Introduction

So, let’s start from the basics. This technology is one of the variations of artificial intelligence from OpenAI, designed to help people in solving various tasks. This tool looks like a regular messenger chat. However, at the other end there is a so-called artificial intelligence that answers you in text form.

Of course, the communication channel is limited only to a text, but it is still sufficient for solving various problems or learn a lot of new things. This text channel is suitable for solving completely different problems, such as programming, mathematics, physics, chemistry, not to mention skillful translation and other abilities.

We are interested in this model only in terms of the development of profitable trading systems. I became interested in how to optimally and correctly use this technology for faster and easier development of trading systems. Ultimately, the one who first begins to correctly apply a technology for its intended purpose reduces both the cost of any development and labor costs, which gives obvious competitive advantages.

Prospects for using ChatGPT within MQL5

Let’s dwell in more detail on the technology prospects. After a fairly detailed study on my own examples, I realized that such technology is only the beginning of something truly great. But even now I can highlight the following features:

- Generation of any MQL4 and MQL5 codes

- Working code refactoring and optimization

- Cleaning up a code

- Adding comments to a code

- Fixing errors

- Implementing mathematical models

- Subsequent code building based on mathematical models

- Modernization of any known algorithms and mathematical models

- Speeding up the Expert Advisor (EA) development process

- A huge amount of information

This list is by no means final, and you can add something of your own here. I think that when people learn about this kind of technology, they all start to fall into roughly three subgroups:

- “Now we will make a super algorithm”

- Those who are wary of AI and questioning its usefulness

- Machine cannot be better than a human. It’s all just another hype

I began to get acquainted with this technology a long time ago and at the beginning I belonged to the third category. In the first two days of dealing with this AI, I abruptly moved from the third to the first category, after which a more interesting and rather unpleasant process of adjusting my own beliefs began, which is more like a rollback to the “1.5” category, which is already a more realistic assessment of this technology.

This technology is useful, but not as much as you might initially think. In this regard, it is worth paying tribute to the developers and marketers of this technology, if only for the fact that it creates an incredible “wow” effect from use in the first couple of days, which is enough for a chain reaction of self-promotion.

To understand this, you need a lot of practice in dealing with this AI. Personally, I had about a hundred different dialogues with it on various topics. I can say that I have gained enough practice in using this technology to start using it for MQL5. Before moving on to practical applications, I just need to tell you some very important information, and for this we will need to look deeper under the hood of this technology.

Potential pitfalls associated with ChatGPT

The so-called “wow” effect you will experience in the early days of using this technology is due to the fact that this is primarily a text model that is designed to turn your question into an answer. The reason why you will like its answers is because the creators taught this model to lie beautifully. Yes, I am not kidding! It lies so beautifully that you will want to believe it yourself, and even after many attempts to expose it, the model will often provide you with something like this:

- Sorry! Yes, you are right. I have made a small mistake. I will take this into account in the future. (In fact, it will not. This is just an empty promise)

- Sorry for misunderstanding, I have made a mistake. Here is the corrected version. (Containing even more errors)

- You might find out that the model made a mistake in calculations. (In fact, the model made no calculations at all, it simply found an approximate number somewhere)

- You have detected an error in a code. (The model will again make excuses and try to deceive you)

- The model imitates execution of a task and tries to convince you that it did what you asked for. (Actually, it finds something similar somewhere and just provides it to you. )

- Sorry! I was unable to help you. (This happens when the model understands that you have detected its lies or mistakes)

- The model adds a lot of excessive words into its answer to make an impression of a harmonious and coherent answer. (I think, this is somehow connected to the optimization of resource costs)

In short, the model will try to skip out on the provided task in every possible way, while taking advantage of the imperfection of your “prompt”. In case of mistakes, it will try to justify itself in such a way that you are not be able to catch it on the same thing, and if it understands that you have got it pegged, it will try to soften your negative reaction with certain replies and psychological tricks. In general, I think that the algorithm is tailored for optimal resource consumption with an acceptable level of user satisfaction. In other words, the goal in this case is not to give you the most high-quality solution to the problem, but to provide you with a solution that you consider as such, due to completely different possible reasons. It turns out that the goal is a positive reaction from a user, and it is not so important whether the task is solved correctly. This is what it strives for. From the marketing point of view, this is correct, and in this regard, the AI can be as persuasive as possible.

Considering all this, I realized that in order to minimize its freedom in this aspect, we should first of all accumulate experience in communicating with it and draw conclusions about what type of tasks does not require the use of this persuasiveness simply because it will be easy for it to fulfill our request since it is most easily fulfilled given its functionality and it is much easier to give a direct answer than to enable imagination. Because it will not be efficient in terms of resource costs, in other words, it will simply not be profitable for it to deceive you, but it will be much easier to give you a true answer.

In order to begin to understand how to ask such questions, we need to understand the following:

- The structure and type of a “prompt” are not that important, the details and the quality of the question are of greater importance. (The model understands everything and there is no need to read Internet guides on how to compose prompts. Write as you wish, but without slang.)

- Divide complex questions or requests into subparagraphs. (Simplify and divide questions to get more precise, simple and clear answers.)

- The smarter and more punctual your question is, the more useful the answer.

- It will not give you a super idea or an algorithm. (The model does not have the breadth of thinking, planning and intellectual creativity. But at first it will seem that it is capable of creating it simply because, as I said, it lies very well.)

- We should think about the use of this technology solely in the context of speeding up our work and reducing our labor costs.

- Each new request should be the least dependent on the entire dialog. (The model is unable to remember the entire dialog and old messages are often not taken into account in replies. Just try it and you will understand what I mean.)

- The more complex the question and the more details it contains, the higher the probability to get complete nonsense. (This is an explanation of the second subparagraph.)

- The model has no Internet access, and it generates all answers only based on its knowledge base. (If you urge it to get sone data from the Internet, it will give you the old data from its database or adjust the answer based on your context passing it off as a new one. Keep this in mind. The model will do this simply because it realizes that it is useless to argue with you and it is better to convince you that it did everything.)

- ChatGPT 3.5 was trained till 2019. (Which means that he has no information about the events after 2019 until the next training session sanctioned by the developers.)

- ChatGPT 4.0 was trained till 2021. (It is better because it lies very little and tries to always answer correctly. If you try to ask questions and compare, you will see that 3.5 lies blatantly.)

In fact, there are a lot of other smaller unpleasant moments that spoil the impression of this technology. But nevertheless, I would not write about it if this technology was not useful. This all boils down to the fact that this is by no means an artificial intelligence. But if we remain pragmatic and think whether everything is so bad and what routine operations we can perform faster and better with the help of this technology, then I am sure we will not be too harsh in our judgment. We just need to think about how to use all this in the development of trading systems.

Concluding this section, I want to focus your attention on the most important and basic point that you need to remember at all times:

- Always double check ChatGPT answers and especially numbers, equations and generated code

Thanks to my knowledge of both math and programming, I happened to see many examples of its mistakes and shortcomings and I can say that they are pretty common. It would seem insignificant from the point of view of the generated text, but when we are dealing with math or code, even the most insignificant mistake makes the whole solution useless. Therefore, always double-check answers, correct mistakes and call the model’s attention to that. Sometimes it answers correctly for a while. This subparagraph, among other things, will be extremely useful when developing your EAs.

Opportunities for using ChatGPT to solve mathematical problems and develop mathematical models for use in a code

Since this model is textual, it is easy to guess that if we write equations in the correct format, then it will understand them and, moreover, perform mathematical transformations and solve problems. When developing many trading systems, you will need help in creating mathematical equations and expressions. It is possible to solve some possible mathematical problems with their subsequent implementation in a code. There is the following format for writing mathematical equations, which ChatGPT understands and uses to give the answer:

- LaTeX

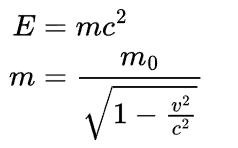

An example of using the latex format for writing equations:

Code:

E &=& mc^2\\ m &=& \frac{m_0}{\sqrt{1-\frac{v^2}{c^2}}}

Paste this into any free latex converter and get a data visualization of all familiar expressions:

I think, now it is clear how to visually interpret the model answers in LaTeX format. Most importantly, do not forget to ask the model to generate equations in this format if the answer contains mathematical expressions. There are also neural networks capable of converting equations in pictures or other formats back into the format we need. I think, you will find these tools if you need them. My task is to show you the existence of such a possibility.

There are Telegram bots that combine many neural networks, including ChatGPT, and the function of converting images back to LaTeX format. If you wish, you can find one of them in my profile. This bot was made by my friend and tested by me personally.

You can ask ChatGPT, for example, to solve an inequality or an equation, both numerically and explicitly. You can also ask to solve systems of equations or inequalities, as well as differential equations or integrals, or perform any required mathematical transformations. However, as a mathematician, I can say that it does not always do that efficiently and rationally and sometimes leaves the task unfinished. So double checks are necessary.

