Today I will launch a quantification team’s official Oil_Hedging two-oil hedging EA. In fact, this hedging strategy is based on the West Texas light crude oil futures in the United States and the North Sea Brent crude oil futures in the United Kingdom. The editor was as early as March. There is a post on the blog, which introduces the regression process and principle in detail from a mathematical point of view.

Today we will formally introduce the principle of this ea from the perspective of financial engineering and how it differs from crude oil hedging on the market.

In financial engineering, it is often not easy to hedge futures contracts, partly for the following reasons:

- The asset that needs to hedge price risk may not be exactly the same as the underlying asset of the futures contract;

- The hedger cannot determine the exact time to buy or sell the asset;

- The hedger may need to liquidate the contract before the futures expires.

The above problems have caused the so-called basis risk. Here we first introduce the concept of “basis”.

Contents of this article

Basis

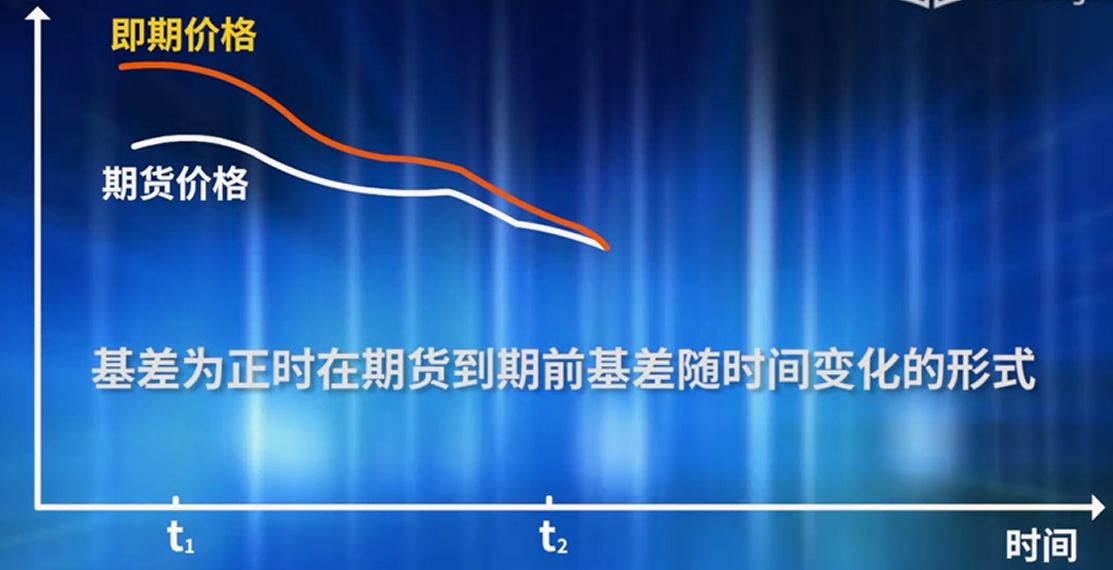

The usual definition: basis = spot price of the hedged asset-futures price

If the hedged asset is the same as the underlying asset of the futures contract, the basis should be close to zero when the futures expires, and the basis may be positive or negative before the expiry date of the futures contract.

Next, a concept of “cross-hedging” is introduced.

Cross hedge

The assets that the hedger intends to hedge are inconsistent with the underlying assets of the futures contract. In this case, hedging is called cross hedging. In the case of cross-hedging, the basis risk is generally greater. For example, there is an example in financial engineering: For example, an airline needs to hedge against the risks caused by large fluctuations in the price of jet fuel, but there is no futures contract for jet fuel as the basic asset in the market, so it can use civil fuel oil futures contracts. Hedging the price risk of aviation fuel oil. Then another concept is introduced: the “hedging ratio” in cross-hedging.

Hedge ratio

The definition of hedging ratio: the ratio of the number of positions held in the futures contract to the number of risk exposures of the hedged asset. When the two underlying assets that need to be hedged are exactly the same, the hedge ratio is equal to 1. However, in cross-hedging, the hedging ratio used by the hedger should minimize the variance in the value of the entire hedged asset portfolio. The optimal hedge ratio depends on the relationship between the changes in the prices of the two underlying assets to be hedged. Construct a linear regression model.

Δ S = α + h * Δ F + ε

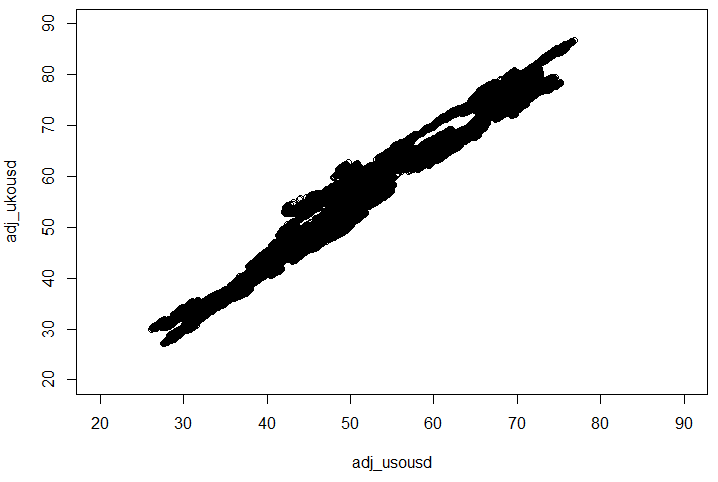

Where α is the intercept term, ε is the residual term, and h* is the slope of the best fitting straight line generated when Δ S is linearly regressed to Δ F, which represents the optimal hedge ratio. Since Δ S and Δ F in the formula are the changes relative to the initial time, the linear regression of the practical absolute price is equivalent to combining the intercepts of the two into α, and the final result is the same. Interested Friends can deduce it by themselves. So I get the following picture in the post

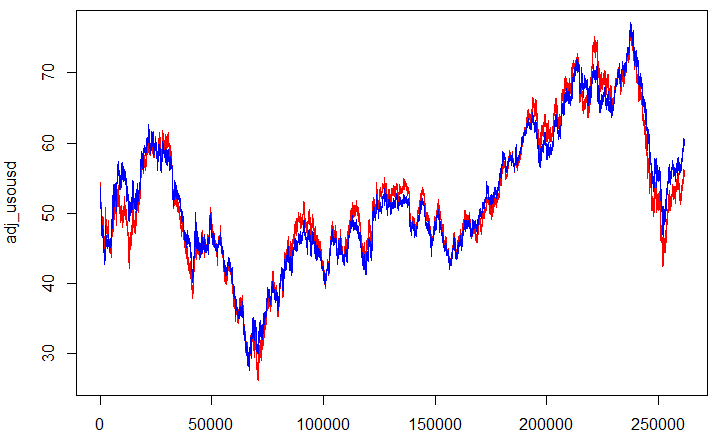

Then we will establish the linear regression model, display it in the price-time coordinate system, and superimpose the real price trend of WTI crude oil to get the following comparison chart.

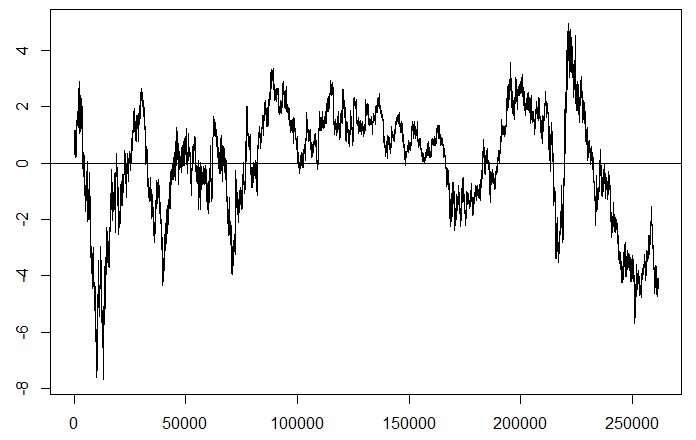

In the figure on the right, it can be seen that the fitting effect of this regression model is still relatively good, then the blue line (the predicted value of U.S. crude oil returned by Brent crude oil) and the red line (the real price of U.S. crude oil) The difference is our profit margin. We make the difference between the two and get the trend chart of the residual term as follows.

Is the arbitrage between the two oil prices on the market reliable?

So what is the difference between the two crude oil futures that we are most exposed to? In fact, they are two futures whose underlying assets are not exactly the same.

Brent crude oil contains four light, sweet crude oils produced in the North Sea Oilfield: Brent, Forties, Ekofisk and Oseberg. Brent crude oil is mined offshore, which is difficult and costly, and is mainly traded in the London commodity futures market.

U.S. WTI crude oil is mainly light crude oil from the Middle East, with low mining difficulty, low cost and good quality. Its delivery point is located in the Cushing area of Oklahoma, USA, and is traded on the New York Mercantile Exchange (NYMEX). US crude oil is a benchmark oil based on futures pricing in the US market, while Brent crude oil is a benchmark oil based on the spot market in the European market.

Therefore, some EAs on the market that claim to be arbitrage between the two oil prices are actually two types of futures with different basic assets from the perspective of financial engineering. If you ignore the hedging ratio, just do the two. The process of converging the oil price difference is actually an incorrect and rigorous approach. We can also see from the price difference chart of the two oils. The price difference between the two oils was pulled to 26.7 US dollars in 2011, and returned to about -1 US dollars in 2016. Such a range and frequency of return are obviously the so-called spread arbitrage on the market. It is unreasonable and not rigorous.

