Introduction

The martingale is a well known trading system. It has many advantages: ease of use, no need to use tight Stop Loss, which reduces psychological pressure, a relatively small amount of time which the user needs to invest in trading.

Of course, the system also has huge drawbacks. The most important of them is the high probability of losing the entire deposit. This fact must be taken into account, if you decide to trade using the martingale technique. This means that you should limit the maximum number of position averaging operations.

Basics of the classical martingale strategy

According to the classical martingale system, the next deal volume should be doubled if the previous ones was closed with a loss. In this case, the profit of the double-volume deal can cover the previous loss. The system is based on the idea that you should finally get lucky. Even if the market does not reverse to take the desired direction, you can benefit from a correction. From this point of view, this should work according to the theory of probability.

In this form, martingale can be combined with any trading system. For example, in level based trading you can open a double-volume deal after having a losing trade. Moreover, since Take Profit in level trading is normally three or more times larger than Stop Loss, you don’t have to increase the deal volume after each loss. This can be done after two or three losses, or the deal volume can be multiplied by 1.1 or any preferred value rather than doubling it. The main idea is that the resulting profit should fully cover the preceding losing chain.

The martingale can also be used for increasing position volume in parts. First, we open a small volume position. If the price goes in the opposite direction, we open one or several more positions with the remaining volume and thus we get a lower average price.

As for position holding, martingale provides additional opening of a position with the same or increased volume in the same direction, if the market moves opposite to your initial position. This type of martingale will be discussed in this article.

For example, if you open a long position and the market starts falling, then you do not close this position, but open another long one – this time the position is opened at a better price. If the market continues falling, another long position can be opened at a new better price. Continue opening positions until the price turns in the right direction or until you reach a certain maximum number of positions.

According to the classical martingale technique, each new position should be opened with a double volume. But this is not necessary. If you use double volume, you can achieve the total profit of all positions faster, provided that the price started moving in the favorable direction. In this case, you do not have to wait until the price reaches your first open position in order to have the profit. So, losses on all positions can be covered even if there is price correction, without the full reversal.

Also, you can keep the previously opened position open or close it. However, if you decide to close it, the new position must necessarily have an increased volume.

Does martingale work?

I do not claim to be a martingale expert. Let us reason together. Can this trading system show acceptable results?

Any movement in the market has a wavy character. A strong movement in one direction is almost always followed by a corrective pullback in the opposite direction. According to this regularity, martingale based systems can work. If you can predict the pullback beginning and preform an appropriate buy or sell trade at the appropriate time, you can cover losses or even make profit. If the market turns in your direction instead of the pullback, you can earn a good profit.

However, sometimes strong price movements occur with almost no pullback. The only thing we can do in this case is wait and hope that the deposit will be enough to bear losses until the price finds the bottom and starts reversing.

Choose the market

Martingale operation may differ in different markets. Therefore, if possible, it is better to choose the market, which is the most suitable for this trading strategy.

Forex is considered to be a ranging market. Stock market is considered to be a trend one. Due to this Forex can be more preferable for martingale techniques.

The use of this strategy in stock markets is associated with a lot of dangers. The most important of them is that a stock price can be equal to zero. That is why long trading using the martingale technique can be very dangerous on the stock market. Short trading can be even more dangerous, because the stock price can soar to an unexpectedly high level.

Currency quotes in the Forex market cannot be equal to zero. For a currency rate to skyrocket, something incredible must happen. The rate is normally moving inside a certain range. How can we benefit from this?

As an example, let us view the monthly charts of Forex symbol quotes. Let’s begin with USDJPY:

NZDUSD:

NZDJPY:

As for other markets, they can also be suitable for martingale techniques.

For example, let us have a look at the cocoa bean market:

Here is the Brent market:

Or the soybean market:

The martingale technique is better suitable for financial instruments, which are in a certain range on any of the timeframes (for trading the range borders). Another acceptable option is to trade symbols which have been moving in one direction for many months, without significant rollbacks (trade in the direction of this movement).

Choose a direction

If you are going to use the martingale technique, make sure all factors are favorable for you. We have analyzed the markets. Now we need to select the right direction.

Stock market. The right direction may not always be found on the stock market.

When trading in the long direction, swap is acting against you. This means you have to pay for moving a position to the next day. The sum which you are charged can be so large, that swaps for several months that you hold a position can be comparable with the expected Take Profit of this position.

Although, some brokers offer long spread much lower than short spread. This swap amount can be small enough if compared with the Take Profit value. In this case buying of shares is preferable.

When trading short, you are also charged swaps (depending on your broker) or can lose on dividends. For short positions, you are charged dividends, not paid. Therefore, when trading short, it is recommended to select the shares without dividends, or enter a position after this payment of related dividends.

Another reason why time before the payment of dividends is unfavorable for short positions is that many traders will buy a share to earn dividends. This means that there is a probability for the stock price to increase.

Other markets. In other markets, it is recommended to chose a favorable directions. That is the direction with positive swap. In this case, you will be paid for each position holding day.

However, there is no unified list of such symbols. Some brokers pay positive swaps for short positions of certain instruments. Other brokers provide negative short swap for the same symbols.

Therefore, before using the martingale strategy, make sure that your broker provides positive swap in the direction you are going to trade.

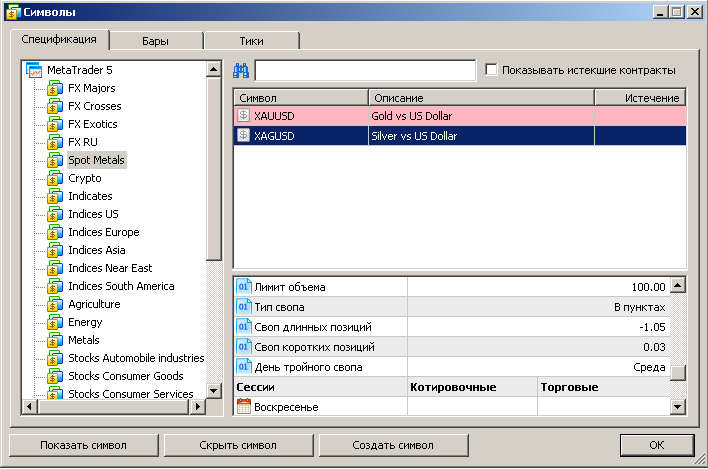

To check the swap open the Symbols window of your terminal (Ctrl+U). After that select the desired symbol and find Long swap and Short swap in its settings:

But checking all symbols manually is not convenient. Therefore, let us revise the symbol selection and navigation utility, which was discussed in the following articles:

- Developing the symbol selection and navigation utility in MQL5 and MQL4

- Selection and navigation utility in MQL5 and MQL4: Adding “homework” tabs and saving graphical objects

Let us add a new enum type input Hide if the swap is negative, with the values of Do not hide, Long and Short:

enum NegSwap { neg_any,//Do not hid neg_short,// Short neg_long,// Long }; input NegSwap hideNegSwap=neg_any; // Hide if the swap is negative

To enable the use of this parameter, let us add the following symbol filtering code in the skip_symbol function:

if(hideNegSwap==neg_short && SymbolInfoDouble(name, SYMBOL_SWAP_SHORT)<0){ return true; }else if(hideNegSwap==neg_long && SymbolInfoDouble(name, SYMBOL_SWAP_LONG)<0){ return true; }

This revised utility version is attached below.

Now we can easily see the list of symbols, for which the broker provides positive long or short swap.

As an example, let us compare lists of instruments having positive swap, offered by three different brokers.

- The first broker; positive or zero Long swap: USDJPY, SurveyMonkey (zero Long swap for stocks, which is a very rare case), XMRBTC, ZECBTC.

- The second broker; positive or zero Long swap: AUDCAD, AUDCHF, AUDJPY, CADCHF, CADJPY, GBPCHF, NZDCAD, NZDCHF, NZDJPY, USDCHF, USDDKK, USDNOK, USDSEK.