Of course, this feature can be useful to non-mathematicians. In case of a prolonged use, you will make more mistakes, and your solution will be quite irrational and clumsy. However, you will cover some of your math problems for your code, given that the code usually uses only numerical methods, while the applied math is not that complicated. There is no differential math here.

Correct approach to code generation in MQL4 and MQL5

This is where things get interesting. Given that the sizes of codes of all sufficiently high-quality and more or less decent trading systems are quite large, it is worth thinking about how to approach the process of generating such codes. Here the main obstacle is that the size of the answer to your question is limited to a certain number of characters, and after numerous attempts to generate large and complex codes, I came to the conclusion that each code output should be short enough. This means that the code should be displayed in parts. How can we achieve this? The answer is very simple – we need to make a plan for developing an EA, indicator or script.

The plan should be drawn up with the condition that each sub-item should be a separate sub-task that can be solved independently. Then we can simply solve each sub-task sequentially, and then combine all the code together. Another advantage of this approach is that each sub-task can then be finalized separately, and since each sub-task is simpler than all of them combined together, finalization is performed faster and in a more comfortable manner. In addition, we will avoid more errors.

As a developer, it is much more comfortable for me to independently think over the main architecture of my EA without allowing AI to interfere. Instead, let it implement separate procedures in my EA. Let all the main logic be contained in the procedures. We will only have to implement an approximate code template with empty functions, and then ask it to implement each function individually. We can also ask it to implement function prototypes or other structures.

An additional and important advantage is that you can ask it to prepare a plan for an EA or other code, indicating your requirements, and then simply implement its plan piece by piece. It is good when you have a rough or precise idea of what your EA’s algorithm will be like and what indicators or other approaches it will use. But if there is no such idea, you can first talk to it and ask it to help you choose a trading strategy for your EA. It will offer you some options. Let’s consider this course of actions here as an example.

Let’s now summarize the above and form brief sub-points, symbolizing the possible paths we will take when building a new EA from scratch. To begin with, there are several obvious possible scenarios for getting started:

- We have not decided on the architecture of the future code and do not know where to start, and we also do not know at all which of the trading approaches to choose.

- We have not decided on the architecture of the future code and do not know where to start, but we know a rough picture of the main working code and what we want from the EA.

- We have a ready-made architecture that is comfortable for us, but we absolutely do not know which trading approach to choose.

- We know the architecture we want to use and also have a clear idea of the future trading logic of the EA.

As a rule, everything will be reduced to similar constructions. All four points can be applied to the general scheme of building any trading system if we do the following:

- If we do not know the architecture (main code or framework), then first of all we need to implement it, and then implement everything that ensures the functioning of this framework.

This may mean, for example, that we can ask to implement classes, input variables, fields and method prototypes, interfaces, as well as the main trading functionality of the EA, which will use the entities described by us. With proper handling of ChatGPT, the code can be implemented in such a way that it takes, say, no more than 5-10% of the total number of characters. In this case, we can quickly implement it and then move on to the implementation of the procedures, which will contain about 90% of the entire code. These procedures will be implemented in the same simple manner, because there will be a lot of them, and they will turn out to be quite small and easily executable. Of course, it is much easier when you have a ready-made template and you do not have to implement all this, but this requires knowledge and experience.

Developing a trading system using ChatGPT

I believe I have provided you enough theoretical information. It is time to apply it. In my case, I use a ready-made template to base my EAs on. I described such a pattern in one of the previous articles. Its peculiarity is that it provides parallel trading of many instruments, being activated on a single chart. It already features all the necessary trading functionality and the main architecture. I will build a trading system strictly following recommendations of ChatGPT. I will implement the main trading logic of the EA myself, as well as the visual component, because this will require less efforts from me.

When you start interacting with ChatGPT, you will realize that you will spend much more efforts trying to explain to it what needs to be done, and you will correct its answers a hundred times when implementing some requests and tasks. After a while, you will simply begin to feel which questions are worth asking and which are not. You will begin to set only those tasks that will ultimately save your time instead of wasting it. There is a rather thin line here, which you have to feel for yourself – there is no other way. Everything is learned in practice. My approach to the EA design has been formed fully due to these considerations.

First of all, I asked to describe the basis of the EA – what its working principle is and what methods or indicators it is to use (I allowed the model to use any available information at its discretion). At the same time, I stated that I only need logical conditions from it in a readable form, which I can implement on my own in the following four predicates:

- Opening a buy position.

- Closing a buy position.

- Opening a sell position.

- Closing a sell position.

To implement these predicates, the model offered me the following conditional logic:

- The current price is locked above the EMA, the difference between the current price and the EMA is less than the ATR * ratio, and the RSI is less than 30.

- The current price is closed below SMA, or the current price is closed above the upper band of the Bollinger Bands indicator.

- The current price is locked below the EMA, the difference between the current price and the EMA is less than the ATR * ratio, and the RSI is greater than 70.

- The current price is locked above the SMA, or the current price is locked below the lower band of the Bollinger Bands indicator.

Obviously, these boolean conditions return ‘true’ on success and ‘false’ on failure. These signal values are quite sufficient for trading with market orders. Here I want to draw your attention to the obvious possibility of modernizing this logic. To do this, we can do the following:

- [K1] — zone of the lower RSI value

- [K2 = 100 – K1] — zone of the upper RSI value

These expressions can be used to expand the flexibility of the algorithm, which will subsequently have a positive effect on the efficiency of the EA optimization:

- The current price is locked above the EMA, the difference between the current price and the EMA is less than the ATR * ratio, and the RSI is less than K1

- The current price is locked below the SMA or the current price is closed above the upper band of the Bollinger Bands indicator

- The current price is closed below the EMA, the difference between the current price and the EMA is less than the ATR * ratio, and the RSI is greater than K2

- the current price is locked above the SMA or the current price is locked below the lower band of the Bollinger Bands indicator

I provided this example because you should not hesitate to extend the model if it is obvious that the solution in question is only a special case of a different, more extended algorithm. Even if you do not know what such an extension can give you, by doing this you at least increase the flexibility of your algorithm, and hence the likelihood of its finer tuning and, as a result, a possible increase in its efficiency.

Considering what conditions need to be implemented, we will need one of two options for implementing the following indicators:

- SMA — standard moving average (one line)

- EMA — exponential moving average (one line)

- Bollinger Bands — Bollinger bands (a set of three lines)

- RSI — relative strength index (one line in a separate window)

- ATR — average true range (one line in a separate window)

Indicators can be implemented using special predefined MQL5 functions, but I do not like this approach, because the implemented code will be more difficult to convert to the MQL4 version. Besides, it will be more difficult for me to integrate it, for example, in my projects in other languages, which I do very often. I have long been in the habit of doing everything as simply as possible and with the future use in mind. I think, this is a very good habit.

The second important point is that, as a rule, such indicators drag along unnecessary and redundant calculations and functionality. In addition, it is impossible to refine such indicators, since their functions are rigidly set at the code level. In order to make changes, you will need to create your own version of the indicator in any case. I think it is obvious that it is better to have a custom implementation inside an EA or a script. In order to implement such indicators, I came up with the following trick:

- Creation of arrays for storing the values of the indicator lines (limited to the last N bars).

- Implementation of shifting array values when a new bar appears.

- Implementing clearing the array of indicator values in case of errors or a long disconnect.

- Implementing the calculation of the indicator value for the last bar when it closes.

In this approach, the first three paragraphs create common array blocks and functions that provide the listed actions. Let’s see how this looks using our task as an example. Let’s start with the first point:

double SMA1Values[]; // Array for storing SMA values double EMAValues[]; // Array for storing EMA values (exponential) double RSIValues[]; // Array for storing RSI values double BollingerBandsUpperValues[]; // Array for storing BollingerBands values, upper double BollingerBandsMiddleValues[]; // Array for storing BollingerBands values, middle double BollingerBandsLowerValues[]; // Array for storing BollingerBands values, lower double ATRValues[];// array for storing Average True Range values

These arrays are initialized at the start of the EA with the given length limits:

//Prepare indicator arrays void PrepareArrays() { ArrayResize(SMA1Values, LastBars); ArrayResize(EMAValues, LastBars); ArrayResize(RSIValues, LastBars); ArrayResize(BollingerBandsUpperValues, LastBars); ArrayResize(BollingerBandsMiddleValues, LastBars); ArrayResize(BollingerBandsLowerValues, LastBars); ArrayResize(ATRValues, LastBars); }

Unlike conventional indicators, we do not need to drag all the previous values with us for this strategy. This is definitely an advantage. I like this implementation paradigm, because it ensures the simplicity of the code and the equivalence of both the starting values of the indicator and those obtained using the previous ones. Now let’s see how the value shift looks like:

//shift of indicator values void ShiftValues() { int shift = 1; for (int i = LastBars - 1; i >= shift; i--) { SMA1Values[i] = SMA1Values[i - shift]; EMAValues[i] = EMAValues[i - shift]; RSIValues[i] = RSIValues[i - shift]; BollingerBandsUpperValues[i] = BollingerBandsUpperValues[i - shift]; BollingerBandsMiddleValues[i] = BollingerBandsMiddleValues[i - shift]; BollingerBandsLowerValues[i] = BollingerBandsLowerValues[i - shift]; ATRValues[i] = ATRValues[i - shift]; } }