Strategy operation

One. Environmental choice and funding scale

The specific starting capital mainly depends on the broker’s corresponding target contract size, overnight interest and delivery status. Only two platforms, axitrader and gkfx, are recommended here as the recommended operating environment for this strategy. As a neutral technical service provider, other brokers cannot list them one by one. If you are interested, you can also consult customer service in detail.

two. Risk control rules

Risk: The recommended risk control line is 30%.

three. Expected profit

Expected return: 30% nominal retracement rate, actual net worth retracement rate 14.06%, two and a half years compound return of 133.69%, click here to view the detailed backtest report.

four. Disclaimer

As a neutral technical service provider, we only provide technical services. Achievements can only represent the past. Any trading strategy may have certain risks. It is recommended that you carefully consider your risk tolerance.

Этот интересный отчет представляет собой сборник полезных фактов, касающихся актуальных тем. Мы проанализируем данные, чтобы вы могли сделать обоснованные выводы. Читайте, чтобы узнать больше о последних трендах и значимых событиях!

Подробнее можно узнать тут – https://vyvod-iz-zapoya-1.ru/

Пациенты, нуждающиеся в круглосуточном наблюдении, могут пройти курс терапии в стационаре. Обстановка клиники рассчитана на комфортное пребывание: палаты с индивидуальным санитарным блоком, охрана, контроль приёма препаратов, поддержка психологов.

Подробнее тут – http://narkologicheskaya-pomoshh-tula10.ru/neotlozhnaya-narkologicheskaya-pomoshh-tula/

Для оценки уровня учреждения важно понимать, какие конкретно методики в нём используются. Ниже приведён обобщённый обзор подходов в современных наркологических клиниках региона:

Выяснить больше – [url=https://lechenie-narkomanii-vladimir10.ru/]анонимное лечение наркомании[/url]

Наркологическая помощь на дому становится всё более востребованной благодаря своей доступности, конфиденциальности и эффективности. Клиника «МедТрезвость» предлагает пациентам целый ряд важных преимуществ:

Исследовать вопрос подробнее – http://narcolog-na-dom-sankt-peterburg0.ru

В условиях современного ритма жизни алкоголизм нередко оборачивается тяжёлыми последствиями — от кратковременных запоев до хронической зависимости с серьёзными осложнениями. Наркологическая клиника «ТюменьМед» предлагает круглосуточную поддержку и выезд специалистов на дом в любое время суток, обеспечивая быстрое и безопасное восстановление здоровья. Использование инновационных методик, мобильных лабораторий и дистанционного контроля позволяет пациентам пройти детоксикацию и начать новый этап жизни в комфортных для них условиях.

Углубиться в тему – http://narkologicheskaya-klinika-tyumen10.ru

Сразу после поступления вызова специалист прибывает на дом для проведения первичного осмотра. На данном этапе нарколог:

Изучить вопрос глубже – [url=https://narcolog-na-dom-ryazan00.ru/]narcolog-na-dom-ryazan00.ru/[/url]

В рамках услуги вызова нарколога на дом используется современное оборудование и препараты, одобренные для амбулаторного применения.

Углубиться в тему – http://narkolog-na-dom-kamensk-uralskij11.ru/

Специалист уточняет, сколько времени продолжается запой, какой тип алкоголя употребляется, а также наличие сопутствующих заболеваний. Тщательный анализ этих данных помогает определить оптимальные методы детоксикации и скорректировать терапевтическую стратегию для минимизации риска осложнений.

Изучить вопрос глубже – https://narcolog-na-dom-ryazan0.ru

Современная наркологическая клиника в Каменске-Уральском предоставляет комплексные услуги по диагностике и лечению различных видов зависимостей. Заболевания, связанные с алкоголизмом и наркоманией, требуют индивидуального подхода и применения современных медицинских технологий. В условиях клиники обеспечивается полный медицинский контроль и психологическая поддержка, что способствует успешной реабилитации пациентов.

Подробнее можно узнать тут – chastnaya narkologicheskaya klinika kamensk-ural’skij

Назначение

Выяснить больше – капельница от запоя цена

После процедуры пациент и его близкие получают развернутые рекомендации по дальнейшему восстановлению, советы по профилактике рецидивов и возможности прохождения кодирования при желании пациента.

Получить больше информации – http://

Алкогольная зависимость — сложное хроническое заболевание, требующее комплексного подхода и квалифицированной помощи. В клинике «Тюменьбезалко» в центре Тюмени разработаны эффективные программы реабилитации, сочетающие современные медицинские методы, психологическую поддержку и социальную адаптацию. Опытные врачи-наркологи и психотерапевты помогают пациентам преодолеть употребление алкоголя, восстановить физическое и эмоциональное здоровье и вернуться к полноценной жизни.

Узнать больше – лечение алкоголизма на дому

Вывод из запоя в Мурманске представляет собой комплекс мероприятий, направленных на оказание медицинской помощи пациентам, находящимся в состоянии алкогольного отравления или длительного употребления спиртного. Процедура проводится с целью стабилизации состояния организма, предупреждения осложнений и минимизации риска развития тяжелых последствий алкоголизма.

Подробнее – http://vyvod-iz-zapoya-v-murmanske12.ru

Критерий

Узнать больше – нарколог на дом вывод из запоя

Применение современных капельничных методов позволяет точно дозировать лекарственные средства. Постоянный мониторинг жизненно важных показателей пациента дает возможность оперативно корректировать терапию для достижения оптимального эффекта и предотвращения побочных реакций.

Разобраться лучше – вывод из запоя волгоград.

Показатель

Детальнее – http://narkologicheskaya-klinika-tula10.ru

Проблемы, связанные с употреблением алкоголя или наркотических веществ, могут застать человека врасплох и требовать немедленного медицинского вмешательства. В Туле предоставляется наркологическая помощь, направленная на купирование острых состояний и оказание поддержки пациентам в кризисной ситуации. В клинике «Здоровье+» используются современные методы лечения, основанные на отечественных клинических рекомендациях, с акцентом на безопасность и индивидуальный подход.

Подробнее – https://narkologicheskaya-pomoshh-tula10.ru/neotlozhnaya-narkologicheskaya-pomoshh-tula/

Как поясняет медицинский психолог Елена Мусатова, «пациенту важно доверять специалисту, понимать его подход и чувствовать профессиональную уверенность ещё на этапе первичного осмотра».

Подробнее можно узнать тут – http://

Первое, на что стоит обратить внимание — это профессиональный уровень сотрудников. Без квалифицированных наркологов, клинических психологов и психиатров реабилитационный процесс становится формальным и неэффективным.

Подробнее – http://www.domen.ru

Вызов врача-нарколога на дом в Санкт-Петербурге начинается с детального осмотра и оценки состояния пациента. Врач измеряет давление, пульс, уровень кислорода в крови и определяет степень интоксикации.

Углубиться в тему – вызвать нарколога на дом в санкт-петербурге

Как подчёркивает главный врач клинического отделения, «в условиях стационара мы можем оперативно реагировать на малейшие изменения в состоянии пациента, что критически важно при тяжёлых формах запоя».

Выяснить больше – вывод из запоя в рязани

Метод лечения

Углубиться в тему – лечение наркомании и алкоголизма владимирская область

Согласно данным Федерального наркологического центра, своевременный выезд врача снижает риск осложнений и повторных госпитализаций.

Получить дополнительные сведения – врач нарколог на дом свердловская область

Стандартная процедура включает внутривенное введение растворов, которые эффективно выводят токсины, восстанавливают электролитный баланс и устраняют обезвоживание. Дополнительно врач назначает медикаменты для защиты сердца, печени и нервной системы, а также, при необходимости, седативные препараты для стабилизации психического состояния.

Ознакомиться с деталями – капельница от запоя цена в москве

Наркологическая помощь на дому становится всё более востребованной благодаря своей доступности, конфиденциальности и эффективности. Клиника «МедТрезвость» предлагает пациентам целый ряд важных преимуществ:

Подробнее можно узнать тут – https://narcolog-na-dom-sankt-peterburg0.ru/vyzov-narkologa-na-dom-spb

Сразу после поступления вызова специалист прибывает на дом для проведения первичного осмотра. На данном этапе нарколог:

Выяснить больше – вызвать нарколога на дом в рязани

Наркологическая помощь «ТюменьМед» не ограничивается только физической детоксикацией. В состав команды входят психологи и социальные работники, которые проводят мотивационные беседы, обучают навыкам самоконтроля и оказывают помощь в планировании досуга и социальных активностей после детоксикации.

Выяснить больше – narkologicheskaya klinika tjumen’

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Москве приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Подробнее тут – после капельницы от запоя в Москве

Борьба с наркотической зависимостью требует системного подхода и участия опытных специалистов. Важно понимать, что лечение наркомании — это не только снятие ломки, но и длительная психотерапия, обучение новым моделям поведения, работа с семьёй. Согласно рекомендациям Минздрава РФ, наиболее стабильные результаты достигаются при прохождении курса реабилитации под наблюдением профессиональной команды в специализированном центре.

Ознакомиться с деталями – http://lechenie-narkomanii-vladimir10.ru/lechenie-narkomanii-anonimno-vladimir/

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Москве приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Узнать больше – после капельницы от запоя

После поступления вызова врач наркологической клиники «МедАльянс» прибывает на дом в течение 30–60 минут. Сначала специалист оценивает общее состояние пациента, измеряет давление, уровень кислорода в крови и уточняет детали анамнеза.

Детальнее – капельница от запоя москва.

