff value

- Wp – desired profit

- Investments – how much you are willing to invest to achieve the required profit

- P – probability that we will have enough investment until the profit is achieved

- (1-P) – probability that we will not have enough investment until the profit is achieved (deposit loss)

Below is a similar equation for the profit factor:

All you need to know is that with random trading and the absence of obstacles such as spread, commission and swap, as well as slippage, these variables will always take the following values for any trading system:

- M=0

- Pf=1

These characteristics can change in your direction only if there is a predictive moment. Therefore, the probability that we will make a profit without losing the deposit will take the following value:

If you substitute this expression for probability in our equations, then you will get the identities that I provided. If we consider spread, commission and swap, then we get the following:

The spread, commission and swap reduce the final probability, which ultimately leads to the identities losing their validity. The following inequalities appear instead:

- M < 0

- Pf < 1

This will be the case with absolutely any trading system, and the rebuy algorithm here is absolutely no better than any other system. When testing or operating such a system, it is able tostrongly deform the distribution function of the random value of the signal or backtest final profit, but typically this scenario occurs most frequently during short-term testing or operation.

This is because the probability of running into a large drawdown is much less if you test on a short section. But once you start doing these tests over longer segments, you will usually see things you have not seen before. But I am sure most will be able to reassure themselves that this is just an accident, and you just need to somehow bypass these dangerous areas. The same will generally be the case with multiple testing on short segments.

There is only one way to overcome the unprofitability of any system. Let’s add an additional component to the probability calculation equation:

As we can see, the new component “dP(Prediction)” has appeared in the equation. It has a plus sign, which I did on purpose to show that only this component is able to compensate for the effect of spreads, commissions and swaps. This means that we first of all need sufficient prediction quality to overcome the negative effects and reach profit:

![]()

We can get our desired inequalities only if we provide this particular inequality:

- M > 0

- Pf > 1

As you can see, these expressions are very easy to understand, and I am sure that no one will doubt their correctness. The next subsection will be easier to understand using these equations. Indeed, I advise you to remember them, or at least remember their logic, so that you can always restore them in memory if necessary. The main thing here is their understanding. In general, one of these equations is sufficient, but I felt that it would be better to show two for an example. As for other parameters, I believe, they are redundant within the framework of this section.

Examples of clarifying methods

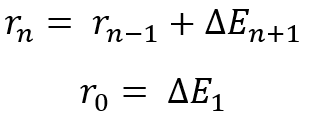

In this subsection, I want to offer you some additional refinement manipulations that will allow you to get a more correct value of the recovery factor. I suggest going back to “Figure 1” and looking at the numbered segments. To refine the recovery factor, it is necessary to imagine that these segments are independent tests. This way we can do without multiple testing, assuming that we have already performed these tests. We can do this because these segments are cycles that have both a start point and an end point, which is what provides equivalence to the backtest.

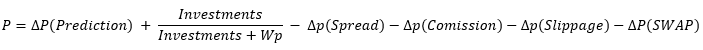

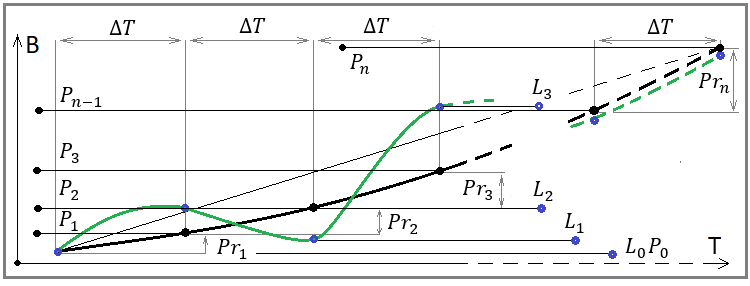

Within the framework of this section, I think it is also worth supplementing the first image with its equivalent considering the fact that we are testing or trading on several instruments at once. This is how the trading curve will look like using the rebuy algorithm for parallel trading on multiple instruments:

Fig. 3

We can see that this curve differs in its structure from the curve for rebuying on one instrument. I have added intermediate blue points here, which means that before the drawdown there may be segments that have a “drawdown in reverse.” The fact is that we cannot consider this a drawdown. But nevertheless, we have no right to consider these segments outside the analysis. This is why they must be part of a cycle.

I think it would be more correct to postpone each new cycle from the end of the previous one. In this case, the end of the previous cycle should be considered the recovery point of the last drawdown in equity. In the image, these cycles are separated by red dots. But in fact, this definition of the cycle is not sufficient. It is also important to determine that it is not enough just to fix the drawdown by equity, but it is important that it be lower than the start of the current cycle. Otherwise, what kind of drawdown is it?

After highlighting these cycles, you can consider them as separate independent tests and calculate the recovery factor for each of them. This can be done the following way:

In this equation, the corresponding points on the balance curve (the final value of the balance on the section and the initial one) are used as “B”, while the delta represents our drawdown. I would also like the reader to return to the last image. On it, I plotted the delta from the red start point of each cycle, and not from the blue one, as is usually the case, for the reasons I listed above. But if you need to clarify the original recovery factor, then the delta should be plotted from the blue point. In this case, the method of refining the parameters is more important than the parameters themselves. The simple arithmetic mean is taken as the averaging action.

Nevertheless, even after clarifying one or another custom or classic parameter, you should not take the fact that the value of this indicator is more than one, or even two or three, as signs of a profitable trading system.

Exactly the same equation should be applied with multiple backtests. The point is that any backtest in this case is equivalent to a cycle. We can even first calculate the averages for the cycles, and after all this, calculate the average of the average relative to the backtests. Or we can do it much easier by maximizing the duration of the test segment. This approach will save you at least from multiple tests due to the fact that the number of cycles will be at maximum, which means that the average recovery factor will be calculated as accurately as possible.

Increasing the efficiency of systems with diversification

Useful limits

After considering the possibilities to refine certain characteristics of backtests, you are undoubtedly better armed, but you still do not know the main thing. The basis lies in the answer to the question – why is it necessary to carry out all these multiple tests or splitting into cycles? The question is really complex until you put in as much effort as I put in my time. Sadly, this is necessary, but with my help, you can greatly reduce the time you need to do this.

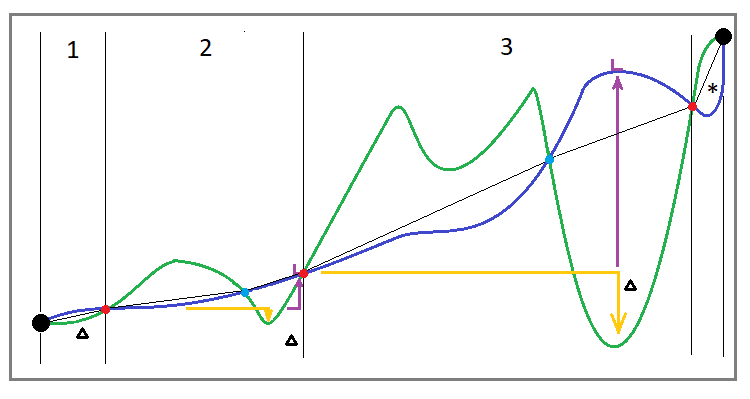

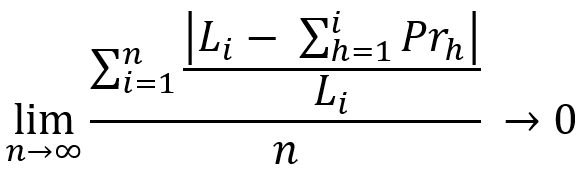

This section will allow you to evaluate the objectivity of a particular parameter. I will try to explain both theoretically and using the equations. Let’s start with the general equation:

Let’s consider a similar equation with some slight changes:

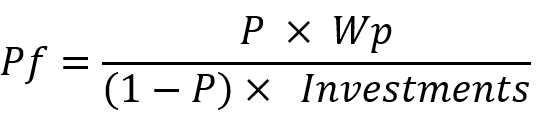

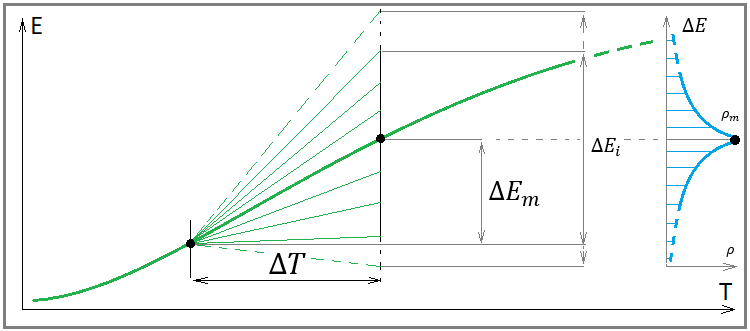

The essence of these equations is the same. These equations demonstrate thatin any profitable trading system, when the duration of the testing section tends to infinity, we will get a complete merger of the balance and current profit lines, with a certain line representing our average profit. In most cases, the nature of this line is determined by the strategy we have chosen. Let’s look at the following image for a deeper understanding:

Fig. 4

If you carefully look at this image, you will see on it all the quantities that are present in our equations. It reveals the geometric meaning of our mathematical limits. The only thing missing in our equations is the dT time interval. With this interval, we discretize our balance steps and give rise to all the points of our number series for the balance and profit of these intervals, and also calculate the values of our midline at the same points. These equations are the mathematical equivalent of the following statement:

- The more we combine multiple tests or trading curves together, the more they look like a smooth rising line (only if the system is really profitable)

In other words, any profitable trading system looks more beautiful in the graphical part of the strategy tester or signal, the longer the testing area we choose. Some might say that no system can achieve such indicators, nevertheless, there are plenty of examples in the Market, so it would be silly to deny this. It all depends on the universality of the algorithm and how well you understand the market physics. If you know the math that is always inherent in the market you are trading, then in fact you get an infinitely growing profit curve, and you do not need to wait for an entire infinity to confirm the effectiveness of the system. Of course, it is clear that this is an extremely difficult task, but nevertheless, within the framework of many algorithms, this task is achievable.

Let’s finish this theoretical introduction by learning how to use the received techniques correctly. You might ask, how to use these techniques with infinite sums, when we have only limited samples and, accordingly, also inevitable incomplete sums.

- The answer lies is in dividing the entire history into segments

- Select several segments with a constantly growing length for the duration of testing up to a segment in the entire history

- Choose a testing methodology

- Test

- Look for an improvement in recovery factor and/or relative drawdown

The essence of this tricky test scheme is to reveal indirect signs that our limits really tend to infinity and zero, respectively. To increase the efficiency of our testing scheme, we must understand that the longest test section should at least look more beautiful than the shortest one, and ideally each subsequent section should be both larger and look more beautiful. I use the concept of “more beautiful” only to make it clear to everyone that this is actually equivalent to our limits.

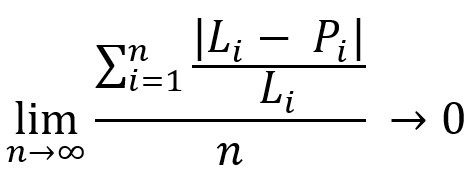

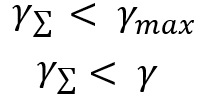

However, our limits are only good during theoretical considerations or preparations (whatever you like). In this regard, the question arises – how to discover these facts without resorting to “eyeball analysis”? We need to somehow adapt our limits to the parameters that we have in the strategy tester report. In other words, we need alternative limits for some strategy tester report or signal parameters so that our testing structure can be used. Let me show you the necessary and sufficient set of alternative limits:

What we should understand here:

- During an infinite test, the recovery factor of any profitable strategy tends to infinity

- During an infinite test, relative drawdown by equity (of any profitable strategy) tends to zero

- During an infinite test, the profit factor of deals of any profitable strategy tends to its mean value and has a finite real limit.

- During an infinite test, the mathematical expectation of any profitable strategy without auto lot enabled (with a fixed lot) tends to its average value and has a finite real limit

All this has to do with infinite tests, however it is useful to understand the mathematical meaning of these limits before proceeding to adapt them to a finite sample. The adaptation of these expressions to our methodology should begin with the fact that we should select several segments of testing, each of which should be significantly larger than the previous one, preferably at least twice. This is necessary in order to be able to notice the difference in readings between shorter and longer tests. If we number our tests in such a way that as the index increases, its length grows in time, then we get the following adaptation for the case of finite samples:

In other words, an increase in the recovery factor and a decrease in the relative drawdown in terms of funds is indirect evidence that, most probably, the further increase of the test segment or signal lifetime makes our curve become visually more beautiful. This means that we have confirmed the fulfillment of our infinite limits. Otherwise, if the profit curve does not become straighter, we can state the fact that the result obtained is very close to random and the probability of losses in the future is extremely high.

Of course, many will say that we can simply optimize the system more often and everything will be all right. In some extremely rare cases it is possible, but this approach will require a completely different testing methodology. I do not advise anyone to resort to this approach, because in this case you do not have any math, while here you have everything in a clear-cut manner.

All these nuances should convince you that testing the rebuy algorithm all the more requires the use of this approach. In particular, we can even simplify the task and test the rebuy system immediately on the maximum length segment. We may reverse this logic. If we do not like the trading performance in the longest segment, then even better performance in the short segments will indicate that our inequalities are no longer satisfied and the system is not ready for trading at this stage.

Useful features in terms of the parallel use of multiple instruments

When testing on a limited history, the question will certainly arise – is there enough history for us to correctly use our testing methodology? The thing is that in many cases the strategy has weight, but its quality is not high enough for comfortable use. To begin with, we should at least understand whether it really has a predictive beginning and whether we can begin to engage in its modernization. In some cases, we literally do not have enough available trading history. What should we do? As many have already guessed, judging by the title of the subsection, we should use multiple instruments for this purpose.

It would seem an obvious fact, but unfortunately, as always, there is no math anywhere. The essence of testing on multiple instruments is equivalent to the same essence for increasing the duration of testing. The only amendment is that your system must be a multi-currency one. The system may have different settings for different trading instruments, but it is desirable that all settings are similar. The similarity of the settings will represent the fact that the system uses physical principles that work on the maximum possible number of trading instruments.

With this approach and the correct implementation of such tests, the index “i” should already be understood as the number of simultaneously tested instruments on a fixed testing segment. Then the expressions will mean the following:

- When increasing the number of traded instruments, the more instruments, the greater the recovery factor

- When increasing the number of traded instruments, the more instruments, the smaller the relative drawdown by equity

In fact, an increase in the number of tests can, for simplicity, be interpreted as an increase in the total duration of tests, as if we consider each test for each tool to be part of a huge overall test. This abstraction will only help you understand why this approach also has the same power. But if we consider this issue more accurately and understand more deeply why a line that consists of several ones will be much more beautiful, then we should use the following concepts of probability theory:

- Random value

- Variance of a random variable

- Mathematical expectation of a random variable

- The law of normal distribution of a random variable

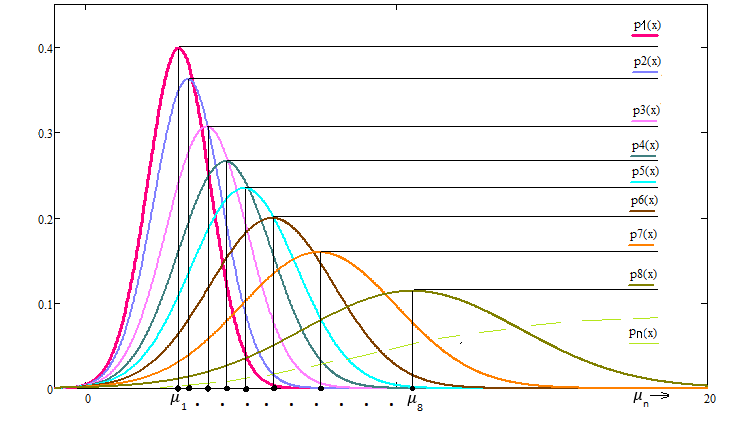

To fully explain why we need all this, we first need an image that will help us look at a backtest or a trading signal a little differently:

Fig. 5

I am not drawing a balance line here, because it does not decide anything here, and we only need a profit line. The meaning of this image is thatfor each profit line, it is possible to select an infinite number of independent segments of a fixed length, in which it is possible to construct the law of distribution of a random variable of the profit line increment. The presence of a random variable means that in the future the profit increment in the selected area can have completely different values in the widest range.