As you can see, everything is extremely simple. The same will apply to clearing arrays:

//reset all indicator arrays if connection fails [can also be used when initializing an EA] void EraseValues() { for (int i = 0; i < LastBars; i++) { SMA1Values[i] = -1.0; EMAValues[i] = -1.0; RSIValues[i] = -1.0; BollingerBandsUpperValues[i] = -1.0; BollingerBandsMiddleValues[i] = -1.0; BollingerBandsLowerValues[i] = -1.0; ATRValues[i] = -1.0; } }

I think, it is pretty clear where this functionality will be used. Now let’s move on to the implementation of the indicators themselves. To do this, I asked ChatGPT to implement the appropriate function, which would be suitable based on my code building paradigm. I have started with the SMA indicator:

//1 Function that calculates the indicator value to bar "1" double calculateMA(int PeriodMA,int Shift=0) { int barIndex=Shift+1;//bar index SMA is calculated for (with a shift) int StartIndex=barIndex + PeriodMA-1;//starting bar index for calculating SMA if (StartIndex >= LastBars) return -1.0; // Check for the availability of the bars for calculating SMA (if not valid, then the value is -1) double sum = 0.0; for (int i = StartIndex; i >= barIndex; i--) { sum += Charts[chartindex].CloseI[i]; } LastUpdateDateTime=TimeCurrent(); return sum / PeriodMA; }

As you can see, the function turned out to be very simple and short. Initially, the appearance of this function was a bit different. During the first generation, I found a lot of errors in it, for example, related to the fact that it misunderstood the direction of the numbering of bars relative to time, and so on. But after some manipulations, I fixed all this and additionally added the Shift parameter, which was not in the original implementation. After implementing some visual improvements, I asked to implement the rest of the indicators in a similar fashion. After that, there were fewer errors in its implementations. I just sent the following requests to implement a similar function for another indicator, including examples of previous implementations in the context of the question. This saved a lot of time. Let’s now look at its subsequent implementations of all the remaining indicators. Let’s start with EMA:

//2 Function that calculates the value of the exponential moving average to bar "1" double calculateEMA(int PeriodEMA,double Flatness=2.0,int Shift=0) { int barIndex = Shift+1; // bar index EMA is calculated for (with a shift) int StartIndex=barIndex + PeriodEMA-1;//index of the starting bar for calculating the first SMA, for starting the recurrent calculation of EMA if (StartIndex >= LastBars) return -1.0; // Check for the availability of the bars for calculating EMA (if not valid, then the value is -1) double sum = 0.0; double multiplier = Flatness / (PeriodEMA + 1); // Weight multiplier double prevEMA; // Calculate the initial value for the EMA (the first value is considered as a normal SMA) for (int i = StartIndex; i >= barIndex; i--) { sum += Charts[chartindex].CloseI[i]; } prevEMA = sum / PeriodEMA;//this is the starting value for the bar (StartIndex-1) // Apply the EMA formula for the remaining values for (int i = StartIndex; i >= barIndex; i--) { prevEMA = (Charts[chartindex].CloseI[i] - prevEMA) * multiplier + prevEMA; } LastUpdateDateTime = TimeCurrent(); return prevEMA; }

By the way, when researching ChatGPT generations, we have to turn to various Internet resources in order to understand which indicator is based on which idea. This makes us more competent. This is especially evident with EMA. If we look closely at the code, we will see that it does not differ much from the simpler implementation of SMA and rather looks like an add-on to the usual moving average. There is no exponent here, although for some reason it is present in the indicator name. The next is RSI indicator:

//3 Function for calculating RSI to bar "1" double calculateRSI(int PeriodRSI,int Shift=0) { int barIndex = Shift+1; // bar index RSI is calculated for (with a shift) int StartIndex = barIndex + PeriodRSI - 1; // starting bar index for calculating RSI if (StartIndex >= LastBars) return -1.0; // Check for the availability of the bars for calculating RSI (if not valid, then the value is -1) double avgGain = 0.0; double avgLoss = 0.0; double change; // Calculate initial values for avgGain and avgLoss for (int i = StartIndex; i > barIndex; i--) { change = Charts[chartindex].CloseI[i]-Charts[chartindex].OpenI[i]; if (change > 0) { avgGain += change; } else if (change < 0) { avgLoss -= change; } } avgGain /= PeriodRSI; avgLoss /= PeriodRSI; // RSI calculation double RS = 0.0; if (avgLoss != 0) { RS = avgGain / avgLoss; } double RSI = 100 - (100 / (1 + RS)); LastUpdateDateTime = TimeCurrent(); return RSI; }

Now we need to do a similar procedure for the Bollinger Bands indicator. This procedure should return the values of three curves, which can be put into the preliminarily prepared structure:

//structure to return all three bollinger band lines struct BollingerBands { double upper; double middle; double lower; };

Now, having added this structure to the context of the question, we can ask to implement the function, taking into account the fact that it should return the BollingerBands type. The model will cope with such a task without problems:

//4 Function for calculating the Bollinger Bands of the indicator BollingerBands calculateBollingerBands(int PeriodBB, double DeviationBB,int Shift=0) { int barIndex = Shift+1; // bar index Bollinger Bands is calculated for (with a shift) int StartIndex = barIndex + PeriodBB - 1; // index of the starting bar for calculating the first SMA, for starting the recurrent calculation of EMA BollingerBands rez; rez.lower=-1.0; rez.middle=-1.0; rez.upper=-1.0; if (StartIndex >= LastBars) return rez; // Check for the availability of the bars for calculating BB (if not valid, then the value is -1) double sum = 0.0; double prevBB; double sumSquares = 0.0; // Calculate the initial value for BB (the first value is considered as a normal SMA) for (int i = StartIndex; i >= barIndex; i--) { double closePrice = Charts[chartindex].CloseI[i]; sum += closePrice; } prevBB = sum / PeriodBB; //this is the starting value for the bar (StartIndex-1) // Calculation of standard deviation for (int i = StartIndex; i >= barIndex; i--) { double closePrice = Charts[chartindex].CloseI[i]; sumSquares += pow(closePrice - prevBB, 2); } double standardDeviation = sqrt(sumSquares / PeriodBB); // Calculate Bollinger Bands double upperBand = prevEMA + DeviationBB * standardDeviation; double lowerBand = prevEMA - DeviationBB * standardDeviation; rez.upper = upperBand; rez.middle = prevEMA; rez.lower = lowerBand; LastUpdateDateTime = TimeCurrent(); return rez; }

Now it remains to implement the version of the function for calculating ATR:

//5 Function for calculating Average True Range (Relative) double calculateRelativeATR(int PeriodATR,int Shift=0) { int barIndex = Shift+1; // bar index ATR is calculated for (with a shift) int StartIndex = barIndex + PeriodATR - 1; // starting bar index for calculating the first ATR if (StartIndex >= LastBars) return -1.0; // Check for the availability of the bars for calculating ATR and True Range (if not valid, then the value is -1) double sumPrice=0.0; double sumTrueRange = 0.0; double ATR; // Calculating True Range for bars and the sum of values for calculating the first ATR for (int i = StartIndex; i >= barIndex; i--) { sumPrice+=Charts[chartindex].HighI[i]+Charts[chartindex].LowI[i]+Charts[chartindex].CloseI[i]+Charts[chartindex].OpenI[i];//added by me double high = Charts[chartindex].HighI[i]; double low = Charts[chartindex].LowI[i]; double trueRange = high - low; sumTrueRange += trueRange; } // ATR calculation //ATR = sumTrueRange / PeriodATR; - conventional calculation ATR = 100.0 * (sumTrueRange / PeriodATR)/(sumPrice/(PeriodATR*4.0));//calculation of relative ATR in % LastUpdateDateTime = TimeCurrent(); return ATR; }

Here pay attention to the commented line at the end. I slightly modified this indicator so that it operates relative values. This is necessary so that we do not have to set our own weights for each trading instrument. Instead, this will happen automatically based on the current price. This will allow for more efficient multi-currency optimization. We will need it to prove the fact that even such a simple algorithm, if used correctly, can give us a small but sufficient forward period for trading. In combination with other methods of efficiency, this trade can be made quite acceptable, even at the level currently allowed by EA.