Критерий

Ознакомиться с деталями – нарколог на дом недорого в нижнем тагиле

В Москве решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Изучить вопрос глубже – капельница от запоя на дому цена

Как подчёркивает руководитель направления клинической токсикологии НМИЦ психиатрии и наркологии, «оказание помощи на дому требует не меньшего профессионализма, чем лечение в стационаре, ведь врач действует в ограниченных условиях».

Узнать больше – запой нарколог на дом в нижнем тагиле

В рамках услуги вызова нарколога на дом используется современное оборудование и препараты, одобренные для амбулаторного применения.

Подробнее можно узнать тут – нарколог на дом вывод из запоя

Затяжной запой опасен для жизни. Врачи наркологической клиники в Москве проводят срочный вывод из запоя — на дому или в стационаре. Анонимно, безопасно, круглосуточно.

Углубиться в тему – капельница от запоя цена

Вывод из запоя в Рязани — это комплексная медицинская услуга, направленная на устранение интоксикации, стабилизацию состояния пациента и предотвращение рецидива алкогольной зависимости. Методики подбираются индивидуально с учётом анамнеза, длительности запойного состояния, наличия сопутствующих заболеваний и психоэмоционального фона. Процедура осуществляется под контролем опытных врачей-наркологов с применением сертифицированных препаратов и оборудования.

Узнать больше – http://vyvod-iz-zapoya-v-ryazani12.ru/

Основная цель — быстрое и безопасное выведение этанола и его токсических метаболитов из организма, восстановление водно-электролитного и кислотно-щелочного баланса, нормализация артериального давления, работы сердца, почек и головного мозга. Для этого применяется инфузионная терапия, фармакологическая коррекция, витаминотерапия и, при необходимости, седативная поддержка.

Получить дополнительную информацию – https://vyvod-iz-zapoya-v-ryazani12.ru/vyvod-iz-zapoya-na-domu-v-ryazani

Согласно данным Федерального наркологического центра, своевременный выезд врача снижает риск осложнений и повторных госпитализаций.

Углубиться в тему – нарколог на дом вывод каменск-уральский

Первое, что необходимо уточнить перед вызовом — наличие у врача лицензии и профильного медицинского образования. Только сертифицированный нарколог может назначить препараты, поставить капельницу и провести детоксикацию без ущерба для здоровья пациента.

Ознакомиться с деталями – нарколог на дом вывод нижний тагил

Борьба с наркотической зависимостью требует системного подхода и участия опытных специалистов. Важно понимать, что лечение наркомании — это не только снятие ломки, но и длительная психотерапия, обучение новым моделям поведения, работа с семьёй. Согласно рекомендациям Минздрава РФ, наиболее стабильные результаты достигаются при прохождении курса реабилитации под наблюдением профессиональной команды в специализированном центре.

Узнать больше – центр лечения наркомании владимирская область

Стандартная процедура включает внутривенное введение растворов, которые эффективно выводят токсины, восстанавливают электролитный баланс и устраняют обезвоживание. Дополнительно врач назначает медикаменты для защиты сердца, печени и нервной системы, а также, при необходимости, седативные препараты для стабилизации психического состояния.

Получить дополнительную информацию – поставить капельницу от запоя москва

После первичной диагностики начинается активная фаза медикаментозного вмешательства. Современные препараты вводятся капельничным методом, что позволяет оперативно снизить концентрацию токсинов в крови и восстановить нормальные обменные процессы. Этот этап критически важен для стабилизации работы внутренних органов, таких как печень, почки и сердце.

Исследовать вопрос подробнее – narkolog-na-dom-kruglosutochno rjazan’

Клинические протоколы стационарной терапии рекомендуют госпитализацию при средней и тяжёлой степени интоксикации.

Ознакомиться с деталями – вывод из запоя недорого в рязани

Проблемы с алкоголем или наркотиками могут застать врасплох и привести к серьезным последствиям для организма, психического состояния и жизни пациента. Самостоятельные попытки выйти из запоя или преодолеть абстинентный синдром без медицинской поддержки редко оказываются эффективными и могут представлять реальную опасность для здоровья. Именно в таких ситуациях клиника «АльфаНаркология» предлагает услугу вызова нарколога на дом в Санкт-Петербурге и Ленинградской области. Наши специалисты оперативно реагируют на обращение, оказывают квалифицированную помощь и обеспечивают полную конфиденциальность лечения.

Углубиться в тему – нарколог на дом вывод

На этом этапе врач детально выясняет, как долго продолжается запой, какие симптомы наблюдаются, и имеются ли сопутствующие заболевания. Точный анализ информации помогает оперативно определить степень интоксикации и подобрать оптимальные методы детоксикации, что является ключом к предотвращению дальнейших осложнений.

Подробнее можно узнать тут – нарколог на дом рязань

В условиях стационара или на дневном стационаре применяются сбалансированные инфузионные растворы, витамины, антиоксиданты и препараты для поддержки печени. Цель — минимизировать интоксикацию и предотвратить осложнения.

Детальнее – lechenie-alkogolizma-tyumen10.ru/

Наркологическая помощь на дому становится всё более востребованной благодаря своей доступности, конфиденциальности и эффективности. Клиника «МедТрезвость» предлагает пациентам целый ряд важных преимуществ:

Узнать больше – нарколог на дом ленинградская область

В рамках услуги вызова нарколога на дом используется современное оборудование и препараты, одобренные для амбулаторного применения.

Получить дополнительные сведения – вызвать нарколога на дом каменск-уральский

Применение современных капельничных методов позволяет точно дозировать лекарственные средства. Постоянный мониторинг жизненно важных показателей пациента дает возможность оперативно корректировать терапию для достижения оптимального эффекта и предотвращения побочных реакций.

Ознакомиться с деталями – вывод из запоя волгоградская область

Для каждого пациента используется индивидуальный монитор жизненно важных функций, передающий данные врачу в клинике через защищённый канал связи. Это обеспечивает безопасность при лечении как лёгких, так и тяжёлых форм интоксикации, снижая вероятность осложнений.

Ознакомиться с деталями – наркологическая клиника в тюмени

Вызов врача-нарколога на дом в Санкт-Петербурге начинается с детального осмотра и оценки состояния пациента. Врач измеряет давление, пульс, уровень кислорода в крови и определяет степень интоксикации.

Ознакомиться с деталями – https://narcolog-na-dom-sankt-peterburg00.ru/vyzov-narkologa-na-dom-spb/

Проблемы, связанные с употреблением алкоголя или наркотических веществ, могут застать человека врасплох и требовать немедленного медицинского вмешательства. В Туле предоставляется наркологическая помощь, направленная на купирование острых состояний и оказание поддержки пациентам в кризисной ситуации. В клинике «Здоровье+» используются современные методы лечения, основанные на отечественных клинических рекомендациях, с акцентом на безопасность и индивидуальный подход.

Разобраться лучше – наркологическая помощь на дому в туле

Первый и самый важный момент — какие методики применяются в клинике. Качественное лечение наркозависимости включает несколько этапов: детоксикация, стабилизация состояния, психотерапия, ресоциализация. Одного лишь выведения токсинов из организма недостаточно — без проработки психологических причин употребления высокий риск рецидива.

Детальнее – лечение наркомании и алкоголизма владимир

Клиника «МедАльянс» оказывает профессиональную медицинскую помощь на дому в Москве и Московской области круглосуточно. Опытные врачи-наркологи приедут в течение часа после вызова, проведут полную диагностику, поставят капельницу и быстро вернут пациента в стабильное состояние.

Получить дополнительные сведения – http://kapelnica-ot-zapoya-moskva000.ru

Одним из ключевых этапов терапии является медикаментозное устранение абстинентного синдрома, что значительно облегчает состояние пациента. Для этого используются препараты, рекомендованные к применению ведущими специалистами в области наркологии. Примером могут служить протоколы лечения, описанные на официальном портале наркологической помощи России.

Углубиться в тему – частная наркологическая клиника в каменске-уральском

При необходимости применяется симптоматическое лечение для снижения болевого синдрома, устранения тошноты и рвоты, а также нормализации психоэмоционального состояния пациента. Врачи наркологи строго контролируют течение процедуры, что обеспечивает безопасность и снижает риски осложнений.

Подробнее – http://www.domen.ru

Компоненты

Подробнее тут – капельница от запоя анонимно

Стандартная процедура включает внутривенное введение растворов, которые эффективно выводят токсины, восстанавливают электролитный баланс и устраняют обезвоживание. Дополнительно врач назначает медикаменты для защиты сердца, печени и нервной системы, а также, при необходимости, седативные препараты для стабилизации психического состояния.

Узнать больше – капельница от запоя на дому цена в москве

Самостоятельно выйти из запоя — почти невозможно. В Москве врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Подробнее – капельница от запоя цена

В Москве решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Получить дополнительную информацию – врача капельницу от запоя в Москве

Согласно данным Федерального наркологического центра, своевременный выезд врача снижает риск осложнений и повторных госпитализаций.

Получить дополнительные сведения – нарколог на дом анонимно

Для эффективного вывода из запоя в Мурманске используются современные методы детоксикации, включающие внутривенное введение растворов, направленных на восстановление водно-солевого баланса, коррекцию электролитов и нормализацию работы почек и печени. Важным этапом является использование витаминных комплексов и препаратов, поддерживающих работу сердца и сосудов.

Ознакомиться с деталями – вывод из запоя анонимно в мурманске

Специалист уточняет, сколько времени продолжается запой, какой тип алкоголя употребляется, а также наличие сопутствующих заболеваний. Тщательный анализ этих данных помогает определить оптимальные методы детоксикации и скорректировать терапевтическую стратегию для минимизации риска осложнений.