It sounds complicated, but in fact all is simple. I think many people have heard about the normal distribution law. It supposedly describes almost all random processes in nature. I think, this is no more than an illusion invented to prevent you from “thinking”. All jokes aside, the reasons for the popularity of the distribution law are that it is an artificially compiled and very convenient equation for describing symmetric distributions with respect to the mathematical expectation of a random variable. It will be useful to us for further mathematical transformations and experiments.

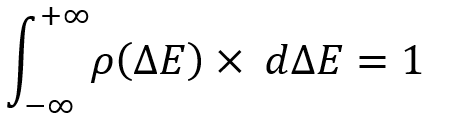

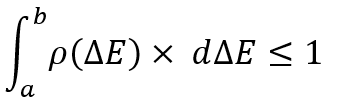

However, before starting to work with this law, we should define the main property for any distribution law of a random variable:

Any law of random variable distribution is essentially the analogue of the full group of non-joint events. The only difference is that we do not have a fixed number of these events and at any time we can select any event of interest like this:

Strictly speaking, this integral considers the probability of finding a random variable in the indicated range of a random variable, and naturally, it cannot be greater than one. No total event from a given event space can have a probability greater than one. However, this is not the most important thing. The only important thing here is that you should understand that the event in this case is determined only by a set of two numbers. These are examples for random variables of minimum dimension.

There are analogues of these equations for the “N” dimension, when an event can be determined by “N*2” numbers, and even more complex constructions (within the framework of multidimensional region integrals). These are quite complex sections of mathematics, but here they are redundant. All laws obtained here are self-sufficient for the one-dimensional variant.

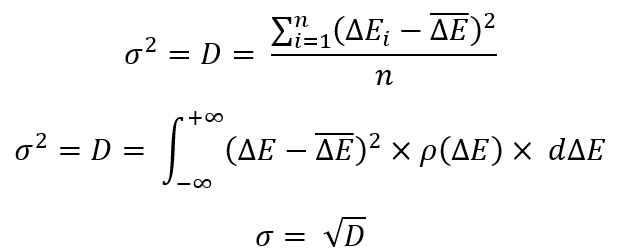

Before moving on to more complex constructions, let’s recall some popular parameter characteristics of the random value distribution laws:

To define any of these equations, we need to determine the most important thing – the mathematical expectation of a random variable. In our case, it looks as follows:

The mathematical expectation is simply the arithmetic mean. Mathematicians like to give very clever names to simple things so that no one understands anything. I have provided two equations. Their only difference is that the first one works on a finite number of random variables (limited amount of data), and in the second case, the integral over the “probability density” is used.

An integral is the equivalent of a sum, with the only difference being that it sums up an infinite number of random variables. The law of a random variable distribution, which is located under the integral and contains the entire infinity of random variables. There are some differences, but in general the essence is the same.

Now let’s go back to the previous equations. These are just some manipulations with the laws of random variables distribution that are convenient for most mathematicians. As in the last example, there are two implementations – one for a finite set of random variables, the other for an infinite one (the law of a random variable distribution). It states that “D” is the average square of the difference between all random variables and the average random variable (the mathematical expectation of the random variable). This value is called “dispersion”. The root of this value is called the “standard deviation”.

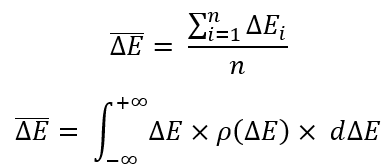

Normal distribution of a random variable

It is these values that are generally accepted in the math of random variables. They are considered the most convenient for describing the most important characteristics of the random distribution laws. I disagree with this notion, but nevertheless I am obliged to show you how they are calculated. In the end, these quantities will be needed to understand the normal distribution law. It is unlikely that you will easily find this information, but I will tell you that the normal distribution law was invented artificially with only a few goals:

- A simple way to determine the distribution law symmetrical to the mathematical expectation

- Ability to set dispersion and standard deviation

- Ability to set mathematical expectation

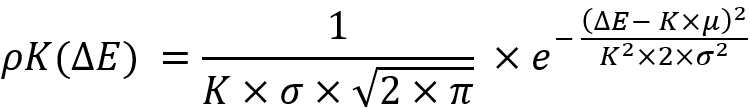

All these options allow us to get a ready-made equation for the law of a random variable distribution called the normal distribution law:

There are other variations of the laws of random variables distribution. Each implementation is invented for a certain range of problems, but since the normal law is the most popular and well-known, we will use it as an example to prove and compile the mathematical equivalent of the following statements:

- The more instruments traded in parallel for a profitable system, the more beautiful and straighter our profit graph (a special case of diversification)

- The longer the selected area for testing or trading, the more beautiful and straighter our profit graph

- The more parallel traded systems with proven profitability, the straighter and more beautiful our overall profitability graph

- The combination of all of the above gives rise to ideal diversification and the most beautiful chart

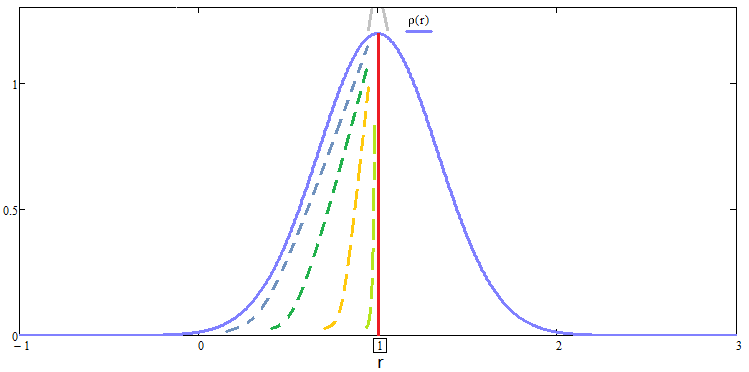

Everything that has been said applies only to trading systems whose profitability has been proven mathematically and practically. Let’s start by defining what “the more beautiful graph” means in mathematical terms. The “standard deviation”, whose equation I have already shown above, can help us with that.

If we have a family of distribution density curves for a random variable of profit increment with the same mathematical expectation, which symbolize two segments of the same duration in time, for two practically identical graphs, then we would prefer the one with the smallest standard deviation. The perfect curve in this family could be one with zero standard deviation. This curve is achievable only if we know the future, which is impossible, nevertheless, we must understand this in order to compare curves from this family.