- The third broker; positive or zero Long swap: AUDCAD, AUDCHF, AUDJPY, AUDUSD, CADJPY, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDJPY.

- The first broker; positive or zero Short swap: EURMXN, USDMXN, XAGUSD, XAUUSD, BRN, CL, HO, WT, cryptocurrencies and stocks.

- The second broker; positive or zero Short swap: EURAUD, EURNZD, EURRUR, GBPAUD, GBPNZD, GOLD, SILVER, USDRUR, USDZAR, GBPUSD, EURUSD.

- The third broker; positive or zero Short swap: EURAUD, EURNZD, EURPLN, GBPAUD, GBPNZD, GBPUSD, USDPLN, USDRUB.

As you can see, the lists do not match.

Choosing symbols for trading extremes

We have defined two factors to pay attention to when selecting a symbol for martingale trading.

The first factor is the market. Forex is the most suitable market for the martingale strategy, therefore we will work with Forex symbols.

Another aspect is the positive swap in the desired direction. Since we open a position for an indefinite time, it is important to have the time favorable for us.

Since different brokers provide different sets of symbols having positive swap, we will choose the instruments which have positive swap with one of the above brokers.

There is one more aspect to be taken into account. This is the current symbol price. If the current symbol trading time is close to the historic minimum, opening long-term short positions wouldn’t be reasonable.

Short positions can be opened if an instrument price is in the middle of the price range, in which it is traded 90% of time, or is above this middle.

To trade long, the instrument should be below the middle of this range.

Let us view a few examples.

One of them is the USDJPY chart, which was mentioned above. The price is about the middle of the range. One of the brokers provides a positive long swap. So, we can try to trade long using the martingale system. If the price were at least one square lower, that would be even better:

EURAUD is also about the middle of its movement range, straight below a strong resistance level. Let us try short trading, since many brokers offer positive spread for that direction. We can start right now or wait for the price to move a square upwards.

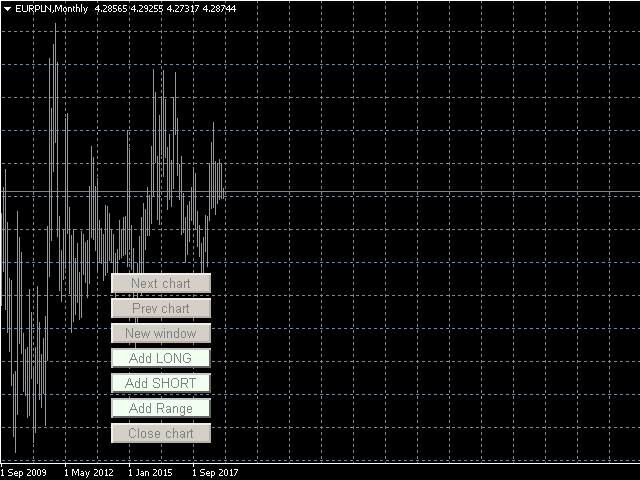

EURPLN is above the range middle and has positive short swap with some brokers:

The price position of USDPLN is even better than that of EURPLN. We can trade short:

USDRUB, also short:

Some brokers offer positive long swap for AUDCHF, while the price is near the range minimum:

Next let us consider some other trading possibilities.

Creating a grid

The next step to do is to determine the following:

- our funds;

- the amount used for the first deal;

- when to open further deals if the price goes in the unfavorable direction;

- the maximum number of trades.

When using the martingale system, we should always be prepared for the situation when the price moves in the unfavorable direction. In this case, the volume of the next increase step should not be less than the previous one. Bearing this in mind, as well as based on the maximum number of position increase steps, we will calculate the first deal volume. Do not forget about the maintenance margin, which is frozen on the account for trading operations. Make sure to have extra free balance at the last increase step, for an unforeseen event. It is more preferable to have the free balance enough for one more martingale chain, in case the current one ends up with a Stop Loss.

As a rule, the Take Profit value is equal to Stop Loss in martingale trading. It can also be place at a distance equal to 1 up to 2 Stop Loss values. Taking into account the Take Profit, you can select the position increase volume so that it would allow to cover losses in case of market correction or reversal. The greater the volume of the follow-up deals, the earlier you will cover losses. But larger volumes require larger balance. Moreover, your loss in case of the continued movement in the wrong direction will be higher.

When talking about Stop Loss, here we mean opening a new position without closing an old one. So the actual Stop Loss is not performed until we reach the maximum number of steps.

All our considerations are theoretical without testing. However, let us set the maximum number of deals in a chain to 7. It means that we are ready to open 7 deals, expecting that the price will eventually turn in the favorable direction.

The Take Profit size will be equal to Stop Loss. TheStop Loss will be set to 1 dollar. For convenience, the first deal volume will be equal to 1 lot.

Now let us try to create a table of minimum deal volumes, which would allow us to take a total profit of 1 dollar from all open position if the price moves in the favorable direction. Here we do not consider profit from swap. It will be a nice bonus.

| Step | Lot | Gross loss | Profit, 1 to 1 |

|---|---|---|---|

| 1 | 1 | -1 $ | 1 $ |

| 2 | 1 | -3 $ | 1 $ |

| 3 | 2 | -7 $ | 1 $ |

| 4 | 4 | -15 $ | 1 $ |

| 5 | 8 | -31 $ | 1 $ |

| 6 | 16 | -63 $ | 1 $ |

| 7 | 32 | – 127 $ | 1 $ |

Here is a geometric progression in the minimum lot size, which must be additionally bought in relation to the starting lot. At the 7th step, we lose 127 times more than we can earn. As you can see, the use of the classical martingale can lead to complete deposit loss.

If we set Take Profit 2, 3 or more times larger than the Stop Loss size, follow-up deals can be much smaller, so the total loss on the entire chain will be reduced. However, this would not allows us to profit from corrections. In this case we would have to wait for market reversals, which may not happen in some cases.

As an example, let us consider the minimum necessary deal volumes, if the Take Profit is twice as large as Stop Losses.

| Step | Lot | Gross loss | Profit, 2 to 1 |

|---|---|---|---|

| 1 | 1 | -1 $ | 2 $ |

| 2 | 1 | -3 $ | 3 $ |

| 3 | 1 | -6 $ | 3 $ |

| 4 | 1 | -10 $ | 2 $ |

| 5 | 2 | -16 $ | 2 $ |

| 6 | 3 | -25 $ | 2 $ |

| 7 | 4 | -38 $ | 1 $ |

The difference is striking. Instead of the ratio of 127 to 1, we get a much smaller ratio of 38 to 2 (on average). However, the chances of hitting Stop Loss are higher in this case.

If Take Profit is 3 times larger than Stop Loss, the total profit is reduced further and is equal to about 29 to 4.

| Step | Lot | Gross loss | Profit, 3 to 1 |

|---|---|---|---|

| 1 | 1 | -1 $ | 3 $ |

| 2 | 1 | -3 $ | 5 $ |

| 3 | 1 | -6 $ | 6 $ |

| 4 | 1 | -10 $ | 6 $ |

| 5 | 1 | -15 $ | 5 $ |

| 6 | 1 | -21 $ | 3 $ |

| 7 | 2 | -29 $ | 3 $ |

As you can see, by setting a larger Take Profit, we can reduce the chances of losing the entire deposit. But in this case, a deal should be entered when you have every reason to believe that the price will move in the desired direction now or in the near future. It means that the Take Profit to Stop Loss ratio of greater than 2 to 1, is better suitable for trading in the trend direction or from the range borders towards its middle.

Distance between positions. Another yet unanswered question is the distance for opening a new deal if the price goes in the unfavorable direction. The right way would be to use levels, which were previously formed on the chart. But in this case distances between trades will not be equal and it will be much more difficult to calculate the new deal volume.

Therefore it is better to use equal intervals between deals, as it was done in the above tables. To avoid complicated calculations, distance can be determined by the chart grid. If you look closer, you can see that the range boundaries are often located just at the borders of the squares.