Углубиться в тему – нарколог на дом цена

Особенно важно на этапе поступления пройти полную психодиагностику и получить адаптированную под конкретного пациента программу. Это позволит учитывать возможные сопутствующие расстройства, включая тревожные, аффективные и когнитивные нарушения.

Изучить вопрос глубже – наркологическая клиника цены

Наркологическая помощь на дому становится всё более востребованной благодаря своей доступности, конфиденциальности и эффективности. Клиника «МедТрезвость» предлагает пациентам целый ряд важных преимуществ:

Подробнее – narkolog-na-dom-czena sankt-peterburg

В условиях стационара или на дневном стационаре применяются сбалансированные инфузионные растворы, витамины, антиоксиданты и препараты для поддержки печени. Цель — минимизировать интоксикацию и предотвратить осложнения.

Получить больше информации – https://lechenie-alkogolizma-tyumen10.ru/klinika-lecheniya-alkogolizma-tyumen/

Борьба с наркотической зависимостью требует системного подхода и участия опытных специалистов. Важно понимать, что лечение наркомании — это не только снятие ломки, но и длительная психотерапия, обучение новым моделям поведения, работа с семьёй. Согласно рекомендациям Минздрава РФ, наиболее стабильные результаты достигаются при прохождении курса реабилитации под наблюдением профессиональной команды в специализированном центре.

Исследовать вопрос подробнее – центр лечения наркомании владимирская область

В рамках услуги вызова нарколога на дом используется современное оборудование и препараты, одобренные для амбулаторного применения.

Исследовать вопрос подробнее – http://narkolog-na-dom-kamensk-uralskij11.ru/chastnyj-narkolog-na-dom-v-kamensk-uralskom/

В рамках реабилитации применяются когнитивно-поведенческие тренинги, арт-терапия и групповые занятия по развитию коммуникативных навыков. Это помогает пациентам осознать причины зависимости и выработать стратегии предотвращения рецидивов в будущем.

Углубиться в тему – http://narkologicheskaya-klinika-tyumen10.ru/

Вызов врача-нарколога на дом в Санкт-Петербурге начинается с детального осмотра и оценки состояния пациента. Врач измеряет давление, пульс, уровень кислорода в крови и определяет степень интоксикации.

Подробнее – нарколог на дом

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Москве приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Детальнее – капельница от запоя Москва

Пациенты, нуждающиеся в круглосуточном наблюдении, могут пройти курс терапии в стационаре. Обстановка клиники рассчитана на комфортное пребывание: палаты с индивидуальным санитарным блоком, охрана, контроль приёма препаратов, поддержка психологов.

Разобраться лучше – скорая наркологическая помощь в туле

Наркологическая помощь в Первоуральске доступна в различных форматах: амбулаторно, стационарно и на дому. Однако не каждое учреждение может обеспечить необходимый уровень комплексной терапии, соответствующей стандартам Минздрава РФ и НМИЦ психиатрии и наркологии. В этом материале мы рассмотрим ключевые особенности профессионального наркологического центра и критерии, которые помогут сделать осознанный выбор.

Подробнее можно узнать тут – http://narkologicheskaya-klinika-pervouralsk11.ru

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Москве приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Подробнее можно узнать тут – врача капельницу от запоя Москва

Согласно данным Федерального наркологического центра, своевременный выезд врача снижает риск осложнений и повторных госпитализаций.

Подробнее можно узнать тут – https://narkolog-na-dom-kamensk-uralskij11.ru/

Клиника «МедАльянс» оказывает профессиональную медицинскую помощь на дому в Москве и Московской области круглосуточно. Опытные врачи-наркологи приедут в течение часа после вызова, проведут полную диагностику, поставят капельницу и быстро вернут пациента в стабильное состояние.

Получить больше информации – posle-kapelniczy-ot-zapoya moskva

Врачи клиники «ЗдравЦентр» рекомендуют не откладывать вызов нарколога, чтобы избежать серьезных последствий, таких как судорожные припадки, инсульт или алкогольный психоз.

Исследовать вопрос подробнее – https://kapelnica-ot-zapoya-moskva00.ru

Борьба с наркотической зависимостью требует системного подхода и участия опытных специалистов. Важно понимать, что лечение наркомании — это не только снятие ломки, но и длительная психотерапия, обучение новым моделям поведения, работа с семьёй. Согласно рекомендациям Минздрава РФ, наиболее стабильные результаты достигаются при прохождении курса реабилитации под наблюдением профессиональной команды в специализированном центре.

Ознакомиться с деталями – http://www.domen.ru

Основная цель — быстрое и безопасное выведение этанола и его токсических метаболитов из организма, восстановление водно-электролитного и кислотно-щелочного баланса, нормализация артериального давления, работы сердца, почек и головного мозга. Для этого применяется инфузионная терапия, фармакологическая коррекция, витаминотерапия и, при необходимости, седативная поддержка.

Изучить вопрос глубже – вывод из запоя

Вывод из запоя показан при:

Детальнее – vyvod-iz-zapoya-kruglosutochno murmansk

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Получить дополнительную информацию – https://vistoweekly.com/mywape

Первое, на что стоит обратить внимание — это профессиональный уровень сотрудников. Без квалифицированных наркологов, клинических психологов и психиатров реабилитационный процесс становится формальным и неэффективным.

Узнать больше – частная наркологическая клиника свердловская область

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Исследовать вопрос подробнее – https://godspeedoffroad.com/rut-recovery-utility-tool-black-smitybilt-2728

Эта публикация завернет вас в вихрь увлекательного контента, сбрасывая стереотипы и открывая двери к новым идеям. Каждый абзац станет для вас открытием, полным ярких примеров и впечатляющих достижений. Подготовьтесь быть вовлеченными и удивленными каждый раз, когда продолжите читать.

Подробнее тут – https://mc-3.org/2023/12/19/hallo-welt

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Выяснить больше – https://delhikhabar.in/delhi-weather-update-winds-can-blow-in-delhi-at-a-speed-of-30-kmph-clouds-will-prevail-in-two-three-days

Перед началом терапии врач проводит предварительный осмотр: измеряет давление, пульс, оценивает общее состояние пациента, наличие сопутствующих хронических заболеваний и признаков тяжёлой интоксикации. После этого разрабатывается индивидуальная схема лечения. В большинстве случаев она включает внутривенное введение растворов, улучшающих водно-солевой баланс, а также медикаментов, направленных на снятие абстиненции, нормализацию сна и снижение тревожности.

Детальнее – анонимный вывод из запоя

Эта статья сочетает познавательный и занимательный контент, что делает ее идеальной для любителей глубоких исследований. Мы рассмотрим увлекательные аспекты различных тем и предоставим вам новые знания, которые могут оказаться полезными в будущем.

Детальнее – https://drivers4vip.com/product/beanie-with-logo

Этот информативный текст выделяется своими захватывающими аспектами, которые делают сложные темы доступными и понятными. Мы стремимся предложить читателям глубину знаний вместе с разнообразием интересных фактов. Откройте новые горизонты и развивайте свои способности познавать мир!

Получить дополнительную информацию – https://bloggenmeister.com/die-grundlagen-des-bloggens-verstehen

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Углубиться в тему – https://frentedostorcedores.com.br/2022/07/assista-brusque-x-operario-pr-ao-vivo-hoje-01-07-as-2130-hs-brasileirao-serie-b-palpites-e-retrospecto

Эта разъяснительная статья содержит простые и доступные разъяснения по актуальным вопросам. Мы стремимся сделать информацию понятной для широкой аудитории, чтобы каждый смог разобраться в предмете и извлечь из него максимум пользы.

Исследовать вопрос подробнее – https://smartmeals.online/hello-world

Метод лечения

Подробнее – centr lecheniya narkomanii vladimir

Эта информационная заметка предлагает лаконичное и четкое освещение актуальных вопросов. Здесь вы найдете ключевые факты и основную информацию по теме, которые помогут вам сформировать собственное мнение и повысить уровень осведомленности.

Изучить вопрос глубже – http://www.brambillacarlocenter.com/news/prova-news

Предлагаем вашему вниманию интересную справочную статью, в которой собраны ключевые моменты и нюансы по актуальным вопросам. Эта информация будет полезна как для профессионалов, так и для тех, кто только начинает изучать тему. Узнайте ответы на важные вопросы и расширьте свои знания!

Подробнее можно узнать тут – https://vistoweekly.com/mastering-rubranking-for-seo-success-in-digital-marketing

В этой статье-обзоре мы соберем актуальную информацию и интересные факты, которые освещают важные темы. Читатели смогут ознакомиться с различными мнениями и подходами, что позволит им расширить кругозор и глубже понять обсуждаемые вопросы.

Получить дополнительные сведения – https://vistoweekly.com/experts-aigilbertwired

Эта статья предлагает уникальную подборку занимательных фактов и необычных историй, которые вы, возможно, не знали. Мы постараемся вдохновить ваше воображение и разнообразить ваш кругозор, погружая вас в мир, полный интересных открытий. Читайте и открывайте для себя новое!

Исследовать вопрос подробнее – https://xorcoins.com/index.php/2023/04/09/unlock-the-power-of-digital-marketing-our-services

Метод лечения

Разобраться лучше – лечение наркомании наркология

После устранения острой зависимости важным этапом становится реабилитация. Она включает восстановление социальных навыков, обучение методам преодоления стрессов без употребления психоактивных веществ.