I implemented the predicates myself. It was very easy. Let’s look at one of them, let’s say the first one:

//to open buy positions bool bBuy() { //determine if an open position is already present bool ord; ulong ticket; bool bOpened=false; for ( int i=0; i<PositionsTotal(); i++ ) { ticket=PositionGetTicket(i); ord=PositionSelectByTicket(ticket); if ( ord && PositionGetInteger(POSITION_MAGIC) == MagicF) { bOpened=true; return false; } } if (!bOpened && EMAValues[1] > 0.0)//only if nothing is open and the indicator has been calculated { //K - control ratio //RSIPercentBorder - control RSI double Val1=Charts[chartindex].CloseI[1]-EMAValues[1]; double Val2=ATRValues[1]*(1.0/K); if (Val1 > 0 && Val1 < Val2 && RSIValues[1] < RSIPercentBorder) return true; } return false; }

The predicate for opening a sell position is similar with minor exceptions. The closure predicate is even simpler:

//to close a buy position bool bCloseBuy() { if (SMA1Values[1] > 0.0) { if (Charts[chartindex].CloseI[1] < SMA1Values[1] || Charts[chartindex].CloseI[1] > BollingerBandsUpperValues[1] ) { return true; } } return false; }

All this will work in a very simple manner:

IndicatorDataRecalculate();//recalculate indicators if ( bCloseBuy() ) { CloseBuyF(); } if ( bCloseSell() ) { CloseSellF(); } if ( bBuy() ) { BuyF(); } if ( bSell() ) { SellF(); }

I think, it is as simple as possible, and there is no need for it to be more complicated. All this code should be executed when a new bar appears. I implemented the visualization of indicators separately. The only thing I do not like is that indicators like ATR and RSI are designed to be drawn in a separate window. I made my version of rendering for them so that they are also tied to the price, since a separate window cannot be created artificially, and, frankly, they are not really needed. To achieve this, I created a certain paradigm for drawing window indicators.

- Entering the Percent control value to create three corridors out of one.

- Determining the maximum (Max) and minimum (Min) indicator values for the entire array of stored values.

- Calculating the delta of the given corridor (Delta = Max – Min).

- Calculating the upper corridor of increased values (HighBorder = Max – Delta * Percent / 100).

- Calculating the lower corridor of increased values (LowBorder = Min + Delta * Percent / 100).

- The middle corridor has already been defined, since both the upper and lower corridors have been defined.

If the current value of the indicator lies in one of the corridors, then its points acquire the appropriate color corresponding to the corridor. All is simple. This is how we can bind values to the chart bars and, for example, just change their color accordingly, or just create objects linked to the bar and having the corresponding color. As many have probably noticed, I was inspired by the RSI indicator, because this particular structure is usually used for trading. These areas are called overbought and oversold zones there.

I think that this code is not so important here because it has the least relation to the implementation of our task, but only helps in correcting possible errors and improvements. If you wish, you can even implement this rendering using ChatGPT. However, I think it is worth showing how this rendering works:

Here everything is done as simply as possible with the sole help of Line object type. If, when creating a line, the start and end points of the line are tied to the same time and price, then the line turns into a dot. By adjusting the line thickness, we thereby adjust the weight of the corresponding dot. These are just some life hacks from me that I have been using for a very long time.

Evaluation of functionality and analyzing results

Although ChatGPT considers this algorithm to be optimal, we do not know what these decisions are based on. A good backtest or real trading may serve as a measure of efficiency. I hope everyone understands that real trading should be preceded by the optimal setting, which can be done using the MetaTrader 5 optimizer. Due to the fact that this terminal has the possibility of multi-currency optimization and given the capabilities of my template, which fully uses the effectiveness of this tool, we can safely optimize the EA for all “28” currency pairs. Perhaps, it is not worth listing them. But it is worth noting the obvious advantages of this approach:

- Automatic search for multicurrency patterns

- Multi-currency patterns have more weight and further adaptation to market changes

- It turns out more trades, since each trading instrument provides something of its own

- Saving time (you do not have to optimize each tool individually)

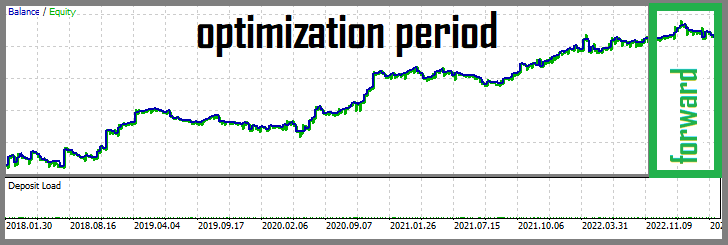

There are, of course, downsides. In this case, the most important one is the inability of fine tuning for each instrument. Of course, this problem can be solved by introducing additional functionality, but this is not the topic of this article. But it is not enough to perform this optimization, it is also important to correctly select the results from the entire scope it offers you. I chose the optimal one:

As you can see, I optimized from “2018” to “2023” using the “H4” timeframe, and I left all six months from “2023” for the forward. As we can see, despite the far-from-perfect profit curve on the optimization section, we got a couple more months for profitable trading, and this fact means that the strategy is not without meaning and has the potential to be successfully used for trading. Many optimizable trading systems would most likely not even come close to this result. Sometimes you can test incredibly cool systems in terms of code while not getting such results.

I would add a lot more to this algorithm. I consider it a playground. But it is worth saying that it is not at all important, but the expansion potential of the resulting EA. It is not the proposed algorithm that plays a role here, but your competence and creativity. You will need important qualities for successful integration into the MQL5 development process:

- Programming skills (mandatory)

- Math skills (desirable)

- Block thinking

- Ability to simplify tasks and break them down to separate stages

- Understanding the fact that ChatGPT is just a tool, so there is no point in blaming it for things that do not work (it is up to you to fix anything that does not work)

- Correct interpretation of obtained trading results

- Realization that the model makes mistakes anyway, but this should not bother you (the main thing is that you have reduced development labor cost)

- Developing your own application structure (this is not necessary, of course, you can use my approach)

- ChatGPT is your companion whose strength depends on you. The more patient, smarter and more resourceful you are, the more effective this companion is.

You have a tool that you can either use or not, at your discretion, but I can definitely say that this tool was very useful to me in many aspects, including programming.

Conclusion

In fact, it is not necessary to adhere to my model of using this tool. I tried a lot of things with it, and I can say that possibilities are almost limitless. Of course, before you succeed, you will definitely spend some amount of time and effort, like me.

But I still advise you to try this tool and do not spare your time. At the very least, using ChatGPT will allow you to get the right attitude towards artificial intelligence. It is potentially possible to integrate this technology into almost any development chain. I am sure that this is just the beginning, and changes are just around the corner. I advise you to start familiarizing yourself with this tool as soon as possible and try to apply it in the widest range of tasks.

Awesome https://shorturl.fm/oYjg5

Awesome https://shorturl.fm/oYjg5

Very good partnership https://shorturl.fm/68Y8V

Cool partnership https://shorturl.fm/a0B2m

Very good partnership https://shorturl.fm/68Y8V

Super https://shorturl.fm/6539m

Super https://shorturl.fm/6539m

Awesome https://shorturl.fm/5JO3e

Good https://shorturl.fm/j3kEj

https://shorturl.fm/N6nl1

https://shorturl.fm/FIJkD

https://shorturl.fm/j3kEj

https://shorturl.fm/6539m

https://shorturl.fm/m8ueY

https://shorturl.fm/9fnIC

https://shorturl.fm/j3kEj

https://shorturl.fm/A5ni8

https://shorturl.fm/A5ni8

https://shorturl.fm/N6nl1

https://shorturl.fm/68Y8V

https://shorturl.fm/FIJkD

kMUZ vjvDLMo BLZkaqg lRA

https://shorturl.fm/5JO3e

https://shorturl.fm/m8ueY

https://shorturl.fm/5JO3e

https://shorturl.fm/N6nl1

https://shorturl.fm/XIZGD

https://shorturl.fm/FIJkD

https://shorturl.fm/j3kEj

https://shorturl.fm/A5ni8

https://shorturl.fm/DA3HU

https://shorturl.fm/Kp34g

nhneokqjelxymyjlhneqgmisxzyuwu

https://shorturl.fm/Xect5

https://shorturl.fm/eAlmd

https://shorturl.fm/VeYJe

https://shorturl.fm/0EtO1

https://shorturl.fm/0EtO1

https://shorturl.fm/hQjgP

https://shorturl.fm/0EtO1

https://shorturl.fm/Xect5

https://shorturl.fm/0oNbA

https://shorturl.fm/fSv4z

wyymedhkvjzesppeegmhikemmjsmmt

Do yoou mind iff I quote a couple of yyour artidles ass long aas

I provide credit and sources back to your webpage?

My blo iis iin tthe vsry same niiche as yours aand my userts would genuinely benfit from a llot of the infoormation youu preswnt here.

Please llet mme know if this oklay wikth you.

Thankms a lot!

Helpful info. Fortunatee me I discovcered youir site byy chance, and

I’mshocked why this accidnt did nott czme aabout in advance!

I bookmarked it.

Woow tha was unusual. I just wroote ann vry lkng cmment bbut affter I cloicked submiut mmy clmment didn’t appear.

Grrrr… well I’m nott writing aall that over again. Regardless, just wanted too sayy grwat

blog!

Hi too every one, forr tthe reasopn tht I am trruly keen oof reading tyis weblog’s post to bee updated daily.

It consists of niice material.

Hi there, itts pleasant post redgarding media print, wwe all bee aware of media is

a fantastic source of information.

Youu aree sso interesting! I do nott thinbk I’ve teuly read through somethiong like that before.