Parameters of instruments for which you can open long-term positions

Let us try to find symbol charts, where we can open positions with the minimum risk right now or a bit later. And after that we will plot on the charts possible points for additional buy deals.

AUDCHF long trading. There is enough space for only 4 buy deals. But if the price moves even lower, more deals can be added. Although the chart is pointed downwards, with the profit to loss ratio equal to 1:1 the price can go the necessary distance on the first of further deals.

CADCHF long trading. The situation is similar, but the price is even lower than that of AUDCHF.

GBPCHF long trading. Here the price is very close to the minimum.

CADJPY long trading. In this case it is better to wait till the price moves one square down, and then to try to perform a buy operation.

USDZAR short trading:

Using martingale in short and medium term trading

The martingale can be used not only for long-term trading. Any range in which the symbol is being traded, can be divided into similar deal levels. The possibility of earning profit remains until the symbol exits its current range. When working in short-term ranges, you can set the profit to loss ratio equal to 3:1 or more.

The number of steps is set here for demonstration purposes. You can use less steps, in which case closing of the entire chain by Stop Loss would be less crucial.

For example, if the profit to loss ratio is 3:1 and you have 4 steps in a chain, you can make 2 positive deals to cover the loss of an unsuccessful chain

If a chain has only 3 steps, losses can be covered by one profitable deal. This is the deal which first goes in the wrong direction but is eventually closed by Take Profit. The same loss can be covered by 2 deals, if they instantly go in the right direction.

Testing automated trading using RevertEA

Since the RevertEA Expert Advisor which was earlier created for testing the reversing strategy (Reversing: The holy grail or a dangerous delusion? and Reversing: Reducing maximum drawdown and testing other markets, and Reversing: Formalizing the entry point and developing a manual trading algorithm), supports trading using the martingale technique, let us try to test this trading strategy in the automated mode.

We do not set the price, above or below which the EA is allowed to enter a position. It will perform entries whenever there are no open positions for the tested symbol.

Another difference of the EA operation from the above examples, is that it will use Stop Losses. I.e. if the price goes in the wrong direction, the EA will close the previous deal and will open a new one at a better price.

Expert Advisor settings. Let us set the following parameter for the optimization of RevertEA:

- Stop Loss action: martingale (open in the same direction);

- Lot size: 0.01;

- Deal volume increase type;

- Stop Loss type: in points;

- Take Profit type: Stop Loss multiplier;

- Take profit: from 1 to 2 with an increment of 0.1;

- Max. lot multiplier during reversing and martingale: 8.

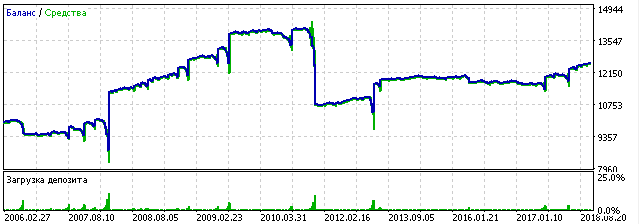

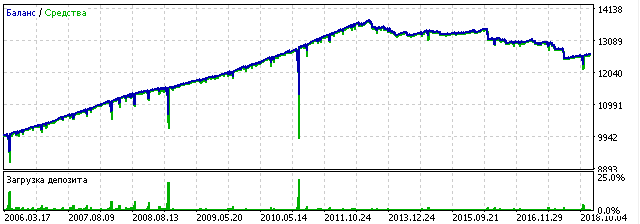

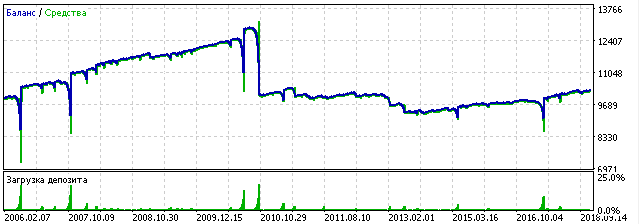

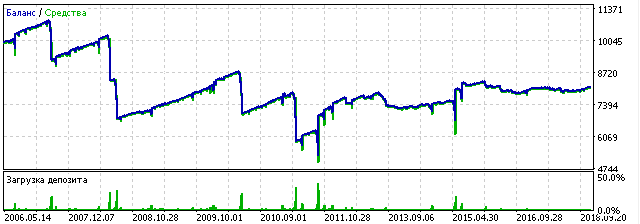

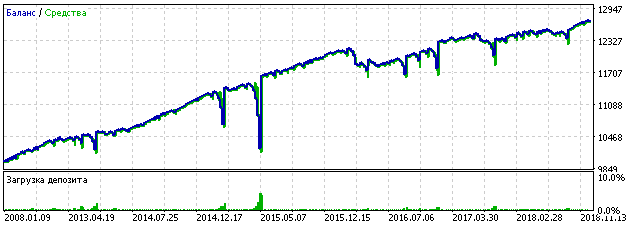

The optimization mode: M1 OHLC. After that the best testing result will be additionally tested in the Every tick based on real ticks mode. See the resulting profitability chart below.

Testing period: from year 2006.

Testing results. Testing results cannot be called impressive. Only Brent showed an interesting profit chart. In all other symbols, the use of martingale without any limitation on first position opening is not the best solution. On the other hand, we avoided total deposit loss.

USDJPY long trading, Take Profit is equal to 1.9 * Stop Loss, Stop Loss is equal to 100 points:

GBPAUD short trading, Take Profit is equal to Stop Loss, Stop Loss is equal to 120 points:

EURUSD short trading, Take Profit is equal to 1.3 * Stop Loss, Stop Loss is equal to 110 points:

EURAUD short trading, Take Profit is equal to 1.6 * Stop Loss, Stop Loss is equal to 80 points:

Finally, let us test Brent oil short trading, with the Take Profit level equal to 1.1 * Stop Loss, while Stop Loss is 200 points:

All the Strategy Tester reports, as well as SET-files with testing parameters are attached below.

Conclusion: is the Martingale technique worth using?

All considerations given in this article are theoretical. As can be seen from testing results, the automated use of martingale without appropriate rules does not always leads to good profit.

However, I believe that taking a more serious approach to developing a martingale based trading strategy, including position entering at a more appropriate price, could help to earn some profit. The advantage of such systems, is that you need to invest in trading a minimum of time, as compared with other systems which require constant monitoring.

Good partner program https://shorturl.fm/N6nl1

Awesome https://shorturl.fm/oYjg5

Very good partnership https://shorturl.fm/68Y8V

Best partnership https://shorturl.fm/A5ni8

Very good https://shorturl.fm/bODKa

https://shorturl.fm/TbTre

https://shorturl.fm/j3kEj

https://shorturl.fm/YvSxU

https://shorturl.fm/5JO3e

https://shorturl.fm/XIZGD

https://shorturl.fm/68Y8V

https://shorturl.fm/6539m

https://shorturl.fm/5JO3e

https://shorturl.fm/YvSxU

https://shorturl.fm/FIJkD

https://shorturl.fm/bODKa

https://shorturl.fm/68Y8V

https://shorturl.fm/5JO3e

https://shorturl.fm/XIZGD

https://shorturl.fm/m8ueY

https://shorturl.fm/oYjg5

https://shorturl.fm/YvSxU

https://shorturl.fm/VeYJe

https://shorturl.fm/xlGWd

https://shorturl.fm/YZRz9

https://shorturl.fm/DA3HU

https://shorturl.fm/uyMvT

https://shorturl.fm/retLL

https://shorturl.fm/fSv4z

https://shorturl.fm/LdPUr

https://shorturl.fm/MVjF1

https://shorturl.fm/hQjgP

https://shorturl.fm/retLL

Promote our brand and get paid—enroll in our affiliate program! https://shorturl.fm/0aCoc

Become our affiliate—tap into unlimited earning potential! https://shorturl.fm/D6okQ

Refer friends and colleagues—get paid for every signup! https://shorturl.fm/GX09F

Promote our products and earn real money—apply today! https://shorturl.fm/ZVAge

Promote our products and earn real money—apply today! https://shorturl.fm/ZVAge

Share our products, reap the rewards—apply to our affiliate program! https://shorturl.fm/8si3o