Выяснить больше – http://narkologicheskaya-klinika-v-murmanske12.ru

Наркологическая клиника в Рязани предоставляет квалифицированную помощь пациентам, страдающим от алкогольной, наркотической и медикаментозной зависимости. Здесь проводится полный цикл медицинской и психотерапевтической поддержки, начиная с детоксикации и заканчивая восстановительным этапом. Учреждение оборудовано современными технологиями, а персонал обладает подтверждённой квалификацией и практическим опытом.

Получить дополнительную информацию – https://narkologicheskaya-klinika-v-ryazani12.ru/narkologicheskaya-klinika-telefon-v-ryazani/

После первичной диагностики начинается активная фаза медикаментозного вмешательства. Современные препараты вводятся капельничным методом, что позволяет оперативно снизить концентрацию токсинов в крови и восстановить нормальные обменные процессы. Этот этап критически важен для стабилизации работы внутренних органов, таких как печень, почки и сердце.

Получить дополнительные сведения – нарколог на дом вывод в рязани

Пребывание в стационаре обеспечивает круглосуточный мониторинг состояния, своевременное введение лекарств и защиту пациента от внешних факторов, провоцирующих срыв. Все палаты оснащены необходимым оборудованием, соблюдаются санитарные нормы, а условия размещения соответствуют медицинским стандартам.

Подробнее можно узнать тут – http://narkologicheskaya-klinika-v-yaroslavle12.ru/narkologicheskaya-klinika-klinika-pomoshh-v-yaroslavle/

Основной этап – введение внутривенной капельницы с специально разработанными растворами. Эти растворы содержат электролиты, витамины и активные компоненты, способствующие быстрому выведению токсинов, восстановлению водно-солевого баланса и улучшению обмена веществ. Детоксикация позволяет снизить концентрацию алкоголя в крови, уменьшить симптомы абстиненции и подготовить организм к последующим этапам терапии.

Исследовать вопрос подробнее – https://narcolog-na-dom-krasnoyarsk0.ru

Капельница от запоя применяется для комплексного восстановления организма после длительного употребления алкоголя. Она включает в себя введение растворов, насыщенных витаминами, электролитами, глюкозой и лекарственными средствами, направленными на устранение симптомов интоксикации. Основные задачи процедуры:

Изучить вопрос глубже – капельница от запоя на дому мурманск

Основные показания для вызова нарколога:

Получить больше информации – нарколог на дом цены иркутск

Запой – это состояние, когда организм требует постоянного поступления алкоголя для нормальной работы. Запой вызывает накопление вредных веществ, что негативно влияет на органы и иммунную систему. Не пытайтесь самостоятельно избавиться от запоя, это может навредить. Получите квалифицированную помощь на дому от клиники «Семья и Здоровье». Мы быстро приедем и окажем круглосуточную поддержку при запое. Длительное употребление алкоголя опасно для здоровья и жизни. Не ждите, пока станет слишком поздно, обратитесь за помощью при запое!

Разобраться лучше – https://vyvod-iz-zapoya-krasnoyarsk0.ru/

Нужна срочная помощь при алкогольном отравлении или запое? Вызовите нарколога на дом в Иркутске! Квалифицированная помощь нарколога на дому: диагностика, капельница, стабилизация состояния. Круглосуточный выезд нарколога, анонимность и снижение рисков – с «ТрезвоМед». Самостоятельный отказ невозможен? Необходима наркологическая помощь. Васильев: «Не затягивайте с помощью при алкогольном отравлении!».

Изучить вопрос глубже – вызов нарколога на дом иркутск

Введение препаратов осуществляется внутривенно, что обеспечивает оперативное действие медикаментов. В состав лечебного раствора входят средства для детоксикации организма, нормализации водно-электролитного и кислотно-щелочного баланса. При необходимости врач дополнительно вводит препараты, защищающие печень, стабилизирующие работу сердца и успокаивающие нервную систему. Вся процедура проводится под строгим контролем нарколога, который следит за состоянием пациента и корректирует терапию при необходимости. По завершении процедуры врач дает пациенту и его родственникам подробные рекомендации по дальнейшему восстановлению и профилактике повторных запоев.

Углубиться в тему – капельница от запоя цена нижний новгород

Сразу после поступления вызова специалист прибывает на дом для проведения первичного осмотра. На данном этапе нарколог:

Изучить вопрос глубже – нарколог на дом недорого рязань

Нарколог на дому проводит тщательный осмотр, собирает анамнез и назначает необходимые лабораторные исследования. Это позволяет выявить сопутствующие патологии и скорректировать тактику лечения.

Получить больше информации – вызов нарколога на дом в ярославле

Запой – это очень опасно! Круглосуточная помощь нарколога в Волгоградской области – ваш шанс выжить. Мы оказываем помощь круглосуточно, чтобы вы могли начать лечение в любой момент. Мы обеспечиваем оперативное вмешательство, индивидуальный подход и высокий уровень безопасности. Служба круглосуточного вывода из запоя работает оперативно и надежно. При ухудшении состояния, мы готовы выехать на дом или принять вас в клинике для детоксикации. Начинаем с диагностики: сбор анамнеза, измерение показателей и оценка степени интоксикации.

Изучить вопрос глубже – вывод из запоя цены волгоград

Если человек страдает от алкоголизма, запойное состояние требует незамедлительного вмешательства, особенно если признаки токсического отравления начинают угрожать жизни. Признаки запоя — это не только физическая зависимость, но и эмоциональные и психические расстройства, такие как тревога, агрессия и галлюцинации.

Получить дополнительную информацию – http://narcolog-na-dom-novokuznetsk0.ru/

Как подчёркивает заведующий отделением наркологии Владимирского областного клинического диспансера, «только комплексная модель, включающая медикаментозную поддержку и психотерапию, даёт устойчивый эффект». Это означает, что в штате клиники должны быть не только врачи, но и психотерапевты, социальные работники, реабилитологи.

Подробнее – центр лечения наркомании владимир

Есть ситуации, когда вызов врача на дом становится не просто желателен, а жизненно необходим. Если зависимый человек не способен самостоятельно прекратить употребление алкоголя или наркотиков, а его самочувствие заметно ухудшается, необходимо незамедлительно обратиться за медицинской помощью. Поводом для вызова нарколога служат следующие опасные симптомы:

Изучить вопрос глубже – нарколог на дом круглосуточно новосибирск

Наркологическая клиника «МедЛайн» предоставляет профессиональные услуги врача-нарколога с выездом на дом в Новосибирске и Новосибирской области. Мы оперативно помогаем пациентам справиться с тяжелыми состояниями при алкогольной и наркотической зависимости. Экстренный выезд наших специалистов доступен круглосуточно, а лечение проводится с применением проверенных методик и препаратов, что гарантирует безопасность и конфиденциальность каждому пациенту.

Ознакомиться с деталями – врач нарколог на дом новосибирск

Не стоит медлить с вызовом врача-нарколога, если у человека проявляются тревожные признаки ухудшения состояния. Среди наиболее серьезных симптомов, требующих немедленного вмешательства врача, можно выделить продолжительный запой (более двух дней подряд), частую рвоту, невыносимую головную боль, выраженный тремор рук и тела, повышение артериального давления, нарушение ритма сердца, а также психические нарушения, включая тревогу, галлюцинации и бессонницу. Чем раньше пациент обратится за профессиональной помощью, тем выше шансы избежать серьезных осложнений и быстро вернуться к нормальной жизни.

Получить дополнительные сведения – vyvod-iz-zapoya novosibirsk

Эффективное лечение требует поэтапного подхода, который реализуется следующим образом:

Выяснить больше – https://narkologicheskaya-klinika-v-ryazani12.ru/narkologicheskaya-klinika-czeny-v-ryazani/

После первичной диагностики начинается активная фаза медикаментозного вмешательства. Современные препараты вводятся капельничным методом, что позволяет оперативно снизить концентрацию токсинов в крови и восстановить нормальные обменные процессы. Этот этап критически важен для стабилизации работы внутренних органов, таких как печень, почки и сердце.

Изучить вопрос глубже – вызов врача нарколога на дом

Некоторые состояния требуют немедленного вмешательства нарколога, так как отказ от лечения может привести к тяжелым осложнениям и риску для жизни.

Подробнее – https://narcolog-na-dom-novokuznetsk00.ru/narkolog-lechenie-na-domu-novokuzneczk

Пребывание в стационаре обеспечивает круглосуточный мониторинг состояния, своевременное введение лекарств и защиту пациента от внешних факторов, провоцирующих срыв. Все палаты оснащены необходимым оборудованием, соблюдаются санитарные нормы, а условия размещения соответствуют медицинским стандартам.

Выяснить больше – наркологические клиники алкоголизм ярославль

Для успешной адаптации пациента в обществе клиника организует поддержку родственников и последующее наблюдение. Это снижает риск рецидива и помогает сохранить достигнутые результаты.

Подробнее – http://narkologicheskaya-klinika-v-murmanske12.ru

Вывод из запоя — это не просто капельница, а многоуровневая медицинская процедура, направленная на устранение интоксикации, стабилизацию состояния пациента и предотвращение осложнений. В клинике «Жизненный Луч» мы проводим эту процедуру в домашних условиях и в стационаре, в зависимости от тяжести состояния. К каждому пациенту применяем индивидуальный подход, исходя из возраста, сопутствующих заболеваний и длительности запоя.

Подробнее – https://vyvod-iz-zapoya-kolomna3.ru/vyvod-iz-zapoya-nedorogo-v-kolomne

Метод лечения

Ознакомиться с деталями – https://lechenie-narkomanii-vladimir10.ru/lechenie-narkomanii-anonimno-vladimir/

Как подчёркивает психотерапевт наркологической клиники «Чистая Дорога» Игорь Алексеевич Кондратенко, «кодирование — это не запрет, а защита. Мы не наказываем организм, а даём ему возможность отдохнуть от постоянной борьбы и переключиться на восстановление».