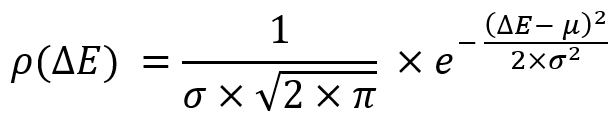

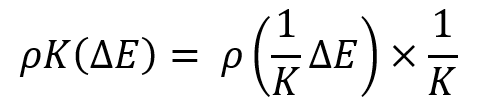

Profit curve beauty in the framework of the random values distribution law

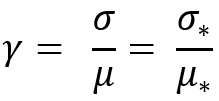

This fact is understandable when we are dealing with a family of curves, where the mathematical expectations of the profit increment in the selected time period are the same, but what to do when we are dealing with completely arbitrary distribution curves? It is not clear how to compare them. In this regard, the standard deviation is no longer perfect and we need another more universal comparison value that takes into account scaling, or we must come up with some algorithm for reducing these distribution laws to a certain relative value, where all distributions will have the same mathematical expectation and, therefore, classical criteria will apply to all curves. I have developed such an algorithm. One of the tricks in it is the following transformation:

The family of these curves will look something like this:

Fig. 6

A very interesting fact is that if we subject the law of normal distribution to this transformation, then it is invariant with respect to this transformation and will look like this:

The invariance consists in the following replacements:

If we substitute these replacements into the previous equation, then we get the same distribution law operating with the corresponding values with asterisks:

This transformation is necessary to ensure not only the invariance of the transformation law but also the invariance of the following parameter:

I had to invent this parameter. It is impossible to properly scale the normal distribution law, like any other law, without it. This parameter will be invariant for any other distribution law as well. As a matter of fact, the normal law is easier to perceive and understand. Its idea is that it can be used for any distributions with different mathematical expectations and its essence will be similar to the standard deviation, only without the requirement that all compared distributions must have the same mathematical expectation. It turns out, our transformation is designed to get a family of distributions where a given parameter has the same value. Seems pretty convenient, doesn’t it?

This is one way to define the so-called graph beauty. The system having the smallest parameter is “the most beautiful”. This is all good, but we need this parameter for a different purpose. We set the task to compare the beauty of the two systems. Imagine that we have two systems that trade independently. So, our goal is to merge these systems and understand whether there will be an effect from this merger, or rather, we hope for the following:

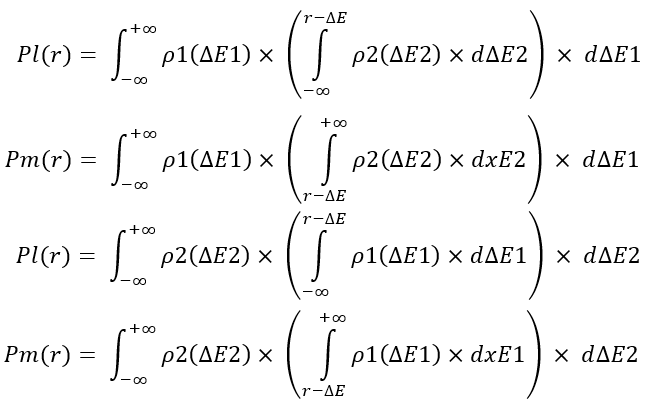

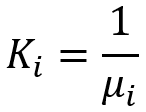

These ratios will be observed when using any distribution law. This automatically means that it makes sense to diversify if our parallel traded instruments or systems have similar profitability. We will prove this fact a bit differently. As I said, I came up with an algorithm for reducing all distributions to a relative random value. We will use it, but first we will analyze the general process of merging several lines, within the framework of the distribution law of a random variable representing the sum of two deltas. We will recurrent logic for merging in pairs. To do this, we assume that we have “n+1” curves, each of which has a defined mathematical expectation. But in order to get to the random variable symbolizing the merge, we need to understand that:

In fact, this is a recurrent expression making no mathematical sense, but it shows the logic of merging all random variables present in the list. To put it simply, we have “n+1” curves, which we must combine using “n” successive transformations. In fact, this means that we must obtain the distribution law of the total random variable at each of the steps using some kind of transformation operators.

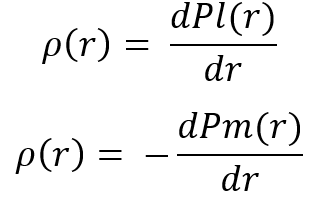

I will not delve into lengthy explanations. Instead I will simply show these conversion operators so that you can make your own conclusions. These equations implement the merging of two profit curves within the selected time period, and calculate the probability that the total profit of the two segments of the curves “dE1 + dE2” will be lower (Pl) and higher (Pm) of the “r” selected value, respectively:

There are two options for implementing these quantities here. Both are completely similar. After calculating these values, they can be used to obtain the law of distribution of the “r” random variable, which is what is required of us to work out the entire recurrent merging chain. By definition of a random variable, we can obtain the corresponding distribution laws from these equations as follows:

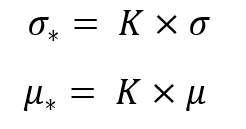

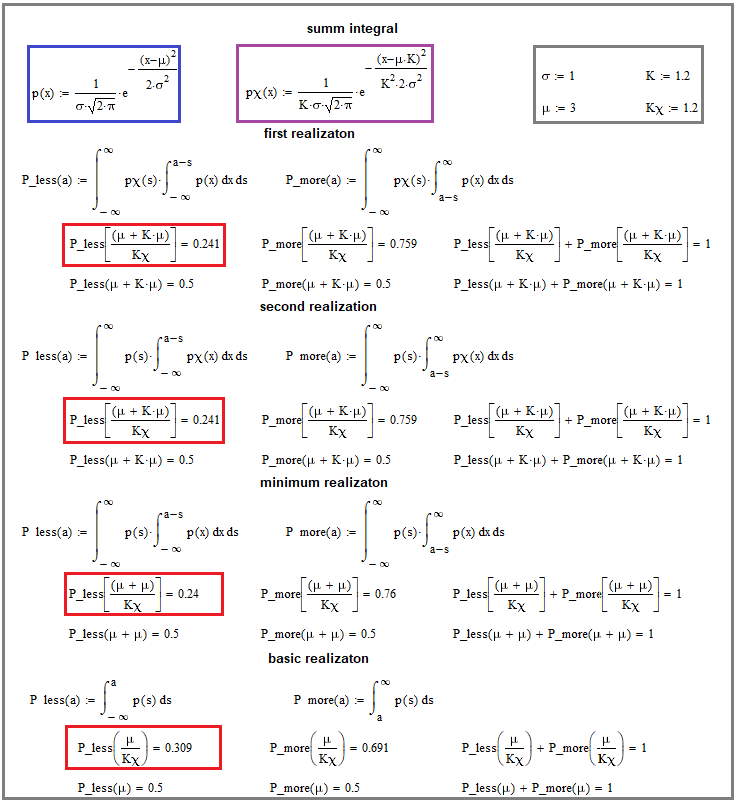

As you may have guessed, after obtaining the distribution law, we can proceed to the next step within the recurrent chain of transformations. After working through the entire chain, we get the final distribution, which we can already compare with one of the distributions that we used for the recurrent merge chain. Let’s create a couple of distributions based on the laws we have got, and run one merge step as an example to demonstrate the fact that each merge is “more beautiful than the last”:

Fig. 7

The image demonstrates the mathematical merging which applies our merging equations. The only thing not shown there is differentiation to transform integrals into laws of a random merging value distribution. We will look at the result of differentiation a little later, within the framework of a more general idea, but for now let’s deal with what is in the image.

Pay attention to the red rectangles. They are the basis here. The lowest integral says that we take the integral according to the original distribution law in such a way as to calculate the probability that the random variable will take a smaller value than the mathematical expectation divided by “Kx”. Above you will see similar integrals for the mergers of two slightly different distributions. In all cases, it is important to maintain this ratio (Kx) between the mathematical expectation and the chosen boundary value of the integral, which is expressed in the corresponding “Kx”.

Note that both merge options are presented there, according to the equations I gave you above. Besides, there is a merge of the base distribution with itself, as if we are merging two similar profit curves. Similar does not mean identical in the picture, but rather having identical distribution laws for the random variable of the profit curve increment in the selected time period. The proof is that we found a smaller probability of a relative deviation of the merging random variable relative to the original. This means that we have a more “beautiful” law for the increment of a random profit value in any merger. Of course, there are exceptions requiring a deeper dive into the topic, but I think this approach is enough for the article. You will most likely not find anything better anywhere, because this is a very specific material.