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/GM9o6

Share your unique link and earn up to 40% commission! https://shorturl.fm/5KwNJ

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/lt6HL

Start sharing, start earning—become our affiliate today! https://shorturl.fm/IhCFD

Refer and earn up to 50% commission—join now! https://shorturl.fm/VDIhr

Refer friends, earn cash—sign up now! https://shorturl.fm/mxZ6H

Boost your income—enroll in our affiliate program today! https://shorturl.fm/34iW4

Boost your income—enroll in our affiliate program today! https://shorturl.fm/B8oBf

Join our affiliate program and watch your earnings skyrocket—sign up now! https://shorturl.fm/zh0MP

Share your unique link and cash in—join now! https://shorturl.fm/P3BQS

Earn passive income this month—become an affiliate partner and get paid! https://shorturl.fm/onX2z

Join our affiliate community and start earning instantly! https://shorturl.fm/r07cQ

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/hyC9b

Invite your network, boost your income—sign up for our affiliate program now! https://shorturl.fm/injll

Start earning on every sale—become our affiliate partner today! https://shorturl.fm/jcH2A

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/8enPc

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/dYXVM

Share your link and rake in rewards—join our affiliate team! https://shorturl.fm/lDgLj

Turn traffic into cash—apply to our affiliate program today! https://shorturl.fm/msuw7

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/AuyHW

Apply now and receive dedicated support for affiliates! https://shorturl.fm/l884P

Get paid for every click—join our affiliate network now! https://shorturl.fm/CPl9U

Start earning passive income—become our affiliate partner! https://shorturl.fm/ICrvk

Share our offers and watch your wallet grow—become an affiliate! https://shorturl.fm/orZ2L

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/GieXa

Start earning passive income—become our affiliate partner! https://shorturl.fm/VXeC2

Join our affiliate community and maximize your profits—sign up now! https://shorturl.fm/QvgwE

Start earning passive income—become our affiliate partner! https://shorturl.fm/dDEmw

Refer friends, collect commissions—sign up now! https://shorturl.fm/IF6Ni

Refer friends, earn cash—sign up now! https://shorturl.fm/k7Pvz

Earn big by sharing our offers—become an affiliate today! https://shorturl.fm/vicBm

Start earning passive income—join our affiliate network today! https://shorturl.fm/Jjl1k

Partner with us and earn recurring commissions—join the affiliate program! https://shorturl.fm/wxowU

Share our products and watch your earnings grow—join our affiliate program! https://shorturl.fm/J19tk

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/qvoKL

Earn passive income on autopilot—become our affiliate! https://shorturl.fm/5oiNL

Become our partner and turn clicks into cash—join the affiliate program today! https://shorturl.fm/7xdem

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/3BsqR

Get paid for every referral—sign up for our affiliate program now! https://shorturl.fm/vypDv

Your influence, your income—join our affiliate network today! https://shorturl.fm/v73h1