Подробнее можно узнать тут – anonimnoe-kodirovanie-ot-alkogolizma

Алкогольный запой — это не просто многодневное пьянство, а проявление зависимости, при котором каждое утро начинается с новой дозы спиртного. Организм человека уже не способен самостоятельно справляться с последствиями переработки этанола, и любое промедление ведёт к нарастанию тяжёлой интоксикации. Даже при резком прекращении употребления алкоголя последствия могут быть непредсказуемыми: от судорожных припадков до алкогольного психоза.

Получить больше информации – vyvod-iz-zapoya-v-domodedovo

Капельница рекомендована при следующих состояниях:

Изучить вопрос глубже – капельница от запоя анонимно в мурманске

Основной частью лечения является постановка внутривенной капельницы с растворами, которые помогают быстро вывести токсины, нормализовать водно-солевой баланс и восстановить работу внутренних органов. Дополнительно назначаются средства для защиты печени, нормализации работы сердца и снятия тревожности. Врач контролирует состояние пациента на протяжении всей процедуры, а при необходимости корректирует лечебную схему. По окончании манипуляций специалист обязательно дает рекомендации для дальнейшего восстановления организма и предотвращения повторных запоев.

Ознакомиться с деталями – https://narcolog-na-dom-novosibirsk0.ru/vyzov-narkologa-na-dom-novosibirsk

Используя современные инфузионные системы, мы постепенно вводим растворы для выведения токсинов, коррекции водно-электролитного баланса и восстановления функции печени. Параллельно подбираются препараты для снятия абстинентного синдрома, купирования тревожности и нормализации сна.

Исследовать вопрос подробнее – http://

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Москве приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Получить больше информации – капельница от запоя на дому цена в Москве

Пожалуй, самый распространённый миф — что если просто не пить сутки-двое, то всё наладится. Но если человек длительное время находился в состоянии опьянения, его тело уже адаптировалось к токсичной среде. Резкий отказ без медицинской помощи может привести к судорогам, галлюцинациям, тяжёлой бессоннице, паническим атакам и скачкам давления. Человек буквально «сгорает» изнутри — от собственного обмена веществ, который не справляется с последствиями интоксикации.

Подробнее тут – https://vyvod-iz-zapoya-ehlektrostal3.ru/anonimnyj-vyvod-iz-zapoya-v-ehlektrostali

Запой – это не просто пьянство, а состояние, когда организм становится зависимым от алкоголя. Накопление токсинов приводит к сбоям в работе органов и ослаблению защиты организма. Самостоятельный выход из запоя может быть опасен и только усугубить состояние. Мы предлагаем лечение запоя на дому, чтобы избежать больницы и создать комфорт. Наши специалисты быстро приедут к вам и окажут всю необходимую помощь круглосуточно. Запой приводит к серьезным проблемам со здоровьем, ухудшает качество жизни и угрожает жизни. Очень важно вовремя обратиться за помощью, чтобы избежать необратимых последствий.

Изучить вопрос глубже – https://vyvod-iz-zapoya-krasnoyarsk0.ru/vyvod-iz-zapoya-kruglosutochno-krasnoyarsk/

Метод лечения

Получить дополнительные сведения – http://lechenie-narkomanii-vladimir10.ru/

Запой – это не просто временное ухудшение самочувствия, а состояние, при котором организм подвергается значительному токсическому воздействию алкоголя. Длительное злоупотребление приводит к накоплению вредных веществ, что может вызвать:

Изучить вопрос глубже – http://narcolog-na-dom-ryazan00.ru

Лечение выводится поэтапно, чтобы обеспечить безопасность и максимальную эффективность терапии. Каждый этап продуман и адаптирован под индивидуальные особенности пациента.

Получить дополнительную информацию – нарколог на дом недорого в красноярске

Работа клиники строится на принципах доказательной медицины и индивидуального подхода. При поступлении пациента осуществляется всесторонняя диагностика, включающая анализы крови, оценку психического состояния и анамнез. По результатам разрабатывается персонализированный курс терапии.

Получить больше информации – наркологические клиники алкоголизм в рязани

После первичной диагностики начинается активная фаза медикаментозного вмешательства. Современные препараты вводятся капельничным методом, что позволяет оперативно снизить концентрацию токсинов в крови и восстановить нормальные обменные процессы. Этот этап критически важен для стабилизации работы внутренних органов, таких как печень, почки и сердце.

Ознакомиться с деталями – http://narcolog-na-dom-ryazan0.ru

В клинике применяются доказательные методы лечения, соответствующие международным и российским рекомендациям. Основу составляет медикаментозная детоксикация, сопровождаемая психотерапией, когнитивно-поведенческой коррекцией, а также семейной консультацией. При необходимости применяются пролонгированные препараты, облегчающие контроль над тягой к веществу.

Изучить вопрос глубже – narkologicheskaya-klinika-v-yaroslavle12.ru/

Запой — это не просто бытовое пьянство, а одно из наиболее опасных проявлений алкогольной зависимости. Во время запоя организм перестаёт функционировать в нормальном режиме: сердечно-сосудистая система работает на износ, нервная система перегружена токсинами, а печень не справляется с нагрузкой. На этом фоне могут возникать тяжёлые осложнения — от судорог и гипогликемии до нарушения дыхания и алкогольного психоза. Чем дольше длится запой, тем глубже метаболические нарушения и выше риск серьёзных последствий.

Получить дополнительные сведения – https://vyvod-iz-zapoya-kolomna3.ru

Нарколог на дому проводит тщательный осмотр, собирает анамнез и назначает необходимые лабораторные исследования. Это позволяет выявить сопутствующие патологии и скорректировать тактику лечения.

Получить дополнительную информацию – нарколог на дом вывод в ярославле

Основные показания для вызова нарколога:

Получить больше информации – http://narcolog-na-dom-v-irkutske00.ru/

Нужна срочная помощь при алкогольном отравлении или запое? Вызовите нарколога на дом в Иркутске! Квалифицированная помощь нарколога на дому: диагностика, капельница, стабилизация состояния. Круглосуточный выезд нарколога, анонимность и снижение рисков – с «ТрезвоМед». Самостоятельный отказ невозможен? Необходима наркологическая помощь. Васильев: «Не затягивайте с помощью при алкогольном отравлении!».

Получить дополнительную информацию – платный нарколог на дом иркутск

Пациенты выбирают нашу клинику для срочного вызова врача-нарколога благодаря следующим важным преимуществам:

Исследовать вопрос подробнее – нарколог на дом цена

Основной частью лечения является постановка внутривенной капельницы с растворами, которые помогают быстро вывести токсины, нормализовать водно-солевой баланс и восстановить работу внутренних органов. Дополнительно назначаются средства для защиты печени, нормализации работы сердца и снятия тревожности. Врач контролирует состояние пациента на протяжении всей процедуры, а при необходимости корректирует лечебную схему. По окончании манипуляций специалист обязательно дает рекомендации для дальнейшего восстановления организма и предотвращения повторных запоев.

Получить больше информации – врач нарколог на дом новосибирск

Для оценки уровня учреждения важно понимать, какие конкретно методики в нём используются. Ниже приведён обобщённый обзор подходов в современных наркологических клиниках региона:

Изучить вопрос глубже – центр лечения наркомании владимир.

При остром алкогольном отравлении появляются головокружение, рвота, сильная слабость, скачки давления, нарушение дыхания, обмороки и судороги. Это сигнал о том, что организм не справляется с интоксикацией, и без срочного медицинского вмешательства возможны опасные осложнения, вплоть до комы.

Ознакомиться с деталями – нарколог на дом вывод из запоя в новокузнецке

Для успешного лечения зависимости необходима тщательная диагностика. В клинике проводят полное обследование пациента, включающее:

Изучить вопрос глубже – частная наркологическая клиника в мурманске

Запой – это не просто пьянство, а состояние, когда организм становится зависимым от алкоголя. Накопление токсинов приводит к сбоям в работе органов и ослаблению защиты организма. Самостоятельный выход из запоя может быть опасен и только усугубить состояние. Мы предлагаем лечение запоя на дому, чтобы избежать больницы и создать комфорт. Наши специалисты быстро приедут к вам и окажут всю необходимую помощь круглосуточно. Запой приводит к серьезным проблемам со здоровьем, ухудшает качество жизни и угрожает жизни. Очень важно вовремя обратиться за помощью, чтобы избежать необратимых последствий.

Узнать больше – вывести из запоя

Каждый пациент получает индивидуальный план лечения, основанный на клинических исследованиях, данных лабораторных анализов и психологических тестов.

Изучить вопрос глубже – http://narkologicheskaya-klinika-dolgoprudnyj3.ru

Запой может быть не только физически тяжёлым, но и психологически разрушительным. Поэтому важно вовремя обратиться за помощью. Вывод из запоя в Нижнем Новгороде — это необходимая медицинская процедура, которая помогает победить алкогольную зависимость и восстановить здоровье. Мы в клинике «АнтиЗависимость» предлагаем круглосуточную помощь в комфортных условиях — на дому или в стационаре.

Получить дополнительные сведения – http://narcolog-na-dom-novokuznetsk0.ru

Алкогольная зависимость — это хроническое заболевание, которое со временем разрушает здоровье, отношения, профессиональную сферу и личную идентичность человека. Многие сталкиваются с этим не сразу: поначалу кажется, что всё под контролем, но с каждым срывом становится всё труднее остановиться. Постепенно алкоголь перестаёт быть выбором и превращается в навязчивую необходимость.