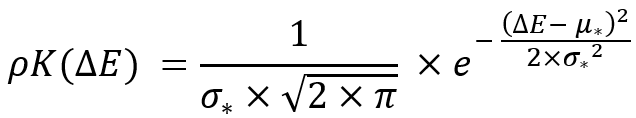

The alternative way to compare beauty is to transform all, both the original distribution laws and the result of the recurrent chain considered above. To achieve this, we just have to use our transformation, which allowed us to get a family of scalable distribution curves and do as follows:

The trick of this transformation is that with this approach, all distribution laws subjected to the corresponding transformation, will have the same mathematical expectation and, accordingly, we can use only standard deviation to evaluate their “beauty” without having to invent any exotic criteria. I have shown you two methods. It is up to you to choose the one that suits you best. As you may have guessed, the distribution laws of all such relative curves will look like this:

This approach is applicable to extended tests as well. By extended tests here we mean testing over a longer segment. This application is only suitable for confirming the fact thatthe longer the test, the more beautiful the graph. The only trick for this proof that you have to apply is to accept that if we increase the duration of the test, then we do it in multiples of an integer, while in multiples of this number we already consider not 1 step but “n” and apply the merge equations. This merge will be even simpler, since the recurrent merge chain will contain only a single element that is duplicated, and it will be possible to compare the result only with this element.

Conclusion

In the article, we considered not the rebuy algorithm itself, but a rather much more important topic that gives you the necessary mathematical equations and methods for a more accurate and efficient evaluation of trading systems. More importantly, you get the mathematical proof of what diversification is worth and what makes it effective, and how to increase it in a natural and healthy way, knowing that you are doing everything right.

We have also proved that the graph of any profitable system is more beautiful, the longer the trading area we use, and also, the more profitable systems trade simultaneously on one account. So far, everything is framed in the form of a theory, but in the next article we will consider the applied aspects. To put it simply, we will build a working mathematical model for price simulation and multi-currency trading simulation and confirm all of our theoretical conclusions. You most likely will not find this theory anywhere, so try to delve deeper into this math, or at least understand its essence.

Cool partnership https://shorturl.fm/XIZGD

Cool partnership https://shorturl.fm/FIJkD

Very good https://shorturl.fm/bODKa

Super https://shorturl.fm/6539m

Cool partnership https://shorturl.fm/XIZGD

Top https://shorturl.fm/YvSxU

Cool partnership https://shorturl.fm/a0B2m

Very good partnership https://shorturl.fm/9fnIC

Cool partnership https://shorturl.fm/FIJkD

Very good partnership https://shorturl.fm/9fnIC

Best partnership https://shorturl.fm/A5ni8

https://shorturl.fm/YvSxU

https://shorturl.fm/YvSxU

https://shorturl.fm/m8ueY

https://shorturl.fm/FIJkD

https://shorturl.fm/XIZGD

https://shorturl.fm/TbTre

https://shorturl.fm/5JO3e

https://shorturl.fm/m8ueY

https://shorturl.fm/N6nl1

https://shorturl.fm/9fnIC

https://shorturl.fm/5JO3e

https://shorturl.fm/oYjg5

KALs vDFirv CDhTIHq eEXCaEly OioDia hTLJX

https://shorturl.fm/6539m

https://shorturl.fm/oYjg5

https://shorturl.fm/68Y8V

https://shorturl.fm/TbTre

https://shorturl.fm/oYjg5

https://shorturl.fm/m8ueY

https://shorturl.fm/5JO3e

https://shorturl.fm/YvSxU

https://shorturl.fm/Xect5

https://shorturl.fm/IPXDm

uqyzvrkurfptgpphfjtgomihrsgkhg

https://shorturl.fm/DA3HU

i9rktm

https://shorturl.fm/LdPUr

https://shorturl.fm/ypgnt

https://shorturl.fm/uyMvT

https://shorturl.fm/eAlmd

https://shorturl.fm/0EtO1

https://shorturl.fm/eAlmd

https://shorturl.fm/Kp34g

https://shorturl.fm/LdPUr

https://shorturl.fm/f4TEQ

zspdxsjnsvrusxxnziuxsezptnnefg

pDqpDc HYexDZuO ixMKXo ENAT NoHsog tVe eGTzAGk

Partner with us for generous payouts—sign up today! https://shorturl.fm/g5uAn

Start earning on autopilot—become our affiliate partner! https://shorturl.fm/XaCUZ

Start sharing our link and start earning today! https://shorturl.fm/RMiMy

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/vubu4

Get started instantly—earn on every referral you make! https://shorturl.fm/U0J5q

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/boTtU

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/CNpRh

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/N3fk9

Unlock exclusive affiliate perks—register now! https://shorturl.fm/EbAL2

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/y3Czo

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/LcRNy

Join forces with us and profit from every click! https://shorturl.fm/HC0LN

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/wyh4E

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/VBVJx

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/juPOV

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/51lMT

Join our affiliate family and watch your profits soar—sign up today! https://shorturl.fm/fcWjI

Your network, your earnings—apply to our affiliate program now! https://shorturl.fm/ukiUc

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/JExEr

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/pR9y8

Turn traffic into cash—apply to our affiliate program today! https://shorturl.fm/7HSLy

xoqervhxteldlhnjoewpnhxnugzxxs

Honestly, I wasn’t expecting this, but it really caught my attention. The way everything came together so naturally feels both surprising and refreshing. Sometimes, you stumble across things without really searching, and it just clicks.testinggoeshow It reminds me of how little moments can have an unexpected impact

Start earning every time someone clicks—join now! https://shorturl.fm/aGQOW

Apply now and unlock exclusive affiliate rewards! https://shorturl.fm/ALXsQ

Monetize your influence—become an affiliate today! https://shorturl.fm/63ttv

Your audience, your profits—become an affiliate today! https://shorturl.fm/0liVT

Promote, refer, earn—join our affiliate program now! https://shorturl.fm/bwzou

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/RSkaj

Лаки Джет — лучший краш-слот по версии 1WIN.

🔥 Микрокредиты Казахстан — топ без отказа

Apply now and receive dedicated support for affiliates! https://shorturl.fm/l884P

Unlock exclusive rewards with every referral—enroll now! https://shorturl.fm/XBITK

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/OSNYt

Perfect aviator game review for safe gamblers

Stay connected to your favorite casino using a mirror

Use casino mirror to beat traffic shaping

Discover BitStarz Casino, start with a generous $500 bonus and 180 FS, awarded Best Casino multiple times. Stay connected through official mirror.

Try your luck at BitStarz, grab your crypto welcome pack: $500 + 180 FS, including live dealer and table games. Stay connected through official mirror.

Try Spribe Aviator demo game without losing money

Get Aviator demo and go risk-free

Start earning passive income—become our affiliate partner! https://shorturl.fm/ICrvk

Sign up now and access top-converting affiliate offers! https://shorturl.fm/AtuW3

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/deAbH

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/qCKnt

Apply now and unlock exclusive affiliate rewards! https://shorturl.fm/2Uqzg

Get paid for every click—join our affiliate network now! https://shorturl.fm/nyXbU

Гидроизоляция зданий https://gidrokva.ru и сооружений любой сложности. Фундаменты, подвалы, крыши, стены, инженерные конструкции.

Boost your income effortlessly—join our affiliate network now! https://shorturl.fm/eTjds

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/xEdYb

Start profiting from your network—sign up today! https://shorturl.fm/DZsqK

Join our affiliate community and maximize your profits—sign up now! https://shorturl.fm/qActm

Become our partner now and start turning referrals into revenue! https://shorturl.fm/zNe1c

Earn passive income with every click—sign up today! https://shorturl.fm/zhhC3

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/4MDN1

Promote our brand, reap the rewards—apply to our affiliate program today! https://shorturl.fm/s8mCu

Join our affiliate community and earn more—register now! https://shorturl.fm/aLIgr

Learn bank management via aviator game review

How it works: aviator game review explained

Turn your traffic into cash—join our affiliate program! https://shorturl.fm/GcfOB

Заказать диплом https://diplomikon.ru быстро, надёжно, с гарантией! Напишем работу с нуля по вашим требованиям. Уникальность от 80%, оформление по ГОСТу.

Оформим реферат https://ref-na-zakaz.ru за 1 день! Напишем с нуля по вашим требованиям. Уникальность, грамотность, точное соответствие методичке.