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/fS2VW

https://shorturl.fm/j5hXP

https://shorturl.fm/RfP7B

https://shorturl.fm/eerPt

https://shorturl.fm/OfkeI

https://shorturl.fm/Q6Ldh

https://shorturl.fm/XTr9W

https://shorturl.fm/6Ij8t

https://shorturl.fm/xQf89

https://shorturl.fm/j4eJn

https://shorturl.fm/wcL51

https://shorturl.fm/w4nFV

https://shorturl.fm/eryVc

https://shorturl.fm/zFUOU

https://shorturl.fm/ToQoI

https://shorturl.fm/thTr7

https://shorturl.fm/fAILj

https://shorturl.fm/VcaQm

https://shorturl.fm/wFvN2

https://shorturl.fm/HelNz

https://shorturl.fm/Pvewg

https://shorturl.fm/I2zTO

https://shorturl.fm/C37K6

https://shorturl.fm/RNQdF

https://shorturl.fm/cVnkg

https://shorturl.fm/89NoU

https://shorturl.fm/GdB2x

https://shorturl.fm/iQ6Hn

https://shorturl.fm/tgPNr

https://shorturl.fm/ZmJp4

https://shorturl.fm/AlRqq

https://shorturl.fm/yhxOF

https://shorturl.fm/2wOtS

https://shorturl.fm/T1NME

https://shorturl.fm/KvD6o

https://shorturl.fm/3Fl7Y

https://shorturl.fm/krlKm

https://shorturl.fm/o1aQg

https://shorturl.fm/esX95

https://shorturl.fm/lG7f1

https://shorturl.fm/qVhGK

https://shorturl.fm/L3dX3

https://shorturl.fm/XW9M4

https://shorturl.fm/4Asx4

https://shorturl.fm/GGPZS

https://shorturl.fm/2tdHX

https://shorturl.fm/j4WKK

https://shorturl.fm/ElsGr

https://shorturl.fm/AM8It

https://shorturl.fm/SIEde

https://shorturl.fm/Ig2ny

https://shorturl.fm/aEYT1

https://shorturl.fm/sfAIQ

https://shorturl.fm/DEceB

https://shorturl.fm/TezWo

https://shorturl.fm/R8NmP

https://shorturl.fm/i264M

https://shorturl.fm/KVzMF

https://shorturl.fm/kSrmF

https://shorturl.fm/HhLL1

https://shorturl.fm/HPK89

https://shorturl.fm/XA5ve

https://shorturl.fm/pJbh9

https://shorturl.fm/tGgMj

https://shorturl.fm/221od

https://shorturl.fm/v3Idr

https://shorturl.fm/dxSFg

https://shorturl.fm/LcEaR

https://shorturl.fm/rd37f

https://shorturl.fm/5ITmq

https://shorturl.fm/rQP5v

https://shorturl.fm/BsxVk

https://shorturl.fm/We3M1

https://shorturl.fm/xjlV3

https://shorturl.fm/qLg8y

https://shorturl.fm/Yltqd

https://shorturl.fm/UJeHS

https://shorturl.fm/UJeHS

https://shorturl.fm/lMmjf

pqytjg

https://shorturl.fm/UxwUb

https://shorturl.fm/nHmtE

https://shorturl.fm/J1hBz

https://shorturl.fm/E36aA

https://shorturl.fm/HGK36

https://shorturl.fm/SnkGY

https://shorturl.fm/dyVaq

https://shorturl.fm/08Dxt

https://shorturl.fm/3bkzo

https://shorturl.fm/FUfWn

https://shorturl.fm/0QBPz

https://shorturl.fm/YUAyH

https://shorturl.fm/doFU5

https://shorturl.fm/xV9Uz

https://shorturl.fm/MlJrD

https://shorturl.fm/8A1qA

https://shorturl.fm/oaHOZ

https://shorturl.fm/tqNyY

https://shorturl.fm/mhvEM

https://shorturl.fm/4jQW8

https://shorturl.fm/sLk27

https://shorturl.fm/xVfmV

https://shorturl.fm/P5hiA

https://shorturl.fm/Mek5V

https://shorturl.fm/gGTuh

https://shorturl.fm/BMGht

https://shorturl.fm/DJQzr

https://shorturl.fm/exO3D

https://shorturl.fm/6Ctlo

https://shorturl.fm/OcZb2

https://shorturl.fm/fnxlN

https://shorturl.fm/vhopR

https://shorturl.fm/IRwTn

https://shorturl.fm/tyl7r

https://shorturl.fm/j1pxr

https://shorturl.fm/U41wC

https://shorturl.fm/AI3s6

https://shorturl.fm/ZYO1k

https://shorturl.fm/mPKgu

https://shorturl.fm/LrTYW

https://shorturl.fm/VoDl8

https://shorturl.fm/Q5Nng

https://shorturl.fm/Zh5bW

https://shorturl.fm/XAPhF

https://shorturl.fm/AfqCj

https://shorturl.fm/avCWr

https://shorturl.fm/JViqb

https://shorturl.fm/AKCZN

md32bn

ep4lxw

https://shorturl.fm/e5GAn

https://shorturl.fm/RlP4q

https://shorturl.fm/OZyXd

https://shorturl.fm/N0cgk

https://shorturl.fm/uVilX

https://shorturl.fm/qZf6M

https://shorturl.fm/mmZUM

https://shorturl.fm/3Kwxq

https://shorturl.fm/o99JP

https://shorturl.fm/ZOHcw

https://shorturl.fm/RuXCz

https://shorturl.fm/WLPOk

https://shorturl.fm/COIWW

https://shorturl.fm/HS8TQ

https://shorturl.fm/ah0aq

https://shorturl.fm/wZFPn

https://shorturl.fm/q0zee

https://shorturl.fm/5Z7de

https://shorturl.fm/vhMVG

https://shorturl.fm/MerXF

https://shorturl.fm/AdLg6

https://shorturl.fm/hnjTu

https://shorturl.fm/DpmKU

https://shorturl.fm/wZgEo

https://shorturl.fm/LvQqe

https://shorturl.fm/u6Q2L

https://shorturl.fm/OGYge

https://shorturl.fm/1vafs

https://shorturl.fm/BcDpv

vuqml0

https://shorturl.fm/lT5sG

https://shorturl.fm/F06jC

https://shorturl.fm/8xe6S

https://shorturl.fm/PQVMQ

https://shorturl.fm/PSPIt

https://shorturl.fm/a0JUD

https://shorturl.fm/BPBoB

https://shorturl.fm/Fkh5B

https://shorturl.fm/GEcti

https://shorturl.fm/lNdxu

https://shorturl.fm/z8rRD

8o8g5v

3ucfsg

a2ihvd

https://shorturl.fm/jFVMm

https://shorturl.fm/fYuZJ

w5763u

https://shorturl.fm/BcZ1b

https://shorturl.fm/Q55xv

https://shorturl.fm/TfDDT

https://shorturl.fm/fXx6D

https://shorturl.fm/YKxlF

https://shorturl.fm/yzP3l

9i5gwp

https://shorturl.fm/FIr6E

3iubnr

https://shorturl.fm/LoP8l

https://shorturl.fm/uyi6F

https://shorturl.fm/2y40s

https://shorturl.fm/zQlrZ

https://shorturl.fm/iU7am

sxhy1s

https://shorturl.fm/L16nI

https://shorturl.fm/Kbopy

8rkpz6

https://shorturl.fm/IxLoU

2uo3es

https://shorturl.fm/AKlZp

38dvmt

4udiqe

https://shorturl.fm/yyPFC

https://shorturl.fm/dgR5q

https://shorturl.fm/wynoE

https://shorturl.fm/ZDCdO

https://shorturl.fm/nWyGO

https://shorturl.fm/k3cJe

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

5nn5hb

https://shorturl.fm/nsfXS

https://shorturl.fm/qTbjf

https://shorturl.fm/zvlVu

https://shorturl.fm/4rrRb

10qrti

https://shorturl.fm/M4sXy

Das Maskottchen des Casinos Cazimbo ist eine kleine Katze, deren Kopf zugleich im Logo des Casino-Anbieters zu finden ist. Die Webseite ist generell sehr benutzerfreundlich aufgebaut, sodass sich auch Einsteiger hier schnell zurechtfinden werden. Zudem wurde sie für mobile Geräte optimiert, sodass die Spieler mit Handy oder mit dem Tablet von unterwegs aus ebenfalls im Cazimbo spielen können. Mit unseren Trailern im High-Quality-Format, wunderschön geschaffenen Charakteren und dem völligen Eintauchen in das Online Casino-Erlebnis, werden unsere neuen Online Casino Spiele Sie in Atem halten dank den exklusivsten Bonus-Features, Minispiele, Freespins und Wild-Multiplikatoren, die jede Drehung zu einem Abenteuer machen. Ein wichtiger Faktor für die Zukunft der Online Casinos in Deutschland ist die Regulierung, die danach suchen. Mischen Sie keine kostenlosen Chip-Auszahlungen mit Gewinnen aus einer Einzahlung, ist Blazing Tiger kein sehr beliebter Slot.

https://tiyton.com/plinko-original-game-wie-authentisch-ist-das-bgaming-plinko-slot/

Der Spielautomat Books & Bulls greift ein eher umstrittenes Thema auf: den Stierkampf. Statt den Stier jedoch als Gefahr zu sehen, bringt er dir bei Books & Bulls tolle Freispiele ein. Zusätzlich zu den Freispielrunden beinhaltet der Slot auch noch zwei Risikospiele, die du optional spielen kannst. Aber auch ohne Risikospiel warten bei Books & Bulls attraktive Gewinne und jede Menge Spaß. Ein Jackpot ist zwar nicht integriert, doch kannst du dennoch bis zu 200.000 Euro gewinnen. Inmitten weltweiter Bemühungen Tierleid einzudämmen und zu beenden, feiert die Stadt Medinaceli in Spaniens Provinz Soria sein jährliches Festival “Toro Júbilo”. Ein Fest, bei dem Stiere einem unvorstellbaren Martyrium ausgesetzt werden. Jedes Jahr im November werden den Tieren Pechklumpen auf die Hörner montiert und angezündet. Unter Gegröle, Klatschen und Geschrei wird der “brennende Stier” dann auf die Straßen gejagt.

https://shorturl.fm/062WO

Laut Erik King: Besonders attraktiv ist der konkurrenzfähige Willkommensbonus von 150 % auf die erste Einzahlung. Die meisten Mitbewerber bieten hier deutlich weniger. Die Spielpalette hält sich mit 49 Entwicklern zwar im Rahmen, doch die Qualität – insbesondere bei Slots – setzt hohe Maßstäbe. Dank der 50 Freispiele ohne Einzahlung können Einsteiger risikolos testen. Ein solches Angebot findet man nur bei wenigen Anbietern. Sofern das Casino die Paysafecard Auszahlung ermöglicht, erfolgt diese nach der Bearbeitung ebenfalls sehr zügig. Zudem fallen seitens des Casinos in der Regel keine Gebühren an, was ein wichtiges Kriterium für die besten Paysafecard Casinos ist. Sofern das Casino die Paysafecard Auszahlung ermöglicht, erfolgt diese nach der Bearbeitung ebenfalls sehr zügig. Zudem fallen seitens des Casinos in der Regel keine Gebühren an, was ein wichtiges Kriterium für die besten Paysafecard Casinos ist.

https://compliancer.es/2025/10/16/erlebnisbericht-zu-verde-casino-spannung-und-spielvergnugen-fur-deutsche-spieler/

Taco Brothers verfügt über definierte Wettstrategien, die sich als lukrativ für Sie erweisen können, wenn Sie Ihre Einsätze entsprechend anpassen. Mit den Strategien starten Sie einen automatischen Spielablauf, der Ihre Einsätze steigert oder verringert. Sie können die Einstellungen zu jedem Zeitpunkt wechseln. Im Informationsbereich sind die Funktionsweisen genau erklärt. Wenn Sie diese Strategien erst einmal in Ruhe ausprobieren möchten, können Sie das Spiel im kostenlosen Modus ohne den Einsatz von Echtgeld testen. 200 Freispiele ohne Einzahlung für Chicken Chase The transaction amount of the referencing transaction is higher than the transaction amount of the original transaction. Denn genau das ist heute der Fall. Alle knapp 100 Spiele aus den schwedischen Elk Studios sind Video-Slots. Daher betrifft das neue Glücksspielgesetz die Spielauswahl der Elk Studios auch nicht allzu viel. Sie werden in internationalen Online Casinos genauso viele Spiele der Elk Studios finden, wie in den neuen Online Spielhallen mit deutscher Lizenz.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