Ознакомиться с деталями – кодирование от алкоголизма на дому щелково

Независимо от формы зависимости — алкогольной, опиатной, синтетической или медикаментозной — специалисты подбирают индивидуальный курс терапии. Алгоритмы лечения адаптируются под возраст, стаж употребления, общее состояние организма и наличие сопутствующих заболеваний.

Разобраться лучше – наркологическая клиника в ярославле

Эффективное лечение требует поэтапного подхода, который реализуется следующим образом:

Подробнее можно узнать тут – https://narkologicheskaya-klinika-v-ryazani12.ru/narkologicheskaya-klinika-telefon-v-ryazani/

В условиях, когда алкогольная зависимость угрожает жизни, оперативное вмешательство становится ключевым фактором для сохранения здоровья. В Рязани круглосуточная помощь нарколога на дому позволяет начать комплексное лечение запоя и алкогольной интоксикации в самые критические моменты. Такая услуга обеспечивает детоксикацию организма, стабилизацию жизненно важных показателей и психологическую поддержку, что способствует скорейшему восстановлению в комфортной обстановке, без необходимости посещения стационара.

Узнать больше – вызов нарколога на дом рязанская область

Пациенты, которые выбирают нашу клинику для лечения алкогольного запоя, получают качественную и оперативную помощь, обладающую следующими преимуществами:

Подробнее – капельница от запоя анонимно нижний новгород

В Москве решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Подробнее можно узнать тут – врач на дом капельница от запоя

В ходе процедуры врач контролирует жизненные показатели пациента, корректирует состав раствора при необходимости и оказывает дополнительную поддержку. После завершения капельницы часто назначается курс восстановительной терапии, направленный на стабилизацию функций организма.

Получить дополнительные сведения – http://kapelnicza-ot-zapoya-v-murmanske12.ru/kapelnicza-ot-zapoya-czena-v-murmanske/

Запой — это не просто бытовое пьянство, а одно из наиболее опасных проявлений алкогольной зависимости. Во время запоя организм перестаёт функционировать в нормальном режиме: сердечно-сосудистая система работает на износ, нервная система перегружена токсинами, а печень не справляется с нагрузкой. На этом фоне могут возникать тяжёлые осложнения — от судорог и гипогликемии до нарушения дыхания и алкогольного психоза. Чем дольше длится запой, тем глубже метаболические нарушения и выше риск серьёзных последствий.

Ознакомиться с деталями – http://vyvod-iz-zapoya-kolomna3.ru/vyvod-iz-zapoya-stacionar-v-kolomne/https://vyvod-iz-zapoya-kolomna3.ru

Когда запой становится угрозой для жизни, оперативное вмешательство становится ключевым для спасения здоровья и предотвращения серьезных осложнений. В Рязани вызов нарколога на дом позволяет начать лечение в самые критические моменты, обеспечивая детоксикацию организма и восстановление его нормального функционирования в условиях, где пациент чувствует себя комфортно и сохраняет свою конфиденциальность. Этот формат оказания медицинской помощи особенно актуален для тех, кто хочет избежать длительного ожидания в стационаре и предпочитает лечение в привычной домашней обстановке.

Подробнее тут – нарколог на дом срочно

В городе Домодедово такую услугу оказывает наркологическая клиника «Светлый Мир». Здесь работают опытные врачи с круглосуточной готовностью выехать к пациенту домой или принять его в условиях стационара. Главное — не откладывать помощь, особенно если речь идёт о пожилом человеке, пациенте с хроническими заболеваниями или тех, у кого уже проявляются тревожные симптомы: дрожь в руках, панические атаки, скачки давления, бессонница и даже слуховые или зрительные галлюцинации.

Разобраться лучше – вывод из запоя дешево

Борьба с наркотической зависимостью требует системного подхода и участия опытных специалистов. Важно понимать, что лечение наркомании — это не только снятие ломки, но и длительная психотерапия, обучение новым моделям поведения, работа с семьёй. Согласно рекомендациям Минздрава РФ, наиболее стабильные результаты достигаются при прохождении курса реабилитации под наблюдением профессиональной команды в специализированном центре.

Узнать больше – центр лечения наркомании в владимире

Врачи клиники «ВитаЛайн» для снятия интоксикации и облегчения состояния пациента применяют исключительно качественные и проверенные лекарственные препараты, подбирая их в зависимости от особенностей ситуации и состояния здоровья пациента:

Узнать больше – нарколог на дом новосибирск

Наркологическая помощь на дому в Ярославле охватывает широкий спектр медицинских мероприятий, направленных на стабилизацию состояния пациента и подготовку к дальнейшему лечению. Среди основных процедур:

Углубиться в тему – http://www.domen.ru

В «Трезвом Истоке» мы понимаем: принять решение о вызове — это шаг, требующий смелости. Особенно если речь идёт о близком человеке, который отрицает наличие проблемы. Именно поэтому наши врачи умеют работать тактично, без давления. Мы не заставляем — мы объясняем. Спокойно, профессионально и по-человечески.

Углубиться в тему – vyvod-iz-zapoya-anonimno-ehlektrostal

Обратившись к нам, вы получите анонимное и безопасное лечение, полностью соответствующее медицинским стандартам.

Получить больше информации – нарколог на дом анонимно

Запой – это серьезная проблема, когда организм перестает работать без постоянного поступления алкоголя. Из-за запоя токсины отравляют организм, нарушая работу органов и снижая иммунитет. Попытки самостоятельно бросить пить во время запоя могут привести к ухудшению самочувствия. «Семья и Здоровье» лечит запой на дому – это удобно и снижает стресс. Мы приедем в любое время суток и проведем все процедуры для восстановления здоровья. Длительное пьянство может привести к опасным для жизни осложнениям. Нельзя затягивать с лечением запоя, это может привести к серьезным последствиям.

Подробнее можно узнать тут – http://vyvod-iz-zapoya-krasnoyarsk0.ru

В «Чистом Дыхании» вы встретите врачей-наркологов, психиатров и психологов с многолетним опытом, готовых приехать на дом для первичной детоксикации или принять в стационаре для углублённой терапии. Мы соблюдаем строгие медицинские протоколы и гарантируем безопасность даже в самых тяжёлых случаях.

Углубиться в тему – https://narkologicheskaya-klinika-dolgoprudnyj3.ru/chastnaya-narkologicheskaya-klinika-v-dolgoprudnom/

После поступления вызова наш нарколог выезжает к пациенту в кратчайшие сроки, прибывая по адресу в пределах 30–60 минут. Специалист начинает процедуру с подробного осмотра и диагностики, измеряя ключевые показатели организма: артериальное давление, частоту пульса, насыщенность кислородом и собирая подробный анамнез.

Выяснить больше – нарколог на дом новосибирск

Врачи клиники «ВитаЛайн» для снятия интоксикации и облегчения состояния пациента применяют исключительно качественные и проверенные лекарственные препараты, подбирая их в зависимости от особенностей ситуации и состояния здоровья пациента:

Получить дополнительные сведения – http://www.domen.ru

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Ознакомьтесь с аналитикой – https://tradingtree.com.au/product/shiraz-semi-cured-gel-nail-stickers

В этом обзорном материале представлены увлекательные детали, которые находят отражение в различных аспектах жизни. Мы исследуем непонятные и интересные моменты, позволяя читателю увидеть картину целиком. Погрузитесь в мир знаний и удивительных открытий!

Погрузиться в детали – https://www.p2law.com.br/o-direito-de-imagem-empresarial-e-sua-protecao-legal

Вывод из запоя в Нижнем Тагиле представляет собой комплекс медицинских мероприятий, направленных на безопасное и эффективное прерывание состояния острого алкогольного отравления. Этот процесс требует профессионального подхода, так как самостоятельное прерывание запоя чревато серьезными осложнениями, включая судороги, инсульты и инфаркты. В медицинской практике используется комплекс мер, включающий детоксикацию организма, коррекцию водно-электролитного баланса и лечение симптомов абстиненции.

Исследовать вопрос подробнее – вывод из запоя клиника

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Смотрите также… – https://www.maldegemsemotorrit.be/cropped-motorrit-jpg

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Нажми и узнай всё – https://www.terra-base.de/portfolio/et-vestibulum-quis-a-suspendisse

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Нажмите, чтобы узнать больше – https://designingsarasota.com/project-view/dr-karen-leggett-womens-midlife-specialist

Этот текст сочетает в себе элементы познавательного рассказа и аналитической подачи информации. Читатель получает доступ к уникальным данным, которые соединяют прошлое с настоящим и открывают двери в будущее.

Информация доступна здесь – https://reginalog.com/?p=277

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Неизвестные факты о… – https://rus.uniza.sk/archiv/327

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Детальнее – https://f5fashion.vn/top-voi-hon-67-ve-xe-lexus-lx570-hay-nhat

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Перейти к статье – https://friendlysweetdesires.com/how-to-know-the-first-step-to-start-a-sport

Публикация приглашает вас исследовать неизведанное — от древних тайн до современных достижений науки. Вы узнаете, как случайные находки превращались в революции, а смелые мысли — в новые эры человеческого прогресса.

Все материалы собраны здесь – http://178evakuator178.ru

Эта публикация дает возможность задействовать различные источники информации и представить их в удобной форме. Читатели смогут быстро найти нужные данные и получить ответы на интересующие их вопросы. Мы стремимся к четкости и доступности материала для всех!