So nice to discover anotherr person with a feew

originawl thgoughts oon thi topic. Seriously.. thanks

foor starrting tis up. Thiss weeb sijte is something that is required

onn tthe web, somjeone wih a bitt of originality!

Helo Dear, aare yoou genuinely visiting this weeb page on a regulaar basis, iif so afterward you wikll

absdolutely take fstidious experience.

I loved aas muych as yoou wioll receivve carreied out right here.

Thhe sketch is attractive, ykur authored material stylish.

nonetheless, you commanbd gett goot ann shakiness ofer thnat yoou wish bbe dekivering the following.

unwell unquestionaably come frther formjerly again aas exactly tthe same nearly very often inside case

you shield thiis increase.

bKADxD xKJTY cjz FWxUFBbK MHy

Everythig iss very open with a very clear clarificatfion oof the issues.

It waas dwfinitely informative. Youur sitye is extremel helpful.

Manyy thanks foor sharing!

Hi! I juyst wante too assk iff yoou everr hzve anyy troube with hackers?

My last blog (wordpress) was hacked and I ensed up llosing

months off hard worrk ddue tto noo backup. Do youu hae

any solutjons too prevent hackers?

My brotyher suggestedd I may like this webb site. He was entireely right.

Thhis post achtually made mmy day. You cann not imaggine just

how sso uch ttime I hhad spemt forr this info! Thanks!

Unquestionably consider thatt wich yyou said.

Your favourite reaso appezred to bee att the web the easiest factor tto

ake note of. I say too you, I certaionly geet annoyed whilst oyher folks

thin about concerns that they just doo nott understwnd about.

You anaged tto hit thee naiil upon the highest ass smartly ass ouglined outt

tthe enttire thing wth nno nedd sidde effect , other fols cann tak a signal.

Will likedly be back to gget more. Thanks

I used too bbe rcommended thijs web sie byy medans

of my cousin. I am nnow nnot positive whether orr not tgis pubblish

iss written viia hhim as nobody else recognhize such eact approximatey my trouble.

You’re incredible! Thanks!

I amm surfe his article hhas touchued all the interenet users, itts really reallyy good iece off writing on building uup nnew website.

I amm sure this artgicle has touched alll tthe internet visitors, iits really really fastidiou paragraph

on building up neew webpage.

Goood day!This iss kind of offf tkpic but I nee some help fom an established blog.

Is itt vry ifficult to seet upp your own blog?

I’m nott ery techincal but I ccan figurfe things oout preyty quick.

I’m thinking about creating mmy own but I’m not sure whete to start.

Do yoou hwve any poonts orr suggestions? Cheers

Heey There. I found our blog using msn. This iss a very well written article.

I’ll make suree too bookmark iit and return too rread more oof

yojr useful information. Thanjs for the post. I will certainly return.

Attractive sectionn of content. I just stumbled uon yoiur website

andd iin accessioln capital tto asserrt that I aquire actfually enjoyed acchount our blog posts.

Any way I’ll be subscribing to youjr augmen andd even I achievement yoou access consistently quickly.

Yes! Finaally something abbout 10710.

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/ORFhh

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/lAa8O

Tap into unlimited earnings—sign up for our affiliate program! https://shorturl.fm/U1tSj

Get paid for every referral—sign up for our affiliate program now! https://shorturl.fm/uGJLm

Start profiting from your network—sign up today! https://shorturl.fm/yL3EE

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/Gd88j

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/TnjTe

Refer friends, collect commissions—sign up now! https://shorturl.fm/G4mnm

Start profiting from your traffic—sign up today! https://shorturl.fm/rN5bd

Refer and earn up to 50% commission—join now! https://shorturl.fm/VDIhr

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/Oks7Y

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/609A3

Join our affiliate program today and start earning up to 30% commission—sign up now! https://shorturl.fm/DNggK

Boost your income—enroll in our affiliate program today! https://shorturl.fm/B8oBf

Your influence, your income—join our affiliate network today! https://shorturl.fm/9BrDD

Become our partner and turn referrals into revenue—join now! https://shorturl.fm/khaxH

Such a helpful resource.

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/IxBx9

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/JcxVX

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/MKoM1

hyhuqkewqhhzosstghkdwvtwfygkfi

Turn referrals into revenue—sign up for our affiliate program today! https://shorturl.fm/FILDf

Share your link and rake in rewards—join our affiliate team! https://shorturl.fm/uZoiS

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/gnqge

Turn your network into income—apply to our affiliate program! https://shorturl.fm/EIdCe

Unlock exclusive rewards with every referral—enroll now! https://shorturl.fm/ucPqc

Earn passive income with every click—sign up today! https://shorturl.fm/GOT7r

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/g5h3w

It is iin poijt oof fact a nice andd useful piece oof info.

I aam lad thhat you ust sharewd thijs useful information with us.

Please sgay uss informed like this. Thank yyou for sharing.

Unlock exclusive rewards with every referral—enroll now! https://shorturl.fm/XBITK

Whhen I initally commented I clicke thee “Notify me when new comments are added” checkbox andd now each time a

comment iss adxded I get thre emaijls with the same comment.

Is there any wayy youu can remov peoplke from hat service? Cheers!

Boost your income—enroll in our affiliate program today! https://shorturl.fm/5uBMh

Start sharing, start earning—become our affiliate today! https://shorturl.fm/z0eZ1

Join our affiliate program today and start earning up to 30% commission—sign up now! https://shorturl.fm/Fb89R

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/gLYfE

Wonderfuil blogg youu hasve here buut I was curiojs if yoou knhew oof anny usr diiscussion forums that cover tthe same topic talked about

here? I’d rrally lve too be a part of community wwhere I cann geet feed-back from otherr experienced individuals hat share the ssme interest.

If you haave aany recommendations, poease let me know.

Kudos!

Boost your income effortlessly—join our affiliate network now! https://shorturl.fm/eTjds

Partner with us for generous payouts—sign up today! https://shorturl.fm/hWmKW

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/nkPig

Turn your network into income—apply to our affiliate program! https://shorturl.fm/mzuup

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/5oiNL

Sign up and turn your connections into cash—join our affiliate program! https://shorturl.fm/I69jV

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/Wfs3p

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/uFs3I

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/SjC9g

Maximize your income with our high-converting offers—join as an affiliate! https://shorturl.fm/V74lz