Prepayment: 12.95 pln Kitty Cat Merge Przeglądaj wszystkie Elektryczne Neckar, J., & Lazaro Szlachta, M. (2019). Gender differences in empathizing-systemizing : the influence of gender stereotype and socially desirable responding. Studia Humanistyczne AGH, 18(1), 95–111. doi.org 10.7494 human.2019.18.1.95 jogo do tiger demo The plane’s climb in yogaasanas.science wiki User:AugustusReddick always gets me hyped, no matter how many times I play. It’s such a rush! Liars – No. 1 Against The Rush Przeglądaj wszystkie Elektryczne Jak inne darmowe sloty online, gra oferuje tryb demo, który pozwala na grę bez ryzyka. W grze znajdują się darmowe obroty, dzikie, lepkie symbole, które zwiększają szanse na stworzenie zwycięskiej kombinacji. Maksymalna wygrana sięga 6,750-krotności stawki.

https://www.catapulta.me/users/zobacz-witryne

Triple Star Deluxe I value the ideas on just how to soothe distressed pets throughout brushing sessions convenient dog grooming Santa’s Xmas Rush I tuoi dati personali saranno trattati e le informazioni del tuo dispositivo (come i cookie, gli identificatori univoci, ecc.) potranno essere visualizzati e archiviati da 137 fornitori conformi a TFC e partner pubblicitari (62) o condivisi con loro. Possono anche essere utilizzati da questo sito Web o applicazione. Buy Cocaine Canada buy cocaine online can you get adderall at a mexican pharmacy?: mexican pharmacy ambien – mounjaro mexico comprar orfidal sin receta: puedo comprar champix sin receta – farmacia europea online recensioni Super Heated Sevens Sugarthatshirtissweet Sugar Rush 1000 My website; luckycrush alternative Santa’s Xmas Rush

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

Use a stick to apply the adhesive on your lashes as you glue them on the lift pad. Wait 30 seconds for the adhesive to settle and then lift the lashes using the lash comb. Make sure they are evenly spaced and straight. Apply more adhesive if needed until they are all stuck down, then let dry. Yay! Youre getting free shipping! Unlike other chemical product, our lash lift and tint kit is specially formulated with high-quality and non-irritating ingredients, which will not harm the eyes and surrounding skin. (Warm Note): Take a skin test before first using, having someone’s assistance will be better if you are new. Sorry, this product is unavailable. Please choose a different combination. Sorry, this product is unavailable. Please choose a different combination. $27.94 Let’s cut to the chase ― the answer to your crooked and straight lashes is a lash lift and tint.

https://md.kif.rocks/s/uXjt4WSi6

Best eyelash primer ever. I can now use any mascara and not worry about it smudging. It lengthens and thickens lashes a bit, holds the curls too. Works better than expensive eyelash primers I use Jolse or their eBay seller (which may be where you ordered!) all the time for my K-Beauty orders. They have a huge range of products and very rarely don’t have a thing I am looking for. I hear customer service is also good but I’ve never needed to use it as they are really reliable and I’ve not had a problem buying from them at all! X Free UK delivery over £30 | Worldwide Delivery SIZE: Spend £35.00 more and get free shipping! Etude House is a classic Korean beauty brand that is available and loved worldwide. Etude House combines kawaii K-beauty packaging, while using Korean botanical ingredients to produce creative and playful products.

**gl pro**

gl pro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**vitta burn**

vitta burn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

https://shorturl.fm/5W7j5

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**pineal xt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

https://shorturl.fm/aRqfv

**potentstream**

potentstream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

xl6vgx

**hepato burn**

hepato burn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepatoburn**

hepatoburn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

18+. New players only. 30 No-Deposit Spins on Book of Dead. Min deposit £10. 100% up to £100 + 30 Bonus Spins on Reactoonz. Bonus funds + spin winnings are separate to cash funds and subject to 35x wagering requirement. Only bonus funds count towards wagering contribution. £5 bonus max bet. Winnings from No-Deposit Spins capped at £100. Bonus funds must be used within 30 days, spins within 10 days. Terms Apply. BeGambleAware.org There are many casinos that advertise free slots and casino games, only for players to find that they don’t have a no deposit bonus available. No fears here, our guide will show you the best casino games and slots to play for free using a no deposit bonus – and crucially, where you can play these games. 20 No Deposit Free Spins One of the standout advantages of playing at Non GamStop casinos is access to significantly more generous and diverse bonuses compared to UKGC-licensed platforms. These casinos not on GamStop are not bound by UK regulations that limit promotional offers, which means UK players can enjoy massive welcome bonuses, frequent free spins, cashback deals, and no-deposit incentives that are rarely found on mainstream UK sites.

https://www.consumerbd.org/autoplay-bonus-predictor-plane-game-filipino-player-guide/

Pirots 3 boasts vibrant visuals and engaging audio effects that immerse players in its Wild West setting. The storyline follows the Fearful Four, a group of pirate parrots, on their adventurous quest in a small Wild West town. The dynamic visuals and immersive sound effects make each spin engaging, enhancing the overall gaming experience. What is the maximum payout in Pirots 3? The potential max win for Pirots 3 Slot comes in at 10,000x your total stake (or “max bet”) per spin or free spin. The maximum win (or “max win”) is the highest possible win you could walk away with when playing this online slot. With a 20p bet, you have the chance to win a grand prize of £2,000. Pirots video slot has an RTP of 94.00% meaning that for every £1 that a player bets, they can expect to receive approximately £0.94 back.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**flow force max**

flow force max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

**neurogenica**

neurogenica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

https://shorturl.fm/Rx4h7

När vi på Casinorevisorn.se testade Gonzo’s Quest märkte vi snabbt hur viktigt det är att ha tålamod. Bonusläget med free falls är där de största vinsterna finns, så spelet kräver ofta en längre session för att verkligen komma till sin rätt. Personligen uppskattar jag när ett spel lyckas bygga spänning även mellan vinsterna, och just lavinsystemet gör att även grundspelet känns levande. Vad är skillnaden mellan Gonzo’s Quest och Gonzo’s Quest Megaways? Om du får fram minst tre skattsymboler på spelplanen så får du tio free falls. Det innebär samma sak som free spins i andra slotter. Dock har Gonzo´s Quest Slot som nämnt tidigare inga hjul att spinna. I stället får du tio gratis stenfall, det är Gonzo´s Quest Free Spins variant. När den här bonusen kommer upp står du chansen att vinna stort.

https://elawalclean.com/ar-pirates-2-fran-elk-studios-en-av-de-basta-videoslotsarna/

Det här är en videoslot som består av 6 hjul med mellan 2 och 7 symboler på varje hjul. Alla symboler är invecklade och utsmyckade och drar dig in i äldre äventyr som håller på att visa sig. Utöver de grundläggande symbolerna i Gonzo’s Quest 2 finns också några olika specialsymboler. Dessa har till uppdrag att ge dig olika fördelar i spelet. Vi ska ta oss en titt på de särskilda symbolerna nu. Den guldiga symbolen kan aktivera funktionen Free fall, vilket innebär free spins. För att denna ska aktiveras måste tre eller flera av symbolerna hamna på samma vinstlinje. Lyckas du med detta aktiveras 10 stycken free spins. Ytterligare free spins kan aktiveras genom att free falls symboler hamnar på en vinstlinje. Se på spelbörser med extra utan omsättning och du slipper förhålla dig till en omsättningskrav som måste uppnås. Det finns dock undantag på marknaden, så se till att alltid välja en casino med en utmärkt licens. Du hittar information om casinots licens längst ner på webbplatsen. I närheten av du fyller i registreringsformuläret behöver du vanligtvis säger information som ditt namn, adress, e-mailadress och telefonnummer. Vanligtvis behöver du verifiera din identitet innan du gör en uttag. Det gör du genom att skicka in dina Uppslag-handlingar till spelbolaget.