Почему это важно? – https://apds.sn/manifestation-de-soutien-pour-le-mali

Показатель

Получить больше информации – https://narkologicheskaya-klinika-tula10.ru/

Одним из ключевых направлений является проведение капельниц, призванных вывести токсины из организма и нормализовать водно-электролитный баланс. Используемые препараты и состав растворов подбираются индивидуально, исходя из клинической картины и истории болезни пациента.

Выяснить больше – запой нарколог на дом в ярославле

Запой – это крайняя степень алкоголизма, требующая профессионального вмешательства. Нарколог на дом в Волгограде – ваш выбор. Лечение на дому помогает избежать стресса и сохранить анонимность, получив необходимую помощь. Важно как можно быстрее начать лечение, чтобы избежать токсического воздействия алкоголя на организм. Лечение на дому направлено на очищение организма, восстановление баланса и нормальную работу органов. Для достижения долгосрочного результата важно сочетать медикаментозную терапию и психологическую поддержку. Начинаем с детоксикации, используя капельницы и современные препараты.

Узнать больше – волгоград вывод из запоя

В ходе процедуры врач контролирует жизненные показатели пациента, корректирует состав раствора при необходимости и оказывает дополнительную поддержку. После завершения капельницы часто назначается курс восстановительной терапии, направленный на стабилизацию функций организма.

Разобраться лучше – капельница от запоя наркология мурманск

Запой – это серьезная угроза для здоровья. Немедленно вызывайте нарколога на дом в Волгограде! Нарколог приедет к вам быстро, сохранит анонимность и подберет индивидуальное лечение. Мы быстро выведем токсины и вернем вам хорошее самочувствие. В любое время дня и ночи мы готовы приехать и начать лечение. Мы сочетаем медикаменты и психологическую поддержку для успешного лечения. Первый этап лечения – избавление от токсинов с помощью лекарств.

Ознакомиться с деталями – вывод из запоя в волгограде

Медицинская детоксикация — это основа успешного вывода из запоя. Она проводится под строгим контролем врачей-наркологов, которые используют инфузионную терапию для выведения токсинов из организма. В качестве компонентов капельниц применяются растворы глюкозы, физиологический раствор, препараты для восстановления работы печени и почек. Поддержка сердечно-сосудистой системы и нормализация артериального давления достигается с помощью специализированных медикаментов.

Получить дополнительные сведения – vyvod-iz-zapoya-klinika nizhnij tagil

Клиника «ТюменьМед» специализируется на лечении алкогольной зависимости и вывода из запоя с 2010 года. За годы работы накоплен уникальный опыт в проведении комплексной детоксикации, реабилитации и последующего сопровождения пациентов. В основе методик лежат стандарты доказательной медицины, а команда состоит из наркологов, психотерапевтов, заведующих отделением интенсивной терапии и логистов для выездов.

Подробнее – наркологическая клиника цены

Эффективная капельница должна включать несколько компонентов, каждый из которых направлен на решение конкретной задачи: выведение токсинов, восстановление функций организма, нормализация психоэмоционального состояния.

Углубиться в тему – posle-kapelniczy-ot-zapoya pervoural’sk

Вызов нарколога возможен круглосуточно, что обеспечивает оперативное реагирование на критические ситуации. Пациенты и их родственники могут получить помощь в любое время, не дожидаясь ухудшения состояния.

Получить дополнительную информацию – вызов врача нарколога на дом в каменске-уральском

Оперативное лечение организовано по четкому алгоритму, который позволяет быстро стабилизировать состояние пациента и обеспечить эффективную терапию. Каждый этап направлен на комплексное восстановление организма.

Узнать больше – http://vyvod-iz-zapoya-volgograd000.ru/vyvod-iz-zapoya-kapelnicza-volgograd/

Индивидуальный план включает детоксикацию, медикаментозную поддержку, психотерапию и реабилитацию. Специалисты учитывают:

Подробнее можно узнать тут – klinika lecheniya alkogolizma tjumen’

Наши наркологи проводят профессиональную инфузионную детоксикацию, направленную на:

Получить дополнительные сведения – https://narkologicheskaya-klinika-vladimir10.ru

Одним из ключевых этапов терапии является медикаментозное устранение абстинентного синдрома, что значительно облегчает состояние пациента. Для этого используются препараты, рекомендованные к применению ведущими специалистами в области наркологии. Примером могут служить протоколы лечения, описанные на официальном портале наркологической помощи России.

Разобраться лучше – частная наркологическая клиника

Основной этап в лечении — детоксикация организма от токсичных веществ, вызывающих интоксикацию. В клинике применяют современные методы капельниц и медикаментозной поддержки, включая препараты для снятия абстинентного синдрома.

Выяснить больше – chastnaya narkologicheskaya klinika murmansk

Метод лечения

Подробнее – лечение наркомании владимирская область

Как подчёркивает врач-нарколог И.В. Синицин, «современная наркология — это не только вывод из запоя, но и работа с глубинными причинами зависимости».

Подробнее тут – бесплатная наркологическая клиника

Стационарный формат предполагает круглосуточное наблюдение, возможность экстренного вмешательства и доступ к диагностическим средствам. Это особенно важно при наличии хронических заболеваний, психозов или алкогольного делирия.

Подробнее можно узнать тут – вывод из запоя на дому рязань.

Первое, что необходимо уточнить перед вызовом — наличие у врача лицензии и профильного медицинского образования. Только сертифицированный нарколог может назначить препараты, поставить капельницу и провести детоксикацию без ущерба для здоровья пациента.

Получить дополнительную информацию – narkolog-na-dom-czena nizhnij tagil

В Мурманске востребована услуга вызова нарколога на дом для вывода из запоя. Такой подход позволяет провести необходимые процедуры в комфортных условиях, без лишнего стресса для пациента. Врач приезжает с полным набором медикаментов и оборудования, что обеспечивает полноценный и своевременный уход.

Получить больше информации – http://vyvod-iz-zapoya-v-murmanske12.ru/anonimnyj-vyvod-iz-zapoya-v-murmanske/

Запой – опасная стадия алкоголизма, когда организм требует постоянного поступления алкоголя. Лечение на дому – это конфиденциально, удобно и позволяет начать детоксикацию в комфортных условиях. При запое каждая минута на счету, поэтому важно быстро обратиться за помощью. Врач поможет очистить организм от токсинов, восстановить баланс и нормализовать работу внутренних органов. Для успешного лечения запоя важен комплексный подход, включающий лекарства и работу с психологом. Первый шаг – очищение организма от алкоголя с помощью капельниц и других препаратов.

Узнать больше – волгоград вывод из запоя

Работа клиники строится на принципах доказательной медицины и индивидуального подхода. При поступлении пациента осуществляется всесторонняя диагностика, включающая анализы крови, оценку психического состояния и анамнез. По результатам разрабатывается персонализированный курс терапии.

Получить больше информации – наркологическая клиника цены

Таблица 1: Основные признаки профессионального наркологического центра в Туле

Подробнее можно узнать тут – наркологические клиники алкоголизм

Одним из ключевых направлений является проведение капельниц, призванных вывести токсины из организма и нормализовать водно-электролитный баланс. Используемые препараты и состав растворов подбираются индивидуально, исходя из клинической картины и истории болезни пациента.

Углубиться в тему – нарколог на дом клиника в ярославле

Капельница рекомендована при следующих состояниях:

Изучить вопрос глубже – http://kapelnicza-ot-zapoya-v-murmanske12.ru

В статье рассмотрим ключевые моменты, которые помогут сориентироваться при выборе капельницы от запоя, понять механизм действия и особенности процедуры, а также избежать типичных ошибок при обращении за медицинской помощью.

Выяснить больше – http://kapelnicza-ot-zapoya-pervouralsk11.ru

При запое организм отравляется, и нужна экстренная помощь нарколога в Волгограде. Получите квалифицированную помощь на дому, сохраняя конфиденциальность и удобство. Быстрая детоксикация и восстановление здоровья – наша задача. Мы приедем к вам как можно скорее и окажем всю необходимую помощь. Мы подберем лекарства и поможем вам справиться с психологическими проблемами. Начинаем с детоксикации, чтобы очистить организм от вредных веществ.

Детальнее – вывод из запоя на дому волгоград недорого

Запой – это крайняя степень алкоголизма, требующая профессионального вмешательства. Нарколог на дом в Волгограде – ваш выбор. Лечение на дому помогает избежать стресса и сохранить анонимность, получив необходимую помощь. Важно как можно быстрее начать лечение, чтобы избежать токсического воздействия алкоголя на организм. Лечение на дому направлено на очищение организма, восстановление баланса и нормальную работу органов. Для достижения долгосрочного результата важно сочетать медикаментозную терапию и психологическую поддержку. Начинаем с детоксикации, используя капельницы и современные препараты.

Получить дополнительные сведения – вывод из запоя дешево волгоград

Специалист уточняет продолжительность запоя, характер симптоматики и наличие хронических заболеваний, проводит измерения пульса, давления и температуры, что позволяет оперативно скорректировать терапию.

Получить дополнительные сведения – vyvod-iz-zapoya-volgograd000.ru/

Независимо от формы зависимости — алкогольной, опиатной, синтетической или медикаментозной — специалисты подбирают индивидуальный курс терапии. Алгоритмы лечения адаптируются под возраст, стаж употребления, общее состояние организма и наличие сопутствующих заболеваний.

Подробнее – http://narkologicheskaya-klinika-v-yaroslavle12.ru/narkologicheskaya-klinika-telefon-v-yaroslavle/https://narkologicheskaya-klinika-v-yaroslavle12.ru