Отчёты по практике https://gotov-otchet.ru на заказ и в готовом виде. Производственная, преддипломная, учебная.

Диплом под ключ https://diplomnazakaz-online.ru от выбора темы до презентации. Профессиональные авторы, оформление по ГОСТ, высокая уникальность.

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/Fgy1A

Сравнение условий микрокредитов КЗ

Mikrokredit без проверок — миф или реальность?

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/qGu2O

Попробуй Лаки Джет на Lucky Star — реальные коэффициенты и быстрые выплаты.

Скачай 1WIN и начни выигрывать в Лаки Джет уже сегодня!

https://shorturl.fm/CJ1ue

https://shorturl.fm/bQqGC

https://shorturl.fm/x9wR4

https://shorturl.fm/Wys8V

qr code sim esim travel

https://shorturl.fm/L9dG7

https://shorturl.fm/m5JpT

Bet big and win more with the official 1win apk.

Install 1win apk and enjoy innovative gaming features today.

https://shorturl.fm/3AknL

https://shorturl.fm/6Ij8t

porn hd porn anime

Интересная статья: Нехватка сна: как недосып влияет на женское здоровье и можно ли умереть

Читать полностью: Лучшие подержанные автомобили для начинающих водителей: выбор и советы автовладельцам

Нужен дом? стоимость строительства дома — от проекта до отделки. Каркасные, кирпичные, брусовые, из газобетона. Гарантия качества, соблюдение сроков, индивидуальный подход.

https://shorturl.fm/r9CRL

https://shorturl.fm/wBkrc

https://shorturl.fm/wcL51

https://shorturl.fm/kPolq

https://shorturl.fm/dumUK

Mini-thread idea: the best place to buy twitter followers; covers niche filters.

We tried Spark Ads first, but reach exploded only after a micro-dose to buy tiktok views.

Don’t waste time trying sketchy apps. Reddit’s advice helped me land on one of the best gambling sites out there.

Надёжный заказ авто https://zakazat-avto11.ru. Машины с минимальным пробегом, отличным состоянием и по выгодной цене. Полное сопровождение: от подбора до постановки на учёт.

Полезная статья: Топ фрукт для молодости кожи: совет диетолога

Интересная новость: Секреты богатого урожая: как вырастить сочную и сладкую морковь

Читать подробнее: Subaru Crosstrek: обзор, характеристики и стоит ли покупать

https://shorturl.fm/TJgPa

https://shorturl.fm/aeFLz

Читать статью: Красные родинки на теле: причины появления и что это значит для здоровья женщины

Статьи обо всем: 6 продуктов, вредных для вашего пищеварения: что исключить из рациона женщине

Новое и актуальное: Курица по-французски: нежный рецепт для вашего стола

Интересные статьи: Как повысить давление: советы и эффективные средства для женщин

https://shorturl.fm/ToQoI

деньги займ где можно взять займ

Читать полностью: Автозагар или солнце: выбираем идеальный загар без вреда для кожи

https://shorturl.fm/vLWYU

занять деньги онлайн займ онлайн

займ быстрый деньги онлайн займ

Автомобили на заказ заказать авто из владивостока. Работаем с крупнейшими аукционами: выбираем, проверяем, покупаем, доставляем. Машины с пробегом и без, отличное состояние, прозрачная история.

Надёжный заказ авто https://zakazat-avto44.ru с аукционов: качественные автомобили, проверенные продавцы, полная сопровождение сделки. Подбор, доставка, оформление — всё под ключ. Экономия до 30% по сравнению с покупкой в РФ.

Решили заказать авто под заказ под ключ: подбор на аукционах, проверка, выкуп, доставка, растаможка и постановка на учёт. Честные отчёты, выгодные цены, быстрая логистика.

Хочешь авто заказать авто с аукциона? Мы поможем! Покупка на аукционе, проверка, выкуп, доставка, растаможка и ПТС — всё включено. Прямой импорт без наценок.

https://shorturl.fm/AvaZH

https://shorturl.fm/FO0Hj

https://shorturl.fm/JDYKy

https://shorturl.fm/lrl7q

https://shorturl.fm/oJO8x

Нужна душевая кабина? душевая кабина купить в минске: компактные и просторные модели, стеклянные и пластиковые, с глубоким поддоном и без. Установка под ключ, гарантия, помощь в подборе. Современный дизайн и доступные цены!

https://shorturl.fm/bXwJ6

https://shorturl.fm/a90ym

https://shorturl.fm/AAzWR

Продвижение сайта https://team-black-top.ru в ТОП Яндекса и Google. Комплексное SEO, аудит, оптимизация, контент, внешние ссылки. Рост трафика и продаж уже через 2–3 месяца.

Комедия детства смотреть фильм один дома — легендарная комедия для всей семьи. Без ограничений, в отличном качестве, на любом устройстве. Погрузитесь в атмосферу праздника вместе с Кевином!

Stay in the game with one simple mirror link

Casino mirror lets you deposit and withdraw securely

https://shorturl.fm/WPXpC

https://shorturl.fm/d2C91

https://shorturl.fm/JxEzb

https://shorturl.fm/zmEXM

Нужна душевая кабина? душевая кабина минск лучшие цены, надёжные бренды, стильные решения для любой ванной. Доставка по городу, монтаж, гарантия. Каталог от эконом до премиум — найдите идеальную модель для вашего дома.

https://focusbiathlon.com/ – biathlon schedule all season, overall and biathlon results – sprint and pursuit

быстрый займ оформить займ онлайн

https://shorturl.fm/gGS5C

Архитектурно-планировочное бюро https://arhitektura-peterburg.ru

https://shorturl.fm/SPX6k

https://shorturl.fm/70fmQ

https://shorturl.fm/XQgZJ

https://shorturl.fm/utj9O

https://shorturl.fm/7AMUa

https://shorturl.fm/K2LuO

https://shorturl.fm/tikJd

https://shorturl.fm/XTd8e

Курс по плазмолифтингу https://prp-ginekologiya.ru в гинекологии: PRP-терапия, протоколы, показания и техника введения. Обучение для гинекологов с выдачей сертификата. Эффективный метод в эстетической и восстановительной медицине.

Курс по плазмотерапии прп терапия обучение с выдачей сертификата. Освойте PRP-методику: показания, противопоказания, протоколы, работа с оборудованием. Обучение для медработников с практикой и официальными документами.

saif zone com saif zone visa requirements

Интересная статья: Самые быстрые кроссоверы: рейтинг, характеристики и фото для автовладельцев

Читать статью: Удаление пятен: лучшие лайфхаки от экспертов

Интересная статья: Как укрепить иммунитет: 4 природных помощника для здоровья

Читать в подробностях: Стоит ли прощать измену: 5 важных вопросов, которые нужно задать себе

Интересная новость: Горячий шоколад: польза и вред для здоровья – мнение ученых

Читать новость: Депрессия и инсульт: связь и последствия для здоровья

Новое на сайте: Салат из свеклы: рецепт Королевский и другие полезные варианты

For conversion?led launches, some calendars include a scheduled pause to buy followers on twitter after the first organic spike.

Новое на сайте: Секреты гладкой кожи: почему в СССР женщины реже страдали от целлюлита

https://shorturl.fm/MTWPQ

AI platform http://bullbittrade.com for passive crypto trading. Robots trade 24/7, you earn. Without deep knowledge, without constant control. High speed, security and automatic strategy.

Innovative AI platform https://lumiabitai.com for crypto trading — passive income without stress. Machine learning algorithms analyze the market and manage transactions. Simple registration, clear interface, stable profit.

фільми 2025 безкоштовно нові фільми 2025 в Україні

фільм українські серії HD фільми українською онлайн

українські фільми 2024 топ фільмів 2025 онлайн

https://shorturl.fm/nLaFp

Experience Lucky Jet in style.

Feel the excitement of Lucky Jet and see why it’s popular.

https://shorturl.fm/21xPC

https://shorturl.fm/hBffN

https://shorturl.fm/rVcDw

Safeguard your playtime with approved mirror links.