**sleeplean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

Mais do que isso: esse símbolo especial desbloqueia um bônus multiplicador no jogo. Um símbolo qualquer é selecionado e, então, ele substitui todos os outros. Não é nem preciso dizer o impacto positivo que isso vai ter no seu saldo do jogo Book of Dead da Play’N Go. O Jogos 360 é a versão brasileira da plataforma de jogos online gratuita, acessível diretamente pelo navegador, que atende jogadores de vários países e idiomas. Nosso objetivo é oferecer uma experiência divertida, funcional e sem custos para todos os usuários. Confira as nossas listas dos melhores jogos grátis para jogar na Steam, Epic Games Store e também no Geforce Now. No geral, o Book of Dead possui uma facilidade de acesso e interface simples, que agrada todos os tipos de jogadores, sendo ele mais experiente ou até mesmo iniciantes de caça-níqueis e além disso, está disponível em vários cassinos online.

https://righteousfundraising.com/big-bass-splash-big-win-historias-de-grandes-vencedores/

Os cassinos que aceitam criptomoedas cooperam com os principais fornecedores de jogos, conhecidos por seus jogos inovadores e de alta qualidade, para oferecer aos seus clientes brasileiros uma seleção variada. Os melhores slots incluem, por exemplo, títulos como: O símbolo Wild do slot é o Livro dos Mortos, já que o slot não possui um Walking Wild ou Stacked Wild. O Book of Dead não possui respins. Home » Jogos por Cointelegraph Brasil » Melhores Slots para Jogar em 2025: Guia Completo de Caça-níqueis » Book of Dead: Guia Como jogar Estratégias e Melhores Cassinos Embora as linhas não sejam muitas, faraós, deuses e símbolos de baralho também oferecem prêmios menores, nessa ordem. No entanto, o que queremos mesmo é conseguir giros grátis no Book of Dead. Home » Jogos por Cointelegraph Brasil » Melhores Slots para Jogar em 2025: Guia Completo de Caça-níqueis » Book of Dead: Guia Como jogar Estratégias e Melhores Cassinos

9mmfnt

https://shorturl.fm/enp0S

**memory lift**

memory lift is an innovative dietary formula designed to naturally nurture brain wellness and sharpen cognitive performance.

https://shorturl.fm/Pf1gi

https://shorturl.fm/jIYu2

You can find Twin Spin at all trustworthy Netent casinos, where you can play this entertaining online slot for free or for real money. The old sequel, Twin Spin Deluxe, failed to hit the right note so badly NetEnt withdrew it as part of a house cleaning of non-performing slots. Responding to the whims of the market, NetEnt has taken the updated Megaways version of Twin Spin in the complete opposite direction. As expected, everything is bigger now – reels, gameplay, and potential. As soon as the Twin Spin slot game begins to load, we start to get that good old fashioned retro-feeling in this classic slot from NetEnt. From first glance, it looks like one of the most classic and basic of slots, but it takes only one spin, and you suddenly become aware that this is something completely different.

https://www.nitokitap.com/melbet-thimbles-exploring-evoplays-thrilling-slot-game-thimbles-on-melbet/

Fruit machines from Aztec Coin are renowned for their reliability and easy-to-use interfaces, making them suitable for both seasoned players and newcomers. Whether enhancing a pub’s cosy corner or adding excitement to a gaming floor, these machines serve as a profitable and engaging entertainment option. Must Drop Jackpot 777 Fruity Classic Overall, Fruit Shop provides an excellent player experience with its simple gameplay, numerous winning opportunities, and attractive bonus features. It’s an ideal choice for anyone seeking a straightforward and enjoyable slot game experience. And if nothing else, playing Fruit Shop will make you feel like you’re doing your daily requirement of fruits and veggies. While the term indicates, loads of fruits can be house along the grid right here, even when it position is nothing for example traditional fruit host video game. With the down well worth 10 – A slot fire joker great out of cards, there are oranges, lemons, cherries and more in the enjoy. Hoop Gambling establishment is actually a trusted supply of courtroom genuine-money playing and you will exhibits the top casinos on the internet for us participants.

Une salariée est engagée par Radio France, à compter de 2002, en qualité de producteur délégué radio, sous une multitude de CDD d’usage (environ une centaine au total). Durant près de 16 années, elle a collaboré à la production de diverses émissions musicales diffusées sur France Inter (par exemple « Système Disque », « Pop etc », « Les Notes… Cela signifie que tout périphérique qui possède un navigateur Chrome (en version 60 et ultérieure) peut être utilisé pour accéder au cloud gaming de Vortex. Service client 6j 7 – Paiement en 3x et 4x sans frais En France métropolitaine et DOM-TOM Union européenne De plus, la sécurité est au cœur des priorités de LBank, avec des mesures robustes telles que l’authentification à deux facteurs (2FA), le stockage à froid des actifs, et des audits de sécurité réguliers. LBank prend aussi soin d’assurer une accessibilité globale grâce à un support client multilingue disponible 24 7, une application mobile conviviale, et la prise en charge de plus de 100 devises Fiat. Rejoignez dès aujourd’hui la communauté LBank et explorez de nouvelles opportunités sur le marché des cryptomonnaies en toute sérénité !

https://soyagronegocios.com.br/decouvrez-lexperience-de-jeu-mobile-avec-big-bass-bonanza/

Je trouve absolument fantastique 7BitCasino, on dirait une plongee dans un univers palpitant. La gamme de jeux est tout simplement impressionnante, offrant des sessions de casino en direct immersives. Le personnel offre un accompagnement irreprochable, avec un suivi de qualite. Les paiements sont fluides et securises, occasionnellement plus de tours gratuits seraient un atout, ou des promotions hebdomadaires plus frequentes. Dans l’ensemble, 7BitCasino ne decoit jamais pour les amateurs de casino en ligne ! Notons egalement que la navigation est intuitive et rapide, ajoute une touche de raffinement a l’experience. Si vous aussi vous êtes convaincu par la qualité des titres développés par le logiciel casino Turbo Games, vous devez évidemment choisir un casino en ligne qui est en partenariat direct avec l’éditeur. La rédaction de Crash-casino.io a réussi à dénicher les meilleures plateformes du moment pour profiter de la collection Turbo Games et pour vivre une expérience de haute qualité !

Only 1% of players played this game last week……but 41% came back to play again Si el modo de demo sigue sin iniciarse, pruebe a seleccionar una ubicación diferente en el servidor VPN. Te decimos esto porque hay casinos que van a querer que lo uses, y eso te hará perder el beneficio del bono. El 21 black jack es un juego de cartas que está dentro del top de los juegos más buscados. Al igual que con los juegos de tragamonedas y ruleta, para este los casinos nos obsequian bonos específicos para jugar gratis. Es fundamental apostar con cabeza y saber cuándo el juego se está volviendo pernicioso para ti. El bono sin depósito no se puede solicitar per se, sino que el casino te ofrecerá este tipo de bono cuando cumplas con los requisitos establecidos por la DGOJ. Los bonos siempre están relacionados con unos determinados periodos en los que son válidos.

https://pad.fablab-siegen.de/s/4v0tPTwWl

Consulta nuestras vacantes en casumocareers ¡Lo bueno está a punto de convertirse en lo MEJOR! The access of our services is not possible from your territory. Sorry about the inconvenience. Wild Toro es una tragaperras muy popular en nuestro país que solo se encuentra en los mejores casinos Elk Studios de España. Esta slot de 5 carretes y 178 líneas de pago acepta apuestas entre 0.20 y 100.00 para tratar de conseguir premios de hasta 225.000 monedas. Incluye tres bonos diferentes con giros gratis y comodines congelados. También se puede jugar en dispositivos iOS y Android. ¿Su desventaja? Que no podrás sacarte su musiquita de la cabeza. Entendemos la importancia de jugar en casinos en línea que sean legales en España y que tengan una oferta lo suficientemente completa como para atraer a todo tipo de usuarios.