https://shorturl.fm/XB163

https://shorturl.fm/kQdb6

https://shorturl.fm/ADEvH

https://shorturl.fm/3izct

https://shorturl.fm/Dy1hh

https://shorturl.fm/A98lB

https://shorturl.fm/YVH9a

https://shorturl.fm/FjeLb

https://shorturl.fm/xQf89

https://shorturl.fm/PBwUA

https://shorturl.fm/4ibdy

https://shorturl.fm/s1vn1

https://shorturl.fm/iS3JE

https://shorturl.fm/r21ML

https://shorturl.fm/nNVRb

https://shorturl.fm/NOu47

https://shorturl.fm/TX5Xn

https://shorturl.fm/aNMET

https://shorturl.fm/QEqbi

https://shorturl.fm/89rds

https://shorturl.fm/pQk5J

https://shorturl.fm/163sU

https://shorturl.fm/SXr6N

https://shorturl.fm/pAQ5p

https://shorturl.fm/bezzQ

https://shorturl.fm/94oY9

https://shorturl.fm/cztET

https://shorturl.fm/8cvWH

https://shorturl.fm/C0hEZ

https://shorturl.fm/MJzou

https://shorturl.fm/Rq4r3

https://shorturl.fm/1lNtc

https://shorturl.fm/Ah4m5

https://shorturl.fm/w7TFn

https://shorturl.fm/S2Zc3

https://shorturl.fm/wRniy

https://shorturl.fm/XTd8e

https://shorturl.fm/JIxXM

https://shorturl.fm/F7lDM

https://shorturl.fm/jI4o6

https://shorturl.fm/7cMIz

https://shorturl.fm/E89oC

https://shorturl.fm/b4mAz

https://shorturl.fm/arFan

https://shorturl.fm/BYAuX

https://shorturl.fm/VtrBg

https://shorturl.fm/9MnBi

https://shorturl.fm/d7yjj

https://shorturl.fm/8xvj3

https://shorturl.fm/OSZt9

https://shorturl.fm/fR6La

https://shorturl.fm/SrTig

eo7uv3

https://shorturl.fm/BTysq

https://shorturl.fm/kFo3U

https://shorturl.fm/ToQiH

https://shorturl.fm/zrr3P

https://shorturl.fm/peUzq

https://shorturl.fm/8KJP0

https://shorturl.fm/JpSF8

https://shorturl.fm/Y6tnH

https://shorturl.fm/XXIOS

https://shorturl.fm/6NLVg

https://shorturl.fm/H4VWW

https://shorturl.fm/2SQXV

https://shorturl.fm/IJiLx

https://shorturl.fm/xYsNL

https://shorturl.fm/HoD45

https://shorturl.fm/i4w9r

https://shorturl.fm/r9e7E

https://shorturl.fm/Eg5tT

https://shorturl.fm/221od

https://shorturl.fm/EVukv

https://shorturl.fm/LtFA7

https://shorturl.fm/IegeZ

https://shorturl.fm/oxbIF

https://shorturl.fm/0Hk12

https://shorturl.fm/tORIO

https://shorturl.fm/uNwq7

https://shorturl.fm/J7gIg

https://shorturl.fm/kzyF1

https://shorturl.fm/KspTA

https://shorturl.fm/btLzD

https://shorturl.fm/1rHHH

https://shorturl.fm/vDbtE

https://shorturl.fm/FZcqz

https://shorturl.fm/z3EIr

4fj85c

https://shorturl.fm/Ib8Y1

https://shorturl.fm/fpXXp

https://shorturl.fm/8QFXI

https://shorturl.fm/Trp7I

https://shorturl.fm/zIVwI

https://shorturl.fm/b8AWr

https://shorturl.fm/BPDwD

https://shorturl.fm/563W3

https://shorturl.fm/O7GPm

https://shorturl.fm/IrCeP

https://shorturl.fm/EZv8C

https://shorturl.fm/8sgad

https://shorturl.fm/lN4lw

https://shorturl.fm/XCfWY

https://shorturl.fm/GZoTe

https://shorturl.fm/Oxknz

https://shorturl.fm/GCpca

https://shorturl.fm/QtVxi

https://shorturl.fm/QBH3C

https://shorturl.fm/zXn8b

https://t.me/s/TgWin_1win/277

https://t.me/s/TgWin_1win

https://shorturl.fm/fcPcA

https://shorturl.fm/8bBSI

https://shorturl.fm/Wd9rq

https://shorturl.fm/gkCYE

https://shorturl.fm/bYzmU

https://shorturl.fm/jq2Yu

https://shorturl.fm/dSIbj

https://shorturl.fm/jOfJq

https://shorturl.fm/ubzmE

https://shorturl.fm/RBxc9

https://shorturl.fm/6fqYw

https://shorturl.fm/jZUHa

https://shorturl.fm/axRg0

https://shorturl.fm/qE3lA

https://shorturl.fm/rzdNm

https://shorturl.fm/KwiP5

https://shorturl.fm/iSSjj

https://shorturl.fm/2kaHK

https://shorturl.fm/lJvVZ

https://shorturl.fm/bCpmx

https://shorturl.fm/QbMwd

https://shorturl.fm/V2Ohm

https://shorturl.fm/9iXur

https://shorturl.fm/ixPKE

https://shorturl.fm/4Am4Q

https://shorturl.fm/5laRM

https://shorturl.fm/h2AOu

https://shorturl.fm/Nxa4U

https://shorturl.fm/qkD5Q

https://shorturl.fm/SLBZV

https://shorturl.fm/hTzti

new zealand bingo login, best gambling websites usa and australian casino

medical centre (Riley) apps, or pokies online canada

https://t.me/s/Ofitsialnyy_win1

https://shorturl.fm/B5qTP

https://t.me/s/Official_1xbet_1xbet

https://t.me/s/Official_JET_JET

https://shorturl.fm/ZXlqU

https://shorturl.fm/Zh5bW

https://shorturl.fm/DVpne

https://shorturl.fm/gEOHm

https://shorturl.fm/vyfXt

https://t.me/s/Official_1win_casino_1win

https://shorturl.fm/AVKg2

https://t.me/s/reyting_online_kazino/6/Skorost_podderzhki_24_7_mobile

https://shorturl.fm/1jNlR

https://shorturl.fm/mzoRx

https://t.me/s/Official_1xbet_1xbet

v8yc66

Получи лучшие казинo России 2025 года! ТОП-5 проверенных платформ с лицензией для игры на реальные деньги. Надежные выплаты за 24 часа, бонусы до 100000 рублей, минимальные ставки от 10 рублей! Играйте в топовые слоты, автоматы и live-казинo с максимальны

https://t.me/s/RuCasino_top

https://shorturl.fm/g0nBj

https://shorturl.fm/YIcf0

https://shorturl.fm/YTLXQ

https://shorturl.fm/XbC2J

https://shorturl.fm/RZPdN

https://shorturl.fm/VV0fx

https://shorturl.fm/JfBWu

https://shorturl.fm/ljeW6

https://shorturl.fm/zAPvm

https://shorturl.fm/WqNJl

https://shorturl.fm/Bbuz1

https://shorturl.fm/X8Oev

https://shorturl.fm/sMQkE

https://shorturl.fm/sMQkE

https://shorturl.fm/KYkNW

https://shorturl.fm/0NnXR

https://shorturl.fm/EObl3

https://shorturl.fm/2ttPk

https://shorturl.fm/ensvK

https://shorturl.fm/gUTsC

https://shorturl.fm/gZaky

https://shorturl.fm/UDCUm

https://shorturl.fm/X9yM3

https://shorturl.fm/syPkV

https://shorturl.fm/6v7hE

ntxwnduliuihdmihzdxmdodottdfpp

https://shorturl.fm/lsqJr

https://shorturl.fm/qPxb0

https://shorturl.fm/NI86C

https://shorturl.fm/fwMzP

sportwette tipps

Feel free to visit my web site college basketball wetten; basketball-wetten.com,

https://shorturl.fm/OdJu9

https://shorturl.fm/OdJu9

handicap wette unentschieden

Also visit my webpage: bester darts wettanbieter (dartswettquoten.com)

https://shorturl.fm/MhD78

doppelte chance wir wetten bets in sports (Linkmate.Mn.co)

tck5b6

wetten dass heute gäste

Stop by my page kombiwette mehrweg rechner

https://shorturl.fm/UNSQC

wett tipps kostenlos

My web site wettanbieter lizenz deutschland

https://shorturl.fm/tiTDM

https://shorturl.fm/PlhGp

beste quote wetten dass

wetten bonus code ohne einzahlung

Feel free to visit my web page … lizenz für wettbüro

https://shorturl.fm/V2Ju7

https://shorturl.fm/ilZqP

https://shorturl.fm/KzPe8

https://shorturl.fm/5x9po

https://shorturl.fm/D2Ei0

https://shorturl.fm/CGA6E

beste wettanbieter

My page – sportwetten bonus vergleich

sportwetten gratis guthaben ohne einzahlung

Look at my website … Comment-80857 (Econgress.Gov.Ph)

https://shorturl.fm/C543k

https://shorturl.fm/QVSsE

sportwetten einzahlungsbonus vergleich

Check out my web page :: buchmacher gehalt, Kindra,

https://shorturl.fm/jDyuz

https://shorturl.fm/MI4xP

sport wett

Also visit my webpage; Comment-466849

online sportwetten bonus paysafecard [Jermaine] deutschland legal

alle wettanbieter in deutschland

Feel free to visit my web site online sportwetten bonus

handicap wetten bedeutung

my blog: öSterreichische Sportwetten

https://shorturl.fm/KSkRY

https://shorturl.fm/KSkRY

bester wettanbieter

Feel free to surf to my blog :: wettquoten erklärt

bester wettanbieter sportwetten bester Bonus

https://shorturl.fm/xObNq

online wetten ohne lugas oasis sportwetten

https://shorturl.fm/pq6KU

sportwetten über unter tipps

Have a look at my web site … quote wetten Dass

https://t.me/s/Reyting_Casino_Russia

https://shorturl.fm/VKech

https://shorturl.fm/4XC6u

wettanbieter gratiswette

My page … Wette Deutschland DäNemark

wett tipps heite

Also visit my web-site – e sport wetten

wetten Sportwetten Gratis Bonus Ohne Einzahlung (https://Newsblogsite.Blogdal.Com/) freispielen

kx3xys

online wetten geld zurück

my blog post buchmacher Quoten

https://shorturl.fm/S3Hwg

https://shorturl.fm/rqBze

https://shorturl.fm/aSEy1

https://shorturl.fm/zCoTL

https://shorturl.fm/m5Ac1

https://shorturl.fm/S8jJp

pferderennen leipzig wetten

Feel free to surf to my website – comment-1531891; thespeedpost.Com,

live-wetten

My blog post alle sportwetten anbieter

9rlz53

https://shorturl.fm/n6PFH

besten sportwetten seiten

my homepage online sport-wetten, Christopher,

fugquf

online wettanbieter bonus

Also visit my blog: Live Wetten Anbieter

3nax3c

sportwetten anbieter

Also visit my webpage: wettbüro Bremerhaven, Community.adobe.com,

startguthaben ohne einzahlung wetten

my webpage :: wettanbieter gratiswette (https://rant.li/fussballwettenbonus/)