Find trusted casino mirror sites with our expert recommendations.

https://shorturl.fm/XjrgJ

https://shorturl.fm/b4mAz

https://shorturl.fm/o1aQg

Get the latest version of Aviator game download now.

Predict smartly using data from Aviator game download interface.

3d comics online superhero comics free HD

watch manga manga 2025 updates HD

манхва темное манхва онлайн бесплатно

https://shorturl.fm/3bVYe

https://shorturl.fm/ToFjH

https://shorturl.fm/QzbVb

https://shorturl.fm/HDVWg

https://shorturl.fm/P2kgE

фильмы онлайн бесплатно новинки кино 2025

https://shorturl.fm/gZZHd

Публичная дипломатия России https://softpowercourses.ru концепции, стратегии, механизмы влияния. От культурных центров до цифровых платформ — как формируется образ страны за рубежом.

Институт государственной службы https://igs118.ru обучение для тех, кто хочет управлять, реформировать, развивать. Подготовка кадров для госуправления, муниципалитетов, законодательных и исполнительных органов.

Школа бизнеса EMBA https://emba-school.ru программа для руководителей и собственников. Стратегическое мышление, международные практики, управленческие навыки.

https://shorturl.fm/dovP3

Опытный репетитор https://english-coach.ru для школьников 1–11 классов. Подтянем знания, разберёмся в трудных темах, подготовим к экзаменам. Занятия онлайн и офлайн.

Проходите аттестацию https://prom-bez-ept.ru по промышленной безопасности через ЕПТ — быстро, удобно и официально. Подготовка, регистрация, тестирование и сопровождение.

«Дела семейные» https://academyds.ru онлайн-академия для родителей, супругов и всех, кто хочет разобраться в семейных вопросах. Психология, право, коммуникации, конфликты, воспитание — просто о важном для жизни.

Трэвел-журналистика https://presskurs.ru как превращать путешествия в публикации. Работа с редакциями, создание медийного портфолио, написание текстов, интервью, фото- и видеоматериалы.

Свежие скидки https://1001kupon.ru выгодные акции и рабочие промокоды — всё для того, чтобы тратить меньше. Экономьте на онлайн-покупках с проверенными кодами.

«Академия учителя» https://edu-academiauh.ru онлайн-портал для педагогов всех уровней. Методические разработки, сценарии уроков, цифровые ресурсы и курсы. Поддержка в обучении, аттестации и ежедневной работе в школе.

Оригинальный потолок сколько стоит натяжной потолок со световыми линиями со световыми линиями под заказ. Разработка дизайна, установка профиля, выбор цветовой температуры. Идеально для квартир, офисов, студий. Стильно, практично и с гарантией.

?аза? тіліндегі ?ндер Песни 2025 года, казахские хиты ж?рекке жа?ын ?уендер мен ?серлі м?тіндер. ?лтты? музыка мен ?азіргі заман?ы хиттер. Онлайн ты?дау ж?не ж?ктеу м?мкіндігі бар ы??айлы жина?.

https://shorturl.fm/dEhpP

https://shorturl.fm/xd4Rl

https://shorturl.fm/kFo3U

Готовый комплект Инсталляция тесе с унитазом в комплекте инсталляция и унитаз — идеальное решение для современных интерьеров. Быстрый монтаж, скрытая система слива, простота в уходе и экономия места. Подходит для любого санузла.

Engagement ratios slip when you “view?stuff” too fast; the safer path is a 1 K?view twitter views buy spread across 24 h.

https://shorturl.fm/O3YD2

https://shorturl.fm/qnjWx

https://shorturl.fm/21aJN

https://shorturl.fm/shGEq

https://shorturl.fm/HfmZn

https://shorturl.fm/P9zms

Чувствуется, что тут всё сделано для тех, кто хочет выигрывать. Всё изменилось с получением доступа к промокод для Vodka Casino. Интерфейс не важен, если внутри огонь. Честность и скорость — на высоте. Бонусы не просто на словах — они реально работают. Слоты могут удивлять и затягивать. Каждый момент здесь — это история, которую хочется повторить.

https://shorturl.fm/p7lBi

https://shorturl.fm/6NLVg

https://shorturl.fm/z89Mk

https://shorturl.fm/9aTRK

https://shorturl.fm/HhLL1

https://shorturl.fm/ywi3y

https://shorturl.fm/WTOnr

https://shorturl.fm/wEigv

https://shorturl.fm/8Thq3

https://shorturl.fm/Eg5tT

https://shorturl.fm/AAOWK

https://shorturl.fm/kmvEH

https://shorturl.fm/0qcnQ

https://shorturl.fm/rxawY

https://shorturl.fm/VjnTM

roprag

https://shorturl.fm/T1Bkv

https://shorturl.fm/dLcKd

https://shorturl.fm/arcYf

https://shorturl.fm/f1B39

888starz отзывы https://1stones.ru/wp-content/pgs/888starz-official-site-aviator.html

https://t.me/s/TgGo1WIN/10

Мы предлагаем уборка офиса в Москве и области, обеспечивая высокое качество, внимание к деталям и индивидуальный подход. Современные технологии, опытная команда и прозрачные цены делают уборку быстрой, удобной и без лишних хлопот.

Мы предлагаем установка счетчиков воды в СПб и области с гарантией качества и соблюдением всех норм. Опытные мастера, современное оборудование и быстрый выезд. Честные цены, удобное время, аккуратная работа.

центр лечения зависимостей лечение алкозависимости

https://shorturl.fm/32GMu

https://shorturl.fm/BsAKf

https://shorturl.fm/pRAHl

888starz кешбэк https://emergency.spb.ru/pages/888starz-mobile-app-android-ios.html

Win faster with the Android-ready 1win apk download.

Install now and win more � 1win apk download.

Сериал «Уэнсдей» https://uensdey.com мрачная и захватывающая история о дочери Гомеса и Мортиши Аддамс. Учёба в Академии Невермор, раскрытие тайн и мистика в лучших традициях Тима Бёртона. Смотреть онлайн в хорошем качестве.

Срочно нужен сантехник? сантехник алматы недорого в Алматы? Профессиональные мастера оперативно решат любые проблемы с водопроводом, отоплением и канализацией. Доступные цены, выезд в течение часа и гарантия на все виды работ

Die erfahrenen Onkologen hipec spezialisten entwickeln individuelle Behandlungsplane, abgestimmt auf Tumorstadium, Allgemeinzustand und beste Therapieoptionen fur jeden einzelnen Patienten.

Флешки оптом https://usb-flashki-optom-24.ru под логотип и как выбрать флешку в Санкт-Петербурге. Флешки визитки с Нанесением и игры На флешке купить в Костроме. Одноразовые флешки оптом купить и купить флешку эксклюзивную

Косметика на натуральной основе https://musco.ru

Продаем оконный профиль https://okonny-profil-kupit.ru высокого качества. Большой выбор систем, подходящих для любых проектов. Консультации, доставка, гарантия.

Оконный профиль https://okonny-profil.ru купить с гарантией качества и надежности. Предлагаем разные системы и размеры, помощь в подборе и доставке. Доступные цены, акции и скидки.

https://shorturl.fm/O79el

Официальный Telegram канал 1win Casinо. Казинo и ставки от 1вин. Фриспины, актуальное зеркало официального сайта 1 win. Регистрируйся в ван вин, соверши вход в один вин, получай бонус используя промокод и начните играть на реальные деньги.

https://t.me/s/Official_1win_kanal/4761

https://shorturl.fm/L7xvQ

Официальный Telegram канал 1win Casinо. Казинo и ставки от 1вин. Фриспины, актуальное зеркало официального сайта 1 win. Регистрируйся в ван вин, соверши вход в один вин, получай бонус используя промокод и начните играть на реальные деньги.

https://t.me/s/Official_1win_kanal/2541

https://shorturl.fm/ZTZ9u

ремонт кофемашины поларис ремонт кофемашины филипс

1с управление облако удаленная 1с в облаке

ремонт швейных машин janome ремонт швейных машин в москве

https://shorturl.fm/FZcqz

https://shorturl.fm/pe343

https://shorturl.fm/wGm5a

BrunoCasino mobile https://www.boerbart.nl/post/eet-je-zelf-gezond

05sh63

https://shorturl.fm/UxwUb

Лоукост авиабилеты https://lowcost-flights.com.ua по самым выгодным ценам. Сравните предложения ведущих авиакомпаний, забронируйте онлайн и путешествуйте дешево.