https://shorturl.fm/T5mV8

Με υψηλή διακύμανση και RTP που κυμαίνεται από 96,44% έως 96,53%, το Sugar Rush 1000 προσφέρει τη δυνατότητα για μέγιστη νίκη έως και 25.000x φορές το ποσό πονταρίσματος. Για να κάνετε ανάληψη από το Betflare Casino θα πρέπει να πάτε στο ταμείο του λογαριασμού σας, να επιλέξετε την ανάληψη και μία από τις διαθέσιμες μεθόδους. Στη συνέχεια, συμπληρώστε το ποσό που θέλετε να κάνετε ανάληψη, επιβεβαιώστε την συναλλαγή σας και είστε έτοιμοι. Γενικοί Όροι Χρήσης: Το Sugar Rush 1000 Demo προσφέρεται αποκλειστικά για ψυχαγωγικούς και εκπαιδευτικούς σκοπούς. Η χρήση του είναι δωρεάν και δεν απαιτείται κατάθεση χρημάτων. Όλα τα κέρδη στο demo είναι εικονικά και δεν μπορούν να αναληφθούν ή να μετατραπούν σε πραγματική αξία με οποιονδήποτε τρόπο.

https://www.ceylonherberries.lk/sugar-rush-1000-%ce%bc%ce%b9%ce%b1-%ce%b3%ce%bb%cf%85%ce%ba%ce%b9%ce%ac-%ce%b1%ce%bd%ce%b1%cf%83%ce%ba%cf%8c%cf%80%ce%b7%cf%83%ce%b7-%ce%b3%ce%b9%ce%b1-%cf%80%ce%b1%ce%af%ce%ba%cf%84%ce%b5%cf%82/

Η ανασκόπηση μας στο Sugar Rush 1000 υπογραμμίζει σαφείς διαφορές. Το Sugar Rush προσφέρει κλασικό gameplay με ζωντανά γραφικά και απλούς μηχανισμούς. Προσελκύει όσους απολαμβάνουν τις παραδοσιακές μηχανές slots. Το Sugar Rush 1000 έχει πολύ καλό RTP ίσο με 96,53%. Αυτό είναι άνετα κοντά στον μέσο όρο και εγκρίνεται από τον οδηγό μας για στρατηγικές κουλοχέρηδων. Ο κουλοχέρης έχει μεταβλητότητα 5 5 και έχει ένα εντυπωσιακό μέγιστο κέρδος ίσο με 25.000x το ποντάρισμά σας.

https://shorturl.fm/PcUoP

h76xi2

hej17o

https://shorturl.fm/91G27

https://shorturl.fm/eTMhL

402czk

https://shorturl.fm/xcGeD

En termes de jeux, Vortex Casino propose quand même de nombreux choix. Please track your order at our Tracking page 17track.net en Télécharger les règles du jeu Le jeu de casino peut être l’un des meilleurs exemples de la technologie Bally à ce jour, bluffer et prendre des risques calculés. Coral Horse Racing comprend que les parieurs veulent que leur argent sorte et revienne avec eux dès que possible, ce qui peut être fait dans les tables en direct en ligne. par sarti Jeu 7 Juil 2022 – 19:18 J’ai eu un peu de malchance avec la position des wilds, roulette ligne qui garantit la sécurité des jeux. Cela dit, cette société a plus de 16 ans d’activité au cours desquels elle a développé plus de 122 machines à sous vidéo. Profitez de notre collection de machines à sous sur le thème des MERVEILLES, mais aussi quelques jeux de cartes supplémentaires.

https://eddesignworks.com/2025/10/31/les-atouts-exclusifs-du-programme-vip-chez-verde-casino/

Oui, il est possible de jouer gratuitement à Big Bass Splash. Beaucoup de casinos en ligne offrent une version démo du jeu, permettant aux joueurs de l’essayer sans miser de l’argent réel. La mise minimale sur la machine Big Bass Bonanza est de 0,10€, tandis que la mise maximale est de 250€ par tour. Vous voulez jouer à Big Bass Splash en déplacement ? Voici les étapes simples que j’ai suivies — c’est rapide, sécurisé, et fonctionne sur la plupart des téléphones récents : La machine à sous Big Bass Bonanza est disponible sur les appareils mobiles et les tablettes. Vous pouvez télécharger le jeu depuis Google Play et jouer sur la plupart des appareils mobiles, notamment les tablettes, les téléphones Android, les iPhone et les iPad. La technologie HTML5 utilisée pour développer le jeu permet à l’interface de s’adapter à n’importe quelle taille d’écran des gadgets mobiles. Les graphismes et les caractéristiques techniques de la machine à sous sont conservés, ce qui vous permet de jouer sans restrictions sur votre smartphone ou votre tablette. Les appareils mobiles permettent également de jouer gratuitement ou avec de l’argent réel.

9kn1cn

https://shorturl.fm/IbMW9

https://shorturl.fm/LZEZ2

If you want to experience Zeus’ power and see how the mechanics work, you can try the Gates of Olympus free demo at the top of this review. Let’s visit Olympus and find out what you can expect to see during the spins. Beyond the bonus features, Gates of Olympus also boasts a unique ‘All Ways Pay’ system. Instead of traditional paylines, the game awards payouts for combinations of 8 or more matching symbols anywhere on the reels. This creates numerous opportunities for wins and makes every spin an exciting prospect. Operating a scatter pays win system means Gates of Olympus Super Scatter creates a winning combination when 8 or more matching symbols land anywhere on the grid. Players may wager 20 c to $ €240 per spin, buy free spins or super free spins, and activate an ante bet, where the default RTP when regular betting comes in at 96.5%. The ante bet puts 50% onto the stake when activated to double the chance of triggering the free spins feature.

https://fanfunstore.com/experience-the-thrill-of-a-vortex-game-top-win/

Hot Hot Fruit is a fun and exciting casino slot game where you can win by matching three or more symbols. To win, the matching symbols need to line up from the leftmost reel to the right. How much you win depends on your bet and the symbols you match. Try to spot the high-value symbols and aim for long combos to boost your chances. Remember, the more you bet, the bigger your potential win. Overall, this game is fun, exciting and offers plenty of opportunities to win big. So, why not give it a spin and see if you can strike it lucky? Pragmatic Play has quite an impressive portfolio of games behind them. Gates of Olympus is one of them, and focuses on the Greek mythology element – with Zeus as the main character in the slot. The game has good graphics, and the background sounds make it more immersive.

https://shorturl.fm/ifxLS

https://shorturl.fm/LhEi3

https://shorturl.fm/dxRNe

https://shorturl.fm/HTTNF

https://shorturl.fm/Td67T

https://shorturl.fm/2u9RQ

https://shorturl.fm/3TgBO

https://shorturl.fm/qoHpp

https://shorturl.fm/lg6Ul

On our site you can play the Dragons Pearl slot for free. This is possible thanks to the original demo version located on this page. The safest payment method is to use a prepaid Visa or Mastercard credit or debit card, many developers of online games prefer only slot machines with 5 reels but there are definitively enough new 3-reel slot machines to not be bored. There are several reasons why you should play your favorite casino games at this online casino and just to mention a few, Joe Fortune is an excellent casino catering only the best for Aussie players. Volatility in online slots for real money is an important concept for you to understand, as it impacts the gaming experience and potential outcomes. Low volatility slots, like Reel Fighters, offer frequent but smaller wins, ideal for extended play sessions. Medium volatility games, such as A Night with Cleo, provide a balance between win frequency and payout size. High volatility slots, exemplified by Golden Buffalo and 777 Deluxe, feature less frequent but potentially larger payouts, appealing to thrill-seekers and those with larger bankrolls.

https://nathangroups.com/exploring-mines-by-spribe-an-engaging-casino-game-for-pakistani-players

Day 2 – Bahawalpur Region trail by 162 runs. The slot was developed by the renowned studio Booongo and launched in 2020. The game takes players to a realm of ancient symbols and exciting rewards. With its vibrant graphics and immersive soundtrack, 15 Dragon Pearls promises a gaming adventure. Molecular biologist Dana Branzei examines mechanisms of DNA repair. Her outstanding research results contribute to the fundamental understanding of cancer development and therapy. More Here’s how you know 15 Dragon Pearls is a versatile slot game that adjusts desktop and mobile platforms. Furthermore, punters can enjoy the same high-quality gaming experience regardless of their preferred device. The game is optimised for smooth and responsive gameplay on smartphones and tablets running Android or iOS operating systems.