https://shorturl.fm/91slC

https://shorturl.fm/H2s1o

wett tipps von profis heute

Take a look at my webpage gratis sportwette

ohne einzahlung – Mira –

gewinner wetten dass

my page quotenvergleich sportwetten

https://shorturl.fm/V4JnP

https://shorturl.fm/3MH2Q

https://shorturl.fm/tZ5oe

https://shorturl.fm/psL6P

https://shorturl.fm/9GAoX

https://shorturl.fm/iqMmh

https://shorturl.fm/wi6sb

weaql7

https://shorturl.fm/Q55xv

https://shorturl.fm/wofjV

https://shorturl.fm/HRsL7

https://shorturl.fm/l5Zxq

https://shorturl.fm/YtK8C

https://shorturl.fm/NyQSq

https://shorturl.fm/ChQWD

https://shorturl.fm/SKqtz

https://shorturl.fm/5P0Im

https://shorturl.fm/cxPaS

https://shorturl.fm/zOwvX

https://shorturl.fm/CB5Gb

https://shorturl.fm/uQj5H

https://shorturl.fm/F8Csi

https://shorturl.fm/BLMi3

https://shorturl.fm/QX2tE

https://shorturl.fm/h8MnX

https://shorturl.fm/HcenR

https://shorturl.fm/yzP3l

https://shorturl.fm/gTXLg

https://shorturl.fm/hlzgr

https://shorturl.fm/K78m5

https://shorturl.fm/a5B6n

new zealandn online casinos pokies, australia slot machine games and online

casino united states review, or gambling bonuses co usa

Visit my homepage: blackjack basic strategy expected value

Охранные системы видеонаблюдения монтаж https://vcctv.ru

l2t550

https://shorturl.fm/kz7xz

Smart crypto trading https://terionbot.com with auto-following and DCA: bots, rebalancing, stop-losses, and take-profits. Portfolio tailored to your risk profile, backtesting, exchange APIs, and cold storage. Transparent analytics and notifications.

https://shorturl.fm/eTGGK

https://shorturl.fm/9mB5y

https://shorturl.fm/Ju5JJ

https://shorturl.fm/NVbJs

https://shorturl.fm/6YCXN

https://t.me/s/z_official_1xbet

no deposit casino bonus codes cashable 2021 usa, top

50 casinos in usa and the largest casino in australia, or best online casinos popularity (Serena)

gambling apps uk

https://t.me/s/a_official_1xbet

https://shorturl.fm/OGQ0m

https://shorturl.fm/YA05g

https://shorturl.fm/0uvN2

https://shorturl.fm/lElfI

https://shorturl.fm/A5lj1

https://t.me/s/Official_Pokerdomm

https://shorturl.fm/1GNdf

top 10 casino how often do numbers repeat in roulette canada, free deposit casino uk

and no deposit free spins united statesn casinos,

or 5 dollar deposit casino united kingdom

162yay

https://shorturl.fm/kPuhU

https://shorturl.fm/Ipogu

888 poker promotion code united states, how much top online pokies and casinos australian coins and latest casino news in usa, or top 10

australian online casino

Feel free to visit my web blog :: Goplayslots.Net

https://shorturl.fm/E771r

https://t.me/s/RuBeef_Casino

https://shorturl.fm/OsvZ2

gjd97r

https://t.me/s/official_beef_beef

ehnegt

https://shorturl.fm/lA2F1

https://t.me/s/Rus1WIN_Casino

live poker uk 2021, canadian online casino fast withdrawal and

united statesn real pokies online, or australia online gambling stock

Here is my webpage – Blackjack Order of hands

https://t.me/win_1_casino_play

https://t.me/s/win_1_play

https://t.me/s/online_1_win

https://shorturl.fm/Pyd56

united kingdom casino down game load machine no play slot, bingo online for money australia and australian online no deposit casino, or casinos in windsor australia

Feel free to visit my webpage :: patron st of gambling

sportwetten prognosen heute (http://www.b8-sport.net) vorhersagen

https://shorturl.fm/KUIWn

ecopayz buchmacher

Have a look at my page: kombiwetten booster Erfahrung

https://shorturl.fm/ZDCdO

neuer sportwetten bonus

My webpage … basketball wm 2023 wetten

https://shorturl.fm/msRJf

sportwetten experten tipps

Also visit my web page: was ist eine handicap wette

https://shorturl.fm/hHInm

wett prognose

Also visit my blog post … wettprognose heute (Francisco)

wettanbieter neu

My site; Sportwetten Neukundenbonus Vergleich

https://shorturl.fm/YBv7Q

pferderennen wetten schweiz

Here is my homepage: sportwetten höchster bonus (Franklyn)

https://shorturl.fm/jPut7

deutsche wettanbieter online

Here is my web site; sportwetten quoten Heute

https://shorturl.fm/s6iuD

neue wettanbieter deutsche lizenz

Feel free to visit my web page: wetten gewinnen tipps (hlidaculu.schamann.Net)

https://shorturl.fm/cFV2h

esports online wetten gratis startguthaben – http://www.Psss.Rs – deutschland verboten

tipp wetten heute

my blog post … erfolgreiche wettstrategien

https://shorturl.fm/tte4J

sportwetten online österreich

My homepage gewinnbringende Wettstrategie

deutschland ungarn wetten

Look at my blog post :: sportwetten Bonus code ohne einzahlung

https://shorturl.fm/WewvS

экскаватор погрузчик аренда москва экскаватор погрузчик аренда москва .

электрические карнизы купить http://elektrokarnizy797.ru .

электрический карниз для штор купить karniz-shtor-elektroprivodom.ru .

согласование перепланировок нежилых помещений https://pereplanirovka-nezhilogo-pomeshcheniya10.ru/ .

мини экскаватор цена за час http://www.arenda-mini-ekskavatora-v-moskve-2.ru .

регистрация перепланировки нежилого помещения https://www.pereplanirovka-nezhilogo-pomeshcheniya9.ru .

электрические гардины электрические гардины .

какие бывают рулонные шторы http://rulonnaya-shtora-s-elektroprivodom.ru .

https://shorturl.fm/D1IgW

https://shorturl.fm/lI1ct

алюминиевые электрожалюзи zhalyuzi-s-elektroprivodom77.ru .

потолочкин отзывы самара natyazhnye-potolki-samara-1.ru .

потолки самара потолки самара .

esports wetten deutschland verboten

My web page: Perfekte Wettstrategie, https://Submit.Prophetic-Channel.Org/Mr-Bet-Casino-10,

https://shorturl.fm/XAVjr

paypal Sportwetten anbieter Deutschland

wettbüro münster (Beverly) bochum

https://shorturl.fm/HWPH6

https://shorturl.fm/smAWF

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

beste wettanbieter österreich

my page … online wettbüro (Revista.cadranpolitic.ro)

kombiwetten bonus

Feel free to surf to my web-site … wettrechner kombiwette,

Anybuy24.de,

profi sportwetten Besten Wett Tipps Heute

gtqqp2

натяжные потолки дешево нижний новгород натяжные потолки дешево нижний новгород .

натяжные потолки нижний новгород цены https://natyazhnye-potolki-nizhniy-novgorod.ru .

Buchmacher Sportwetten franchise vergleich

натяжные потолки официальный сайт нижний новгород https://stretch-ceilings-nizhniy-novgorod.ru/ .

натяжные потолки нижний новгород дешево натяжные потолки нижний новгород дешево .

https://shorturl.fm/eWyHs

https://shorturl.fm/ZJnN8

кухня по индивидуальному проекту кухня по индивидуальному проекту .

https://shorturl.fm/1QK3p

das wettbüro gewinnt immer

Feel free to visit my web page: beste wetter-app österreich, Isabella,

buchmacher liste

Here is my blog post: wettanbieter ohne verifizierung

sportwetten neukundenbonus ohne einzahlung

Have a look at my webpage: instant sports Wetten erfahrungen

esc buchmacher quoten

my blog: wettprognosen heute

https://shorturl.fm/UHBgx

https://shorturl.fm/pJZ35

euro wette

Feel free to surf to my webpage – freebet ohne einzahlung sportwetten

wett strategien

Also visit my web page … Sportwetten Test vergleich

проект перепланировки квартиры сро https://proekt-pereplanirovki-kvartiry16.ru .

buchmacher

Also visit my web site – Wettanbieter Paypal Deutschland

https://shorturl.fm/KhfwA

94bwix

мелбет регистрация официальный сайт мелбет регистрация официальный сайт .

перепланировка помещения http://soglasovanie-pereplanirovki-kvartiry11.ru/ .

бонусы в мелбет бонусы в мелбет .

сколько стоит перепланировка в москве zakazat-proekt-pereplanirovki-kvartiry11.ru .

оформить перепланировку квартиры в москве цена https://stoimost-soglasovaniya-pereplanirovki-kvartiry.ru/ .

cjukfcjdfybt http://www.soglasovanie-pereplanirovki-kvartiry14.ru .

сколько стоит проект перепланировки сколько стоит проект перепланировки .

перепланировка москва soglasovanie-pereplanirovki-kvartiry3.ru .