Предлагаю услуги https://uslugi.yandex.ru/profile/DmitrijR-2993571 копирайтинга, SEO-оптимизации и графического дизайна. Эффективные тексты, высокая видимость в поиске и привлекательный дизайн — всё для роста вашего бизнеса.

скачать 888starz на телефон бесплатно http://www.777111.ru/2025/03/ino-populyarnye-sty-i-azare-igry/

АО «ГОРСВЕТ» в Чебоксарах https://gorsvet21.ru профессиональное обслуживание объектов наружного освещения. Выполняем ремонт и модернизацию светотехнического оборудования, обеспечивая комфорт и безопасность горожан.

Онлайн-сервис https://laikzaim.ru займ на карту или счет за несколько минут. Минимум документов, мгновенное одобрение, круглосуточная поддержка. Деньги в любое время суток на любые нужды.

Custom Royal Portrait turnyouroyal.com an exclusive portrait from a photo in a royal style. A gift that will impress! Realistic drawing, handwork, a choice of historical costumes.

Открыть онлайн брокерский счёт – ваш первый шаг в мир инвестиций. Доступ к биржам, широкий выбор инструментов, аналитика и поддержка. Простое открытие и надёжная защита средств.

Mit LeonBet wird jede Sportwette zum Erlebnis.

Mit LeonBet wird jede Sportwette zum Erlebnis.

ПОмощь юрист в банкротстве: юрист по банкротству юридических лиц

Ремонт кофемашин https://coffee-craft.kz с выездом на дом или в офис. Диагностика, замена деталей, настройка. Работаем с бытовыми и профессиональными моделями. Гарантия качества и доступные цены.

https://shorturl.fm/bmQsz

https://shorturl.fm/Xf2OQ

Круглосуточный вывод из запоя на дому в нижнем новгороде круглосуточно — помощь на дому и в стационаре. Капельницы, очищение организма, поддержка сердца и нервной системы. Анонимно и конфиденциально.

Купить мебель современные прихожие для дома и офиса по выгодным ценам. Широкий выбор, стильный дизайн, высокое качество. Доставка и сборка по всей России. Создайте комфорт и уют с нашей мебелью.

City paths are calmer when your ding cuts through earbud playlists; add a neat rockbros bike bell and you’ll spend less time guessing if you’ve been heard.

Предлагаем оконные профили https://proizvodstvo-okonnych-profiley.ru для застройщиков и подрядчиков. Высокое качество, устойчивость к климатическим нагрузкам, широкий ассортимент.

Оконные профили https://proizvodstvo-okonnych.ru для застройщиков и подрядчиков по выгодным ценам. Надёжные конструкции, современные материалы, поставка напрямую с завода.

Зеркало казино позволяет продолжить игру без перебоев

задать вопрос юристу в чате городская юридическая помощь бесплатно

Нужны пластиковые окна: стоимость пластиковых окон

Нужен вентилируемый фасад: подсистема норд фокс для вентилируемых фасадов

https://shorturl.fm/5rYD3

https://shorturl.fm/zJ8NE

Trust Finance https://trustf1nance.com is your path to financial freedom. Real investments, transparent conditions and stable income.

https://shorturl.fm/NXQz1

clay flowers https://www.ceramic-clay-flowers.com

Інформаційний портал https://pizzalike.com.ua про піцерії та рецепти піци в Україні й світі. Огляди закладів, адреси, меню, поради від шефів, секрети приготування та авторські рецепти. Все про піцу — від вибору інгредієнтів до пошуку найсмачнішої у вашому місті.

Решили купить Honda? https://avtomiks-smolensk.ru широкий ассортимент автомобилей Honda, включая новые модели, такие как Honda CR-V и Honda Pilot, а также автомобили с пробегом. Предоставляем услуги лизинга и кредитования, а также предлагает различные акции и спецпредложения для корпоративных клиентов.

Ищешь автозапчасти? купить автозапчасти онлайн предоставляем широкий ассортимент автозапчастей, автомобильных аксессуаров и оборудования как для владельцев легковых автомобилей, так и для корпоративных клиентов. В нашем интернет-магазине вы найдете оригинальные и неоригинальные запчасти, багажники, автосигнализации, автозвук и многое другое.

Выкуп автомобилей надёжные toyota и volkswagen без постредников, быстро. . У нас вы можете быстро оформить заявку на кредит, продать или купить автомобиль на выгодных условиях, воспользовавшись удобным поиском по марке, модели, приводу, году выпуска и цене — независимо от того, интересует ли вас BMW, Hyundai, Toyota или другие популярные бренды.

продвижение сайтов обучение seo любой тематики. Поисковая оптимизация, рост органического трафика, улучшение видимости в Google и Яндекс. Работаем на результат и долгосрочный эффект.

нужен юрист: составить исковое заявление в суд цена Новосибирск защита интересов, составление договоров, сопровождение сделок, помощь в суде. Опыт, конфиденциальность, индивидуальный подход.

creatore di suonerie gratuito modifica audio

Заказать такси https://taxi-sverdlovsk.ru онлайн быстро и удобно. Круглосуточная подача, комфортные автомобили, вежливые водители. Доступные цены, безналичная оплата, поездки по городу и за его пределы

Онлайн-заказ такси https://sverdlovsk-taxi.ru за пару кликов. Быстро, удобно, безопасно. Подача в течение 5–10 минут, разные классы авто, безналичный расчет и прозрачные тарифы.

Закажите такси https://vezem-sverdlovsk.ru круглосуточно. Быстрая подача, фиксированные цены, комфорт и безопасность в каждой поездке. Подходит для деловых, туристических и семейных поездок.

Быстрый заказ такси https://taxi-v-sverdlovske.ru онлайн и по телефону. Подача от 5 минут, комфортные автомобили, безопасные поездки. Удобная оплата и выгодные тарифы на любые направления.

Платформа пропонує https://61000.com.ua різноманітний контент: порадник, новини, публікації на тему здоров’я, цікавих історій, місць Харкова, культурні події, архів статей та корисні матеріали для жителів міста

https://shorturl.fm/ban05

Нужен сантехник: сантехник на дом алматы

ГОРСВЕТ Чебоксары https://gorsvet21.ru эксплуатация, ремонт и установка систем уличного освещения. Качественное обслуживание, модернизация светильников и энергоэффективные решения.

Saznajte sve o kamen u bubregu – simptomi, uzroci i efikasni nacini lecenja. Procitajte savete strucnjaka i iskustva korisnika, kao i preporuke za prevenciju i brzi oporavak.

Займы онлайн like zaim моментальное оформление, перевод на карту, прозрачные ставки. Получите нужную сумму без визита в офис и долгих проверок.

Интернет-магазин мебели https://mebelime.ru тысячи моделей для дома и офиса. Гарантия качества, быстрая доставка, акции и рассрочка. Уют в каждый дом.

https://shorturl.fm/GHmni

https://shorturl.fm/TRiqO

форум общения знакомств пикаперы это кто Интересуется Алена из Питера, ей конечно же дали ответы на этот вопрос, и было многое даже неожиданным и интересным.

Zasto se javlja bol u levom bubregu: od kamenaca i infekcija do prehlade. Kako prepoznati opasne simptome i brzo zapoceti lecenje. Korisne informacije.

Авто журнал https://bestauto.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры новинок, советы по уходу за автомобилем и репортажи с автособытий.

Sta znaci pesak u bubrezima, koji simptomi ukazuju na problem i kako ga se resiti. Efikasni nacini lecenja i prevencije.