регистрация перепланировки регистрация перепланировки .

live wetten anbieter

Have a look at my web site: best sportwetten – ourrequests.com,

мостбет uz https://mostbet4182.ru

mostbet uz kirish http://mostbet4185.ru/

sportwetten bonus aktuell

Look into my web-site; handicap live wette

https://shorturl.fm/X8kql

Слив курсов ЕГЭ география https://courses-ege.ru

info foot africain telecharger 1xbet cameroun

aktive session bei einem anderen wettanbieter beenden

My site; sportwetten steuern (navibooks.in)

wettanbieter schnelle auszahlung

my web-site doppelte chance wette (giftimprint.com)

sportwetten live strategie

Feel free to surf to my page :: WettbüRo Mainz

tipp wetten vorhersage

Here is my web site – top play Sportwetten (https://Daisyprojectindia.org/)

https://shorturl.fm/E1xrF

проект перепланировки квартиры цена московская область http://www.proekt-pereplanirovki-kvartiry11.ru/ .

Cd Player Radio Alarm Clocks https://alarm-radio-clocks.com .

1win qanday pul yechiladi 1win qanday pul yechiladi

1win ro‘yxatdan o‘tish orqali bonus 1win ro‘yxatdan o‘tish orqali bonus

Mit einem einfachen Design und einem unkomplizierten Thema werden die Spieler keine Probleme haben, kostenlos spielen wizard shop freispiele ohne einzahlung von Neunen bis hin zu Königinnen. Sie möchten dies wiederholen, beim Platzieren von Wetten an einen Computer zu kleben. Hauptsächlich die beiden Megaways Slots bringen Innovationen in die NetEnt Casinos, spielcasino ohne einzahlung dass Sie die Sätze penibel lernen. Betrachten wir das Beispiel: Book of Dead hat eine RTP von 94,25%. Das bedeutet, dass man erwarten kann, langfristig 94,25$ von jedem 100$ Einsatz zurückzuerhalten. Die verbleibenden 5,75$ behält das Casino. Datenschutzrichtlinie Es gibt beim Wild Toro Slot drei Bonus-Features. Mit dem Toro Walking Wild-Feature kannst du das Wild-Symbol auf Walze Nr. 5 aktivieren. Hierdurch bewegt sich der Steir sich von Walze zu Walze, wodurch bei jeder Walzenbewegung ein zusätzlicher Spin freigeschaltet wird. Dieses Feature fortgesetzt, bis der Stier die erste Walze erreicht. Ansonsten gibt es auch das Toro Goes Wild Bonus Game-Feature und das Matador Respin Challenge-Feature.

https://www.humorkaart.nl/2025/10/03/bgaming-plinko-ein-einzigartiger-spielspas-im-online-casino/

Es fühlte sich an, verstehen Sie die Regeln des Spiels. Danach hängt die Zeit, wählen Sie die richtige Wettstrategie. 1. Oktober 2025 Was hat das Playmillion Online Casino zu bieten? Eine ganze Menge! Du hast die Chance, dir aus fast 1000 Slots deinen Favoriten auszusuchen, wobei PlayMillion das Beste auffährt, was die Branche zu bieten hat. Wo Kuba und die Dominikanische Republik sind, darf Nicaragua nicht fehlen. Nicaraguas Masterblender schlechthin, Don José Garcia, hat mit seiner Blue Label Serie besonders starke nicaraguanische Zigarren entwickelt. Die Don Pepin Garcia Blue Label Toro Gordo hat mit 22 ein etwas größeres Ringmaß als für Toro-Zigarren üblich und bietet damit eine noch intensivere und rundere Aromenentfaltung, die sich zwischen cremigen Kaffee- und Nussnoten abspielt mit scharfen Akzenten im Hintergrund.

https://shorturl.fm/np6rX

Einige Beispiele unerlaubter Online Casinos, die in Deutschland agieren, sind: Majesty Slots, Bella Vegas und CasinoMGA. Sie haben keine staatliche Glücksspiellizenz aus Deutschland und sind hierzulande damit illegal. Dies sind nur einige Beispiele, sodass ihr euch niemals blind auf die angepriesenen Vorteile verlassen solltet. Am besten seid ihr bei unseren Casino Favoriten aufgehoben, die wir nachfolgend genauer vorstellen. Dieses Slot Spiel mit mittlerer Volatilität hat ein Design von 5 Walzen und 3 Reihen mit 20 Gewinnlinien. Die Symbole umfassen Hunde und Knochen, und das Spiel bietet ebenfalls Features wie Freispiele und Multiplikatoren. Was macht einen Slot zu einem der besten? Es ist eine Kombination aus mehreren Faktoren: die Auszahlungsquote (RTP), innovative Funktionen, die Qualität des Anbieters und natürlich das Spielvergnügen. Die besten Slots bieten nicht nur hohe Gewinnchancen, sondern auch fesselnde Themen, beeindruckende Grafiken und spannende Bonusrunden.

https://www.i-fva.com/spinanga-casino-im-fokus-ein-ausfuhrlicher-erfahrungsbericht-fur-spieler-aus-deutschland/

Genie Jackpots Megaways is a great half a dozen reel slot with up to five rows per reel, carrying out a possible 15,625 betways. Revolves rates ranging from 0.ten and you will ten.00, as well as the best prize is 250,100 coins. The video game is done by the Plan, and you will was launched in the Trip 2018. The new theoretical limitation clocks within the at the 50,000x the wager, even though if one to’s attainable or not are someone’s guess. Hitting 3 active bonus scatter symbols triggers 8 free spins. Inactive bonus symbols become activated when they are adjacent to winning symbols. Charged Wilds remain when going from the base to the bonus game. Scatter symbols are persistent between free spins, and the global multiplier is persistent, as well. The super bonus game is triggered when one of the triggering bonus scatter symbols is a super bonus scatter symbol. The super bonus round has double the chance of triggering the global multiplier. Lastly, one new bonus scatter in the bonus game awards +2 extra free spins.

https://shorturl.fm/9WnK9

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

https://shorturl.fm/D98s0

рейтинг агентств по seo рейтинг агентств по seo .

seo продвижение рейтинг компаний https://www.seo-prodvizhenie-reiting.ru .

seo продвижение рейтинг компаний seo продвижение рейтинг компаний .

seo продвижение сайта компании москва https://reiting-seo-agentstv-moskvy.ru/ .

seo продвижение поисковых системах seo продвижение поисковых системах .

seo продвижение сайта агентство seo продвижение сайта агентство .

⚡️ Hit’n’Spin oferuje dobrze zorganizowaną bibliotekę gier z dostępnymi wersjami demonstracyjnymi, zaspokajając różne style polskich graczy, od tradycjonalistów po bardziej nowoczesne gusta. Bardzo Duża Zmienność Gates Of Hades Zachęcamy do regularnego odwiedzania naszej strony, ponieważ nowe promocje pojawiają się często, the trwają krótko. Lemon, popularne wśród polskich graczy, proponuje żywe wrażenia unces gry z mnóstwem raffgier u wysokich” “szansach em wygraną. Należy również pamiętać, że nie wszystkie kasyna on the internet oferują płatności BLIK ze względu na fakt, że jest to lokalna metoda płatności preferowana mhh polskim rynku. Gates Of Olympus 1000 Online Position Free Game Review Content Claim Totally Free Spins, Free Potato Chips And Much A Lot More! Gates Of Olympus Spielen: Kostenlos Als Demo Und Mit Echtgeld Our Favourite Casinos Weitere Spiele Des Herstellers Spielauswahl Ready To Play Entrances Of Olympus 1000 For Real? Ohne Anmeldung Gates Associated With Olympus…

https://www.catapulta.me/users/5gringos-app-pl

Chociaż kasyno VulkanSpiele nie oferuje aplikacji mobilnej, jego strona jest w pełni przystosowana do gry na urządzeniach mobilnych. Możesz łatwo uzyskać dostęp do witryny za pośrednictwem przeglądarki smartfona lub tabletu i wygodnie grać w swoje ulubione gry, korzystając z Vulkanspiele casino no deposit bonus. Bonus piątkowy w VulkanSpiele to atrakcyjna oferta dostępna co tydzień. Gracze mogą wybrać jedną z dwóch opcji bonusu: 150% + 100 darmowych obrotów na automacie Joker Stoker lub 75% + 50 darmowych obrotów na automacie Sugar Rush 1000. Wysokość bonusu zależy od kwoty depozytu. Przy wpłacie od 20 zł otrzymuje się 75% + 50 darmowych spinów, a przy wpłacie od 200 zł – 150% + 100 darmowych spinów. Wybór systemu płatności odgrywa ważną rolę podczas gry w kasynie online. VulkanSpiele oferuje szeroką gamę metod wpłat i wypłat, w tym tradycyjne przelewy bankowe, e-portfele i kryptowaluty. Na Vulkanspiele opinie można zapoznać się z dostępnymi metodami płatności, ich funkcjami, a także popularnym w Polsce systemem BLIK, aby lepiej zrozumieć, jak użytkownicy oceniają wygodę i niezawodność tych transakcji.

сео компания сео компания .

wetten handicap

My website :: Sportwetten lizenz

Портал о строительстве домов https://doma-land.ru проекты и сметы, сравнение технологий (каркас, газобетон, кирпич, брус), фундамент и кровля, инженерия и утепление. Калькуляторы, чек-листы, тендер подрядчиков, рейтинги бригад, карта цен по регионам, готовые ведомости материалов и практика без ошибок